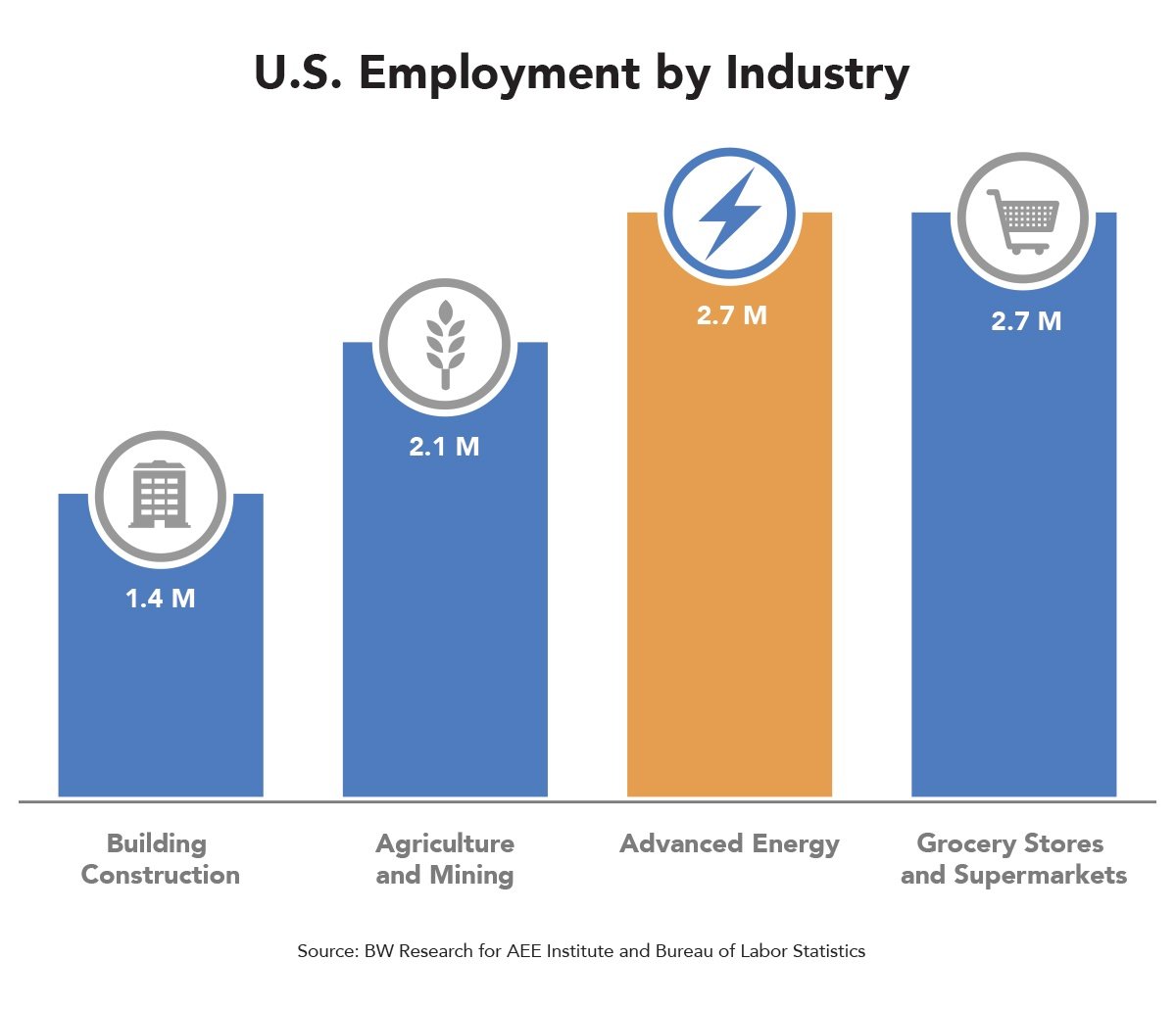

For years now, AEE has been tracking the growth of the advanced energy industry in terms of dollars. Since 2011, U.S. advanced energy revenue has grown 29%, reaching $200 billion in 2015. While market growth has been impressive, we have struggled to pinpoint the number of jobs supported by the industry given the complexity of industry surveys. But now, thanks to newly available data, we can say definitively that advanced energy is a major source of employment in the U.S. How does advanced energy measure up compared to other employment sectors? Let’s look at the numbers.