As the United States transitions toward advanced energy and transportation, the nation (and indeed the world) will witness exponential growth in demand for energy storage. Lithium-ion batteries are key to this development, accounting for more than 99% of electric vehicle (EV) batteries and 90% of utility-scale storage in 2021. China currently dominates nearly every aspect of the lithium-ion supply chain, enjoying the ensuing economic and strategic advantages that come with it. For the U.S. to upend this dynamic and build a domestic storage industry, the first step is understanding the battery supply chain and identifying opportunities for disruption, from responsible sourcing and recycling of materials to support for domestic manufacturing. There is no time to lose.

China now controls production of more than 80% of minerals used in EV batteries, accomplishing this dominance through purchasing mines around the globe, expanding mainland mining efforts, and dominating mineral processing. China can sell to the companies and countries they align with; centralized control allows the Chinese Communist Party (CCP) to ensure that Chinese battery cell manufacturers receive better prices and sometimes even an exclusive mineral supply. Furthermore, Chinese mineral processing means significantly lower transportation costs for mainland battery manufacturers. Opportunities to increase U.S. lithium-ion manufacturing hinge on addressing domestic mineral shortages through incentivizing domestic production and recycling.

Global Sources of Key Minerals for Li-Ion Batteries

Source: Chemical & Engineering News, December 2019, cen.acs.org/energy/energy-storage-/Northvolt-building-future-greener-batteries/97/i48

Source: Chemical & Engineering News, December 2019, cen.acs.org/energy/energy-storage-/Northvolt-building-future-greener-batteries/97/i48

The most important minerals in lithium-ion battery manufacturing are lithium, nickel, and cobalt. While Australia and Chile account for most lithium mining, China controls nearly all global lithium processing, lending it command over supply of this vital mineral. However, the U.S. and Mexico hold some of the world’s largest untapped reserves of lithium, so expanding responsible mineral development and processing in North America offers an opportunity to reduce foreign reliance.

China also dominates processing and sourcing of cobalt through mining investments and a close trade relationship with the Democratic Republic of Congo (DRC). The DRC has the vast majority of global cobalt reserves, but humanitarian issues in that country and price volatility make cobalt a particularly challenging element in the lithium-ion supply chain. Recent innovations to eliminate cobalt from some kinds of lithium-ion batteries, such as Tesla’s 4680 battery cell, could help avoid this issue altogether.

Battery manufacturers may be able to reduce reliance on cobalt, but doing so will require increasing the nickel content in the battery’s cathode (positive side). With Indonesia, Philippines, Australia, and Canada leading global nickel production, the nickel supply chain may appear insulated from China’s influence. However, through a $35 billion investment in Indonesia’s nickel mines, China also retains a level of control over this element in the lithium-ion supply chain as well.

As demand for nickel grows, tracking not only the growth in batteries but also its substitution for cobalt, this will open opportunities for the U.S. battery recycling industry. Recyclers break down batteries from consumer electronics, extract cobalt and nickel, then sell those minerals for new batteries. Leading recycling companies, such as Redwood Materials and Li-Cycle, have already shown positive unit margins, with overall profitability within sight. As the recycling industry grows and achieves economies of scale, it can help meet the increasing demand for battery materials.

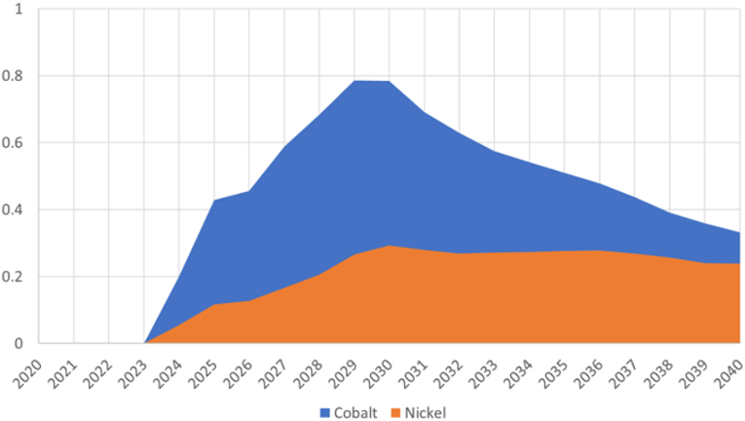

Because EV batteries last decades, the recycling industry plans to focus on consumer electronics until at least 2030. Only 15% of retired lithium-ion batteries are currently being recycled, so policy could greatly aid current industry collection efforts. The graph below projects the portion of domestic nickel and cobalt demand that recyclers could meet if the government takes steps to support the industry – up to 78% of cobalt demand and 27% of nickel demand by 2030.

Proportion of Nickel and Cobalt Needed for New Batteries that Could be Recovered from Recycled Batteries

Source: The White House, June 2021, www.whitehouse.gov/wp-content/uploads/2021/06/100-day-supply-chain-review-report.pdf, p. 109.

Technology innovation as a solution to supply chain constraints can also be seen in the development of synthetic graphite. China has 60% of global graphite mining and nearly 100% of graphite processing, but the advent of synthetic graphite eliminates that advantage. The U.S. currently produces synthetic graphite for a 50% premium over the price of naturally occurring graphite, but that price is quickly declining as manufacturing scales.

Current legislative efforts center around stimulating the demand side of the domestic battery industry. For instance, the most common incentives across major renewable technologies are investment tax credits (ITCs). These incentives go to investors who purchase solar, wind, or batteries primarily charged with one of the two, making it cheaper to purchase. Current efforts focus on expanding eligibility for ITCs to apply to nearly all forms of energy storage technology, but still center around demand-side subsidies. Policymakers need to take into consideration supply-side measures as well.

If the U.S. wants to increase domestic production of lithium-ion cells, ensuring a North American mineral supply is the place to start. That needn’t be achieved strictly through mineral extraction, because research and innovation can help reduce or eliminate the need for some of the most problematic resources. Expanding domestic mineral processing and recycling efforts can help solve others. State and local governments responsible for waste collection may play a valuable role in achieving that. Creating streamlined ways to send used electronics to recyclers would address the largest constraint on the battery recycling industry.

Investments in mining, mineral processing, and recycling are prerequisite to an affordable and independent U.S. lithium-ion industry. Building an enduring supply chain begins with laying a stable foundation.

Brendan Foody is an AEE policy intern attending Georgetown University this fall.

For more on the potential for domestic production of advanced energy technologies, download AEE's policy paper, "Advanced Energy Manufacturing: an Economic Opportunity for the United States," by clicking below.