New Report: Service-Based Alternatives to Capital Investments Can Benefit Consumers and Utility

Modeling shows that a variety of regulatory mechanisms can allow the use of cloud-computing services and third-party distributed energy resources in place of capital investments to save money for customers without cutting earnings for utility

Washington, D.C., January 30, 2018 — Electric utilities can reduce costs for customers without hurting profits by considering service-based alternatives to capital investments, utilizing one of several mechanisms that could be considered by state regulators. Those are the findings of a new report from the Advanced Energy Economy Institute (AEE Institute), “Utility Earnings in a Service-Oriented World.”

"With a dynamic market and improved technology options, it makes sense to consider regulatory alternatives for service-based solutions when they can provide cost savings and better service to customers," said Lisa Frantzis, Senior Vice President, 21st Century Electricity System at Advanced Energy Economy, the national business group affiliated with AEE Institute. "The point of this report is to show that there are options available that can correct for the regulatory disadvantage that service solutions face and allow both customers and utilities to share in the benefits from their deployment."

"We're always looking for creative ways to better serve our customers in a reliable and cost-effective manner. Considering available solutions on equal financial footing makes that possible.” Val Jensen, Senior Vice President, Customer Operations at ComEd.

Throughout the economy, companies are finding efficiencies and operational benefits through services provided by third parties instead of physical assets that they own and manage. However, under prevailing cost-of-service regulation, electric utilities may be discouraged from using such services, since they do not generate profits the way that investments in capital assets do.

This report utilizes financial models to explore the impact of different regulatory mechanisms for encouraging utilities to pursue two types of service-based solutions: cloud computing services, which take the place of utility investments in computers, servers, and propriety software; and distributed energy resources (DER), which defer or displace utility investments in distribution equipment and infrastructure by contracting for the use of customer- or third party-owned assets such as solar installations, battery storage, or demand response.

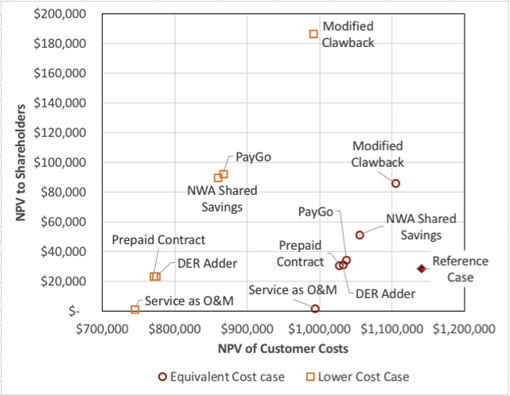

"Our analysis showed that five alternative regulatory mechanisms can provide a service-based solution in place of capital investment at equal or lower cost to customers, while in many cases providing equivalent or greater earnings to the utility – a win-win for consumers and shareholders," said lead author Danny Waggoner, Senior Manager, Regulatory Transformation at Advanced Energy Economy.

Two status quo options were considered: rate basing a capital investment and services paid from operating expenses. The improvements came from the five alternatives. As no one regulatory mechanism clearly outperforms the others under all scenarios, all five are worthy of further exploration and refinement by state regulators, taking into account local circumstances.

“This paper takes an important step forward in the urgent national evolution towards a an electricity system that relies heavily on DER. Utility-dispatchable DERs, such as aggregated energy storage, are already proving to be a win for all stakeholders in the right regulatory environment. With this paper, the AEE Institute provides a useful set of possible blueprints for regulators to set up their electric utilities for long-term success with customer or third-party owned DERs,” said Ted Ko, Director of Policy, Stem, Inc.

The five alternative regulatory mechanisms analyzed are as follows:

- DER Incentive Adder – This option is similar to the standard practice of treating a service payment as an operating expense, except that the utility receives 4% of the cost of the periodic payments for the service solution as an incentive to compensate for the utility’s avoided earnings.

- Capitalization of a Prepaid Contract – This option employs a prepaid asset, a commonly used form of cost recovery for utilities, which treats an expense similar to a physical asset by placing it into the rate base, amortizing it, and recovering it over time. In this case, a service payment would be pre-paid for a number of years and would be amortized over the length of the contract. The utility would collect its yearly carrying costs, including return for the investors’ equity, based on any unamortized balances.

- Non-Wires Alternative (NWA) Incentive – The NWA Incentive functions similarly to the Prepaid Contract, but with an additional earnings incentive to compensate for lower earnings when the service costs less than the equivalent capital asset. The utility shares in 30% of the present value of the total savings when compared to the capital investment it would replace.

- Modified Clawback Mechanism – This option is an adjustment to the net capital plant reconciliation, or “clawback,” mechanism, which is used in some states to reclaim the unspent portion of an approved capital budget, plus the associated earnings. The Modified Clawback Mechanism leaves intact any portion of the capital budget that goes unspent because the associated investment was replaced with a service expenditure. Any positive difference between the original amount in the capital budget and the service cost paid through Operations and Maintenance (O&M) is retained as profit until the next rate case, when the O&M budget is increased to provide rate recovery for the service expenditure.

- Pay-as-you-Go – This option combines a number of features from the other mechanisms. Under PayGo, the utility prepays a service expenditure for one year at a time and places the prepayment into the rate base as a regulatory asset. With authorization from the state utility commission, the utility would amortize these regulatory assets over a period greater than one year. In the AEE Institute model, the amortization rate, based on one-third the life of the service contract, would apply to the prepayments as a group. Thus, the regulatory asset would build year-on-year while simultaneously being amortized. In addition to these earnings from rate base, the utility receives a variable shared savings earnings incentive proportional to the cost savings provided by the service option. For example, if the all-in costs of the service solution are 25% less than the capital investment alternative, the utility would take 25% of the total savings.

As shown in the table below, many of the regulatory mechanisms, under various scenarios, provide savings to customers by substituting a service solution for a capital investment, even when the cost of the solution is comparable, and provide similar or greater earnings for the utility, even when the cost of the service solution is less than the capital investment replaced. The figure below provides results for one of three scenarios modeled.

Figure A: Modeling Results for the Short-Term Replacement Scenario

“Because of the cloud revolution in the technology industry, utilities now have many different ways to buy the software they use to run their businesses. It’s important that regulation catch up with this revolution so that utilities can make the best decisions for their customers. This paper shows that everyone can be better off when utilities have the option to buy software as a service,” said Richard Caperton, Director of National Policy and Regulatory Affairs at Oracle Utilities.

Background Resources:

- Utility Earnings in a Service-Oriented World report download link is here.

- Advanced Energy Perspectives, “How Utilities Make Money” blog post is here.

- Advanced Energy Perspectives, “New York REV Order Gives Utilities Ways to Make Money in Changing Role” blog post is here.

About Advanced Energy Economy Institute and AEE

The Advanced Energy Economy Institute (AEE Institute) is a 501 (c)(3) charitable organization whose mission is to raise awareness of the public benefits and opportunities of advanced energy. AEE Institute provides critical data to drive the policy discussion on key issues through commissioned research and reports, data aggregation and analytic tools. AEE Institute also provides a forum where leaders can address energy challenges and opportunities facing the United States. AEE Institute is affiliated with Advanced Energy Economy (AEE), a 501(c)(6) business association, whose purpose is to advance and promote the common business interests of its members and the advanced energy industry as a whole. AEE and its State and Regional Partner organizations are active in 27 states across the country, representing more than 1,000 companies and organizations in the advanced energy industry.