This post is one in a series of feature stories on trends shaping advanced energy markets in the U.S. and around the world, drawn from Advanced Energy Now 2016 Market Report, which was prepared for AEE by Navigant Research.

High penetration of renewables in markets such as Hawaii, California, Denmark, Germany, and China is one aspect of the ongoing changes in the electricity system that points toward rising opportunity for energy storage at the residential, commercial, and utility levels. Solar and wind, in particular, as rapidly scaling forms of variable generation, could benefit from storing excess electricity generation – whether on the grid or in the home – until it is needed. At the same time, energy storage is emerging as an alternative to traditional sources of ancillary services, for voltage regulation and other grid supports. Ultimately, large-scale storage could replace peaking power plants that are needed to run only a few hours a year to meet peak demand, while also being used to provide other valuable grid services year-round.

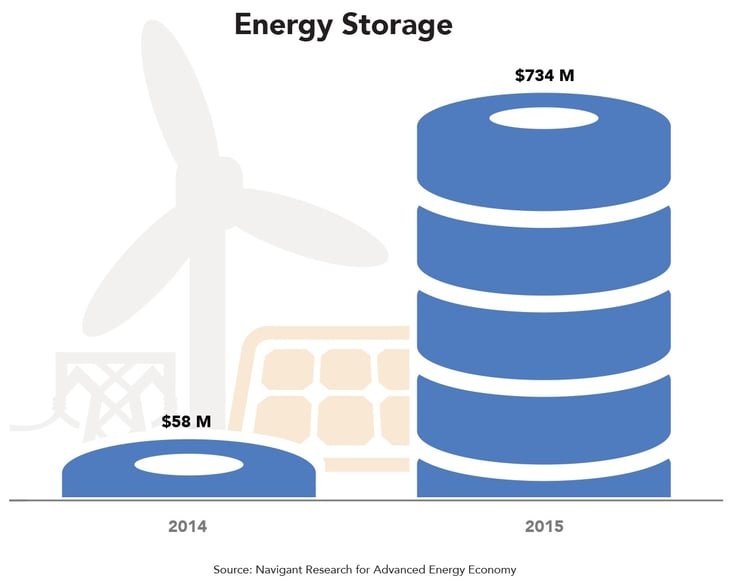

As noted in last year’s Market Report, energy storage is transitioning from a large infrastructure market of pumped hydro and underground compressed air projects – which it still is, in much of the world – to a technology-driven market, with rising scale and falling prices. And it is taking off: global revenue from Energy Storage multiplied five-fold, from $462 million in 2014 to $2.1 billion in 2015, and in the U.S. more than ten-fold, from $58 million to $734 million. (See graph above.)

Lower prices for advanced batteries and a flood of new systems integrators are opening up new use cases and geographic markets for energy storage systems situated on the distribution grid or behind the meter. Tesla’s Powerwall, a home battery storage system announced in May, is being marketed as a companion to PV systems as well as a back-up power source. It is being sold to customers by companies including SolarCity, and Vermont utility Green Mountain Power. Tesla claims to have taken enough reservations to account for the entire rst years’ worth of estimated production. Sungevity, another distributed solar provider, is also offering a solar-plus- storage package in the United States, in partnership with Sonnen, one of Europe’s leading home energy storage firms.

According to Navigant Research, new installed energy storage systems for renewable energy integration are expected to grow from 196 MW globally in 2015 to 12.7 GW in 2025.

Several countries are forecast to see substantial growth in energy storage deployments in the coming decade. The two leading countries, the United States and China, are expected to have a balanced mix of utility-scale and distributed storage installations. Annual deployments of utility-scale energy storage in the United States are expected to increase from 184 MW in 2015 to 4.2 GW in 2025, and from 89 MW in 2015 to 2.6 GW of distributed systems. Even larger growth rates are expected for China, where annual utility-scale deployments are forecast to grow from 97 MW in 2015 to 5.5 GW in 2025, and from 60 MW in 2015 to 3.6 GW of distributed systems.

Growth in the United States to date has been led by California, where market trends and legislative actions have combined to create a rapidly growing market for both distributed and utility-scale energy storage. In 2010, the state passed AB 2514 – the country’s first energy storage mandate – requiring utilities to procure 1.3 GW of energy storage by 2020, of which 875 MW must be distribution grid-connected or customer-sited storage. Southern California Edison (SCE) was the rst utility to procure energy storage under these requirements and announced contracts for 261 MW of new energy storage capacity, five times the amount required under the new state law. SCE’s contracts for energy storage included a 100 MW battery system from AES Energy Storage and a 26 MW thermal energy storage system from Ice Energy.

Many of the energy storage projects procured to meet California’s energy storage requirements will be installed over the next five years, and additional procurements from utilities will continue. In 2015 the state passed SB 350, modifying the state’s RPS to require utilities to generate 50% of their electricity from renewable sources by 2030. More energy storage projects are expected to come online in order to help integrate variable renewable generation.

The majority of the market for advanced energy storage comes from battery technologies, which have seen significant reductions in price along with improvements in capabilities and functionality in the last two years. An average utility-scale Li-ion energy storage system, which could be installed for around $1,500/kWh in 2014 are now being built for under $1,000/kWh. Li-ion batteries have undergone technological advancements in recent years. But cost and operational life continue to present an obstacle to deploying Li-ion storage at utility-scale. New advancements in liquid metal batteries, pioneered by Ambri, are designed to help solve the problem of cost-effective, utility-scale battery storage. Ambri’s liquid metal battery is made from abundant materials, is designed to handle high voltage, and made to last for signi cantly longer than most Li-ion batteries. If successfully commercialized, Ambri’s batteries could also be made at a fraction of the cost of Li-ion batteries.

But batteries aren’t everything that’s hot in energy storage. Other interesting developments include advances in modular thermal energy storage from companies such as Ice Energy and Calmac. Their technologies are used to reduce the energy demand from air conditioners by freezing water at night to provide cooling during daytime peaks. Significant advances have been made in flywheel technology in recent years by companies including Amber Kinetics, Temporal Power, and Beacon Power. New ywheel systems now allow energy to be stored for up to four hours. This technology has the advantage of a longer lifecycle with potentially lower operating costs compared to batteries.

While battery and other hardware improvements will continue, much of the industry’s focus is now on innovation in software and energy management controls. Many leading storage system integrators such as, Greensmith, Invenergy, RES Americas, AES Energy Storage, Stem, and Younicos offer proprietary software and controls that are designed to maximize the value of a system by providing multiple services to the grid or end-users, thereby capturing the maximum possible revenue.

Energy storage enabling technology – including power conversion (primarily focused on inverters), system-level software and controls, and systems integration services – is a portion of the energy storage value chain getting intensive attention. While battery prices have fallen 40% to 60% in the past 18 months, thanks to manufacturing innovations and volumes, energy storage systems overall still vary wildly in terms of price. Now that battery prices have started to come down, the balance of plant—or the enabling technology portion of overall cost— needs to deliver on pricing. Once this happens, the industry will scale further and faster.

Learn more about the growth of energy storage, as well as the rest of the advanced energy industry, by downloading the free report below: