This post is one in a series of feature stories on trends shaping advanced energy markets in the U.S. and around the world, drawn from Advanced Energy Now 2016 Market Report, which was prepared for AEE by Navigant Research.

A CHP facility at the University of Arizona.

The use of CHP in large buildings has increased recently in the United States, Europe, and Asia-Pacific. This is due largely to technical improvements and cost reductions in smaller-scale (often pre-packaged) systems that match thermal and electrical requirements of buildings. Nevertheless, many owners of commercial properties, especially those of smaller facilities, are not aware of opportunities to install CHP, as they do not consider energy to be part of their core businesses. This educational gap presents a potential limitation on the continued growth in the number of CHP installations that are ultimately pursued.

The commercial CHP market is a bright spot for CHP. It consists of a loose collection of building types ranging from hospitals and college campuses to high rises, prisons, and other categories within the built environment. In 2015, continued growth brought total installations to just over 33 GW of capacity, with an average capacity of approximately 3 MW per installation. Today, installations are mostly confined to developed markets in Northern Europe, South Korea, Japan, and the United States. Hospitals, universities, and other applications with nearly 24/7 heat load requirements represent the greatest share of the global installations.

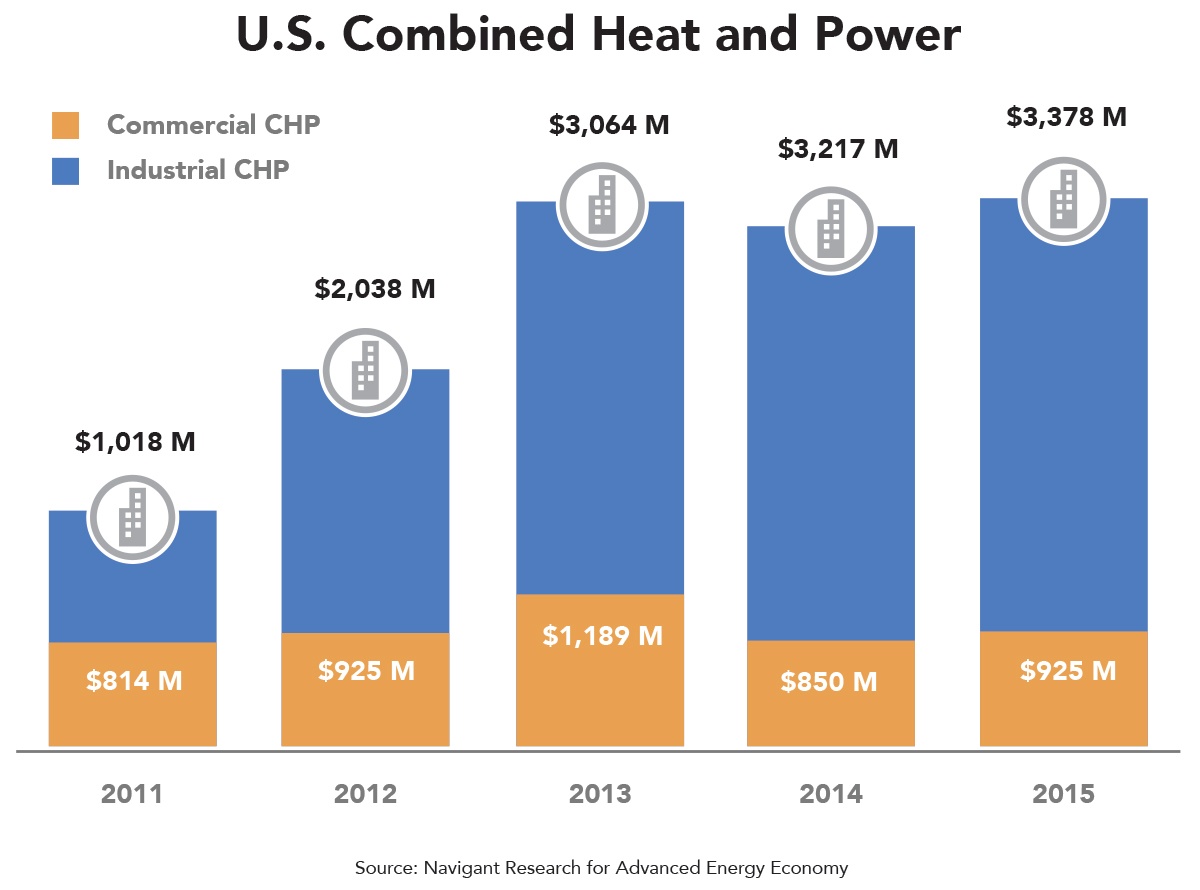

Industrial CHP is still a bigger market, with $29.9 billion in revenue globally in 2015, $3.4 billion of that in the United States, with growth of 5% over last year in both. But commercial CHP is growing faster: up 17% globally, to $3.5 billion, and up 9%, to $925 million, in the United States Although hospitals and institutional buildings such as universities represent the largest installed base among application groups, small and large commercial buildings are expected to gain an increasing share of the market over the next decade.

The upfront capital cost associated with CHP systems is the primary barrier to continued market growth. In addition, a range of factors impact the prospects for CHP:

-

High or volatile “spark spreads,” or the difference between electricity and natural gas prices on a $/MMBtu basis;

-

Significant, year-round thermal requirements;

-

Match between customer needs for thermal and electrical output;

Favorable regulatory framework with utilities (i.e., interconnection standards, net metering or feed-in tariffs, demand charges, standby charges, etc.).

The relative importance of these factors depends on geographic location, building size, building function, and other site-specific factors. End users – from hospitals to schools to business parks – have installed CHP systems as a means of reducing operating expenses, improving power reliability, and capturing sustainability benefits monetized through credits, rebates, and increased sales or tenant occupancy based on market differentiation. The two primary motivations, though, are energy savings potential and guaranteed power supply to mission- critical operations (e.g., research institutions, hospitals, and data centers). CHP received an additional boost in 2012 when President Barack Obama signed an executive order to accelerate investments in industrial energy efficiency, including CHP. The executive order sets a national goal of 40 GW of new CHP installations over the next decade.

Among equipment suppliers, GE designs and manufactures a variety of components used in CHP systems including Waukesha gas engines, designed for isolated, mission-critical applications. 2G Energy focuses on mass-manufactured systems, which reduce the cost and complexity of installation, as these systems can be manufactured, delivered, and installed in 15 to 21 weeks. Capstone Turbines’ microturbine systems are designed to work individually or in a series, on- or off- grid, and as prime power or backup units. Germany-based MWM, acquired by Caterpillar in 2010, produces turnkey CHP container systems that are designed to enable quick availability at low cost, maximize control over the entire system, encourage flexibility, require low maintenance, and provide high run-times. Using pre-manufactured components and a modular design, installation costs are kept to a minimum. To overcome the need for regular oil changes, Tecogen typically installs one extra module that allows customers to avoid exorbitant charges when they must rely on the grid for short periods of downtime.

Companies involved in developing, operating, and managing CHP institutional and district energy systems in the United States and around the world include Veolia, GE, Blue Delta Energy, and Invenergy.

Learn more about CHP and the entire advanced energy industry in Advanced Energy Now 2016 Market Report, available for free at the link below.