.png?width=626&height=313&name=What%20to%20Watch%20in%20the%20Energy%20System%20in%202023%20(and%20Beyond).png)

Advanced Energy United is looking at macro trends impacting the electricity system in 2023 and beyond. This is the first in a seven-part series looking at what lies ahead – part of a broader look at what lies ahead for policymakers, customers, and utilities following government incentives and market shifts in 2022. Read the rest of the series here.

Renewables are the least-cost option for new generation, and often beat out existing generation.

The biggest energy story of 2022 was undoubtedly the Inflation Reduction Act (IRA), which will catalyze a transition to clean energy across economic sectors by providing significant tax credits and other incentives for technologies big and small. Even without taking the IRA into account, the unsubsidized levelized cost (the “all-in” cost without incentives) of new large-scale solar photovoltaic and wind generation continues to beat out new fossil fuel generation. This was already the case before recent increases in natural gas prices that make the switch to renewables even more compelling. Efforts to reduce the greenhouse gas emissions from fossil plants – whether by blending hydrogen or renewable natural gas with fossil natural gas, or by adding carbon capture and storage – only drives their costs up further.

But this story is not just about new generation. Both Lazard and Energy Innovation have found that new large-scale renewable facilities are often less expensive on an all-in basis than simply operating existing coal plants. This means that it can be cheaper to build an entirely new renewable energy project than to continue to run existing coal plants.

Of course, the levelized cost of energy only tells part of the story. Additional research by RMI has found that portfolios of clean energy resources can provide all of the same services as fossil fuels – all at a lower price tag. With gas prices as high as they have been in the last year, new renewables might even begin to outcompete existing gas plants in the next decade.

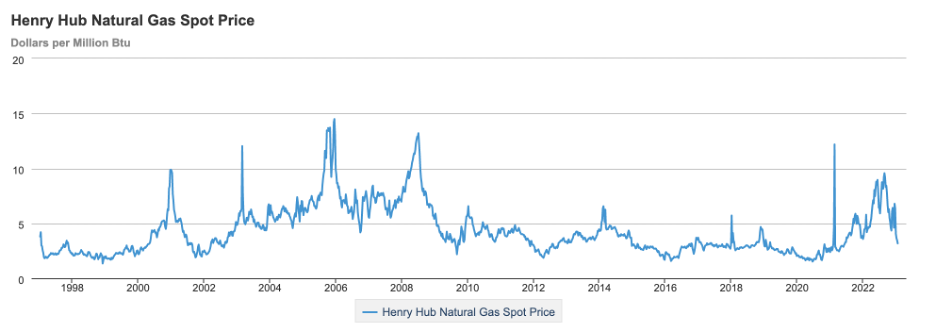

Natural gas gets pricey… and more volatile.

The 2010s marked a decade of low and relatively stable natural gas prices in the United States. The favorable economics of the fuel spurred major growth in natural gas electricity generation and increased reliance on natural gas for home space heating, water heating and other uses. But the past two years have been a wakeup call, with several factors driving up prices. First, as global trade in liquefied natural gas (LNG) has increased, domestic pricing has become more exposed to supply/demand imbalances and geopolitical factors, just like petroleum. Russia’s war against Ukraine, for example, significantly impacted international trade in gas via pipeline and LNG. There is also the ongoing need to cover the extraordinary costs of 2021’s Winter Storm Uri (and several cold snaps since) in the United States.

As a result, gas and electric utilities across the country requested significant rate increases to cover their high fuel costs in 2022. Under the current regulatory model, these costs are simply passed on to customers. Although utilities make efforts to manage fuel price risk, customers ultimately pick up the tab for higher fossil fuel prices. Xcel Colorado recently increased its gas bills by 54%. Arizona Public Service expects its customers to pay $20 more per month to cover its gas-powered electricity generation. Duke Energy Indiana requested electric rate increases of 16% and then another 7% “because fuel markets have been volatile and there has been a “significant and prolonged” risk in the price of coal and natural gas.”

Looking ahead: As we layer IRA incentives, the takeaway for utilities becomes crystal clear: new large-scale renewable generation is by far the most affordable energy option for customers. Expect to see newly issued and newly-refreshed Request for Proposals to account for these new economics, and an explosion of renewable projects in the development pipeline.

Looking ahead: As we layer IRA incentives, the takeaway for utilities becomes crystal clear: new large-scale renewable generation is by far the most affordable energy option for customers. Expect to see newly issued and newly-refreshed Request for Proposals to account for these new economics, and an explosion of renewable projects in the development pipeline.

Gas prices are notoriously hard to predict, although few expect a near-term return to stable, low costs. These conditions will make running gas plants relatively more expensive. Despite this, utilities and power producers still plan to build around 17 gigawatts of new natural gas over the next several years. Expect hard conversations at public utility commissions across the country and staunch disagreements about the best and most affordable pathway forward.

On the buildings side, rising gas bills may convince some gas customers to ditch their old gas furnaces and water heaters for new high efficiency electric alternatives. For the next decade, the IRA will also support that move with tax credits and rebates. Several states are beginning to consider how this may affect future customer bills and infrastructure needs.

Next up: Part 2: The Grid in Transition: Storage deployment and distributed generation will transform grid development.

Advanced Energy United Managing Director Hannah Polikov and Policy Principal Angela Kent contributed to this series