This post is one in a series of feature stories on trends shaping advanced energy markets in the U.S. and around the world, drawn from Advanced Energy Now 2016 Market Report, which was prepared for AEE by Navigant Research.

On November 30, 2015, 12 months after its official deadline to propose the RFS levels for 2014 (that’s right, 2014), EPA released the final annual percent standards for 2014, 2015, and 2016, and for the 2017 Biodiesel volume.

For 2014, EPA played it safe, matching the annual percent standards with the actual consumption of biofuels in transportation fuel, heating oil, and jet fuel in the contiguous United States and Hawaii. EPA increased slightly the total mandate from 9.2% to 10.1% of U.S. fuel consumption in the next two years. Under the new mandate, there are separate carve-outs for advanced biofuels, which include biomass-based diesel (biodiesel or renewable diesel produced from vegetable oils or animal fats) and cellulosic fuels (biofuel including biogas that is produced from plant matter), and a general pool that can be fulfilled with other biofuels including grain-based ethanol (defined as starch-based ethanol). Most of the growth in the annual percent standards is expected to come from advanced biofuels, which are set to increase 35%, from 16.5% to 20% of the total mandate in 2016. Conventional biofuels, in contrast, will grow by 6.5% in the same period. The new annual percent standards make no one really happy – neither the biofuel producers, who wanted the standards higher, nor the petroleum industry, which wants them gone altogether – which was probably the intention.

RFS was first introduced under President George W. Bush and later revised and expanded in 2007. Iowa has benefited mightily from the mandate, serving up a sea of corn and soybeans, both commodities that have played a crucial role in America’s first-generation biofuels capacity growth. Since the revised standard went into effect, biofuels production in the United States has doubled. According to Navigant Research, conventional biorefineries (those that produce starch-based ethanol) concentrated in the Midwest currently account for just under half of global biofuels production capacity today.

For conventional biofuels, the new mandate is not good, but perhaps not surprising. In the original mandate, conventional biofuels had a target for 2015 of 15 billion gallons (1.6 billion gallons more than in the final mandate), but the increased use of ethanol has been limited by what the industry calls the “blend wall,” the limit of 10% ethanol by volume that older gasoline engines can use in their fuel. As consumption of transportation fuel has slowed, due in part to more fuel-efficient vehicles, the blend wall has limited the growth of biofuel consumption.

The Renewables Fuel Association reported June 1, 2015 that operating capacity of the industry was 14.9 billion gallons per year, which implies that the mandate covered 92% of its capacity in 2015 and 98% in 2016. The mandate is high enough to support all the plants currently operating (although some might have to reduce their production). Leading producers like POET, Green Plains Renewable Energy (GPRE), and Abengoa are expected to do well.

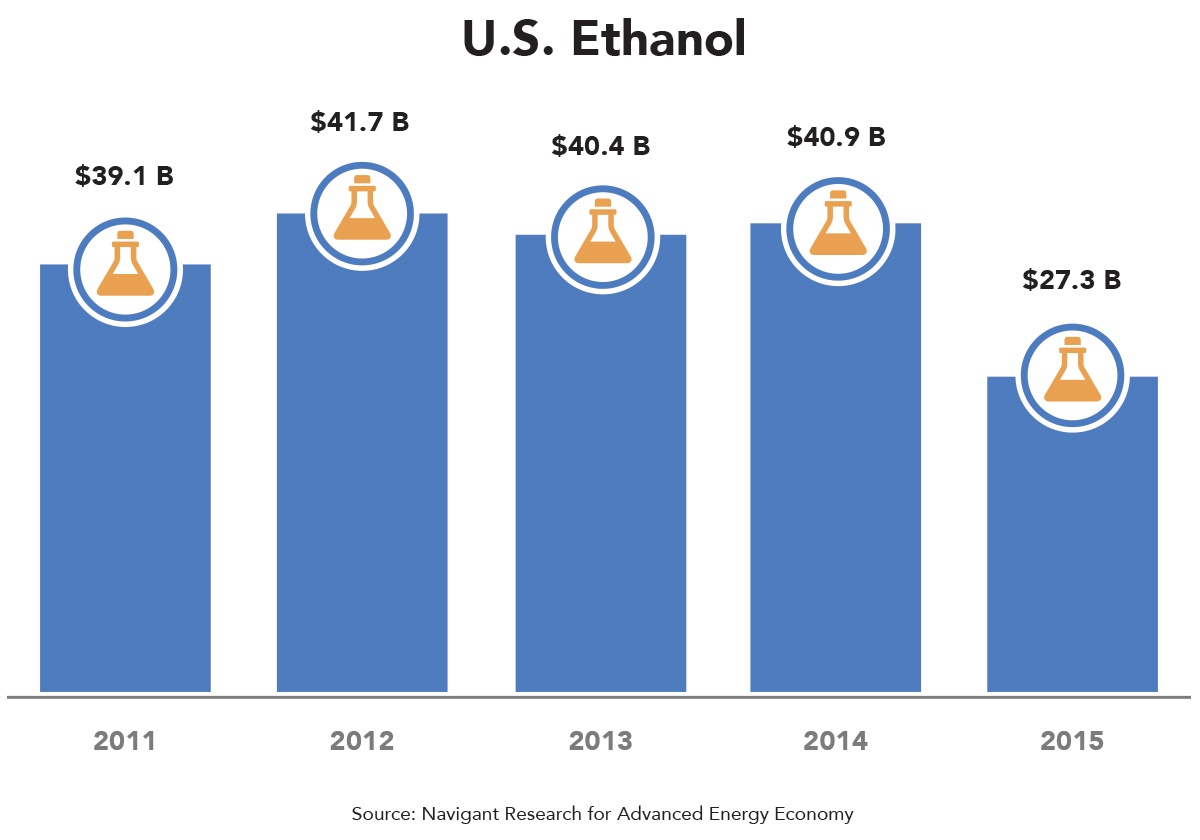

Revenue generated by the ethanol industry dropped dramatically between 2014 and 2015, driven by the falling price of ethanol. During 2014 wholesale ethanol in the United States sold, on average, at $2.75 per gallon, while in 2015, the price averaged $1.74 per gallon (36% less). Globally, ethanol was sold at $2.97 on average during 2014, and at $1.87 per gallon in 2015. As a fuel substitute, the price of ethanol is highly correlated to the price of crude oil. In years when ethanol production exceeded the RFS mandate, ethanol has traded at around 70%

of the price of gasoline, due to its lower energy content. The other factor affecting ethanol margins is the price of feedstocks (corn, sugar beet, and sugar cane). When the price of these feedstocks is too high relative to the price of ethanol, it forces some plants to shut down as they become unprofitable.

Largely as a function of a drop in price, revenue from the Ethanol product category dropped dramatically in 2015 – down 40% globally, to $45.6 billion, and 31% in the United States, to $27.1 billion. In both worldwide and U.S. markets, Ethanol revenue hit its lowest point in the five years Navigant Research has been tracking the industry for AEE.

The picture for the rest of the biofuel industry is rosier. The new annual percent standard for biomass-based diesel is high enough to absorb the current capacity. U.S. consumers used a record of nearly 2.1 billion gallons of biomass-based diesel in 2015. U.S. revenue from Biodiesel, fell slightly from $3.3 billion in 2014 to $3.2 billion in 2015 in line with global revenue, which also fell slightly – 2% – to $19 billion. The new annual percent standard will benefit producers like the Renewable Energy Group and Neste Oil – both large producers of biomass-based diesel.

In the new standard, EPA did keep a large carve-out for cellulosic biofuels. The United States used 127 million gallons of ethanol-equivalent cellulosic biofuels in 2015, 4 million gallons above the 2015 mandate. Although a lot of investment has gone into technologies to produce liquid fuels from cellulosic material, this segment of the biofuels industry has yet to achieve true commercial scale. Rather, it is biogas producers that are benefiting most from this mandate. Biogas is the product of the process of decomposing organic material – typically sewage slurry, manure, and food residues – in an oxygen free environment, known as anaerobic digestion. Biogas producers are supplying virtually all the cellulosic biofuels – 125 million gallons of ethanol equivalent – while only 2 million gallons of cellulosic ethanol were actually blended, even though biogas was approved as a cellulosic biofuel just halfway through 2014.

Learn more about biofuels and the entire advanced energy industry in Advanced Energy Now 2016 Market Report, available for free at the link below.

Featured image courtesy of Oak Ridge National Laboratory.