Extreme weather. Spiking natural gas prices. Peak levels of electricity use that push the grid to its limit. Our energy system faces a growing set of challenges, and our utilities and their regulators have to make big infrastructure and investment decisions today to solve those challenges. But even with a growing number of advanced energy technologies and solutions available – including those on the demand-side – many electric utilities just want to build more natural gas-fired power plants. We think there is a better way. Here’s how utilities – and one utility in particular – can use rates, incentives, and technology to manage energy use and save customers money.

The natural gas “peaker” plants that utilities are often quick to put forward cost hundreds of thousands to billions of customer dollars to build, and generally run only 5% to 10% of the time, when demand for electricity is at its highest. As the resource mix shifts toward cleaner energy sources for much lower cost, these fossil fuel plants, built to last half a century or more, come with significant risk of becoming obsolete before they are fully paid off by customers. And with the recent passage of the Inflation Reduction Act, that shift will only accelerate.

That’s why AEE has been engaging in electric utility resource planning processes to promote distributed energy resources such as demand response, time varying rates, and energy efficiency as cost-effective and valuable tools for a utility to add to its toolkit, and as attractive substitutes for more gas peakers. These resources are adaptable to changing grid conditions over time and modular, in that they can be added in increments along with a utility’s need. This protects electric customers from utility over-investment in costly assets that might not be needed.

We commissioned analysis from Demand Side Analytics to examine these resources in the context of AES Indiana’s ongoing Integrated Resource Planning stakeholder process. Though the findings in Indiana Opportunities for Demand-Side Resources are situated in the specific AES context, they are in many ways broadly applicable to electric utilities across the country. Here are the results.

Time-Varying Rates (TVR)

The first section of the report examines TVR as a resource that can meaningfully lower daily or critical system peak demand. It also examines the trade-offs between different rate design decisions in terms of system-level capacity, cost, participation, savings per customer, and net benefits.

TVR brings to electricity sales a style of scarcity pricing common in our daily lives. Ride-sharing apps and airline and event tickets are good examples. When a service is most in demand, and therefore hardest to provide to everyone, the price rises. Customers then have an incentive to use the service or product when it is cheaper and more abundant. The same applies to electricity. Time varying rates encourage customers to shift their energy use to times of the day when it is less expensive for them and for the system. As long as the plan is designed and communicated well, customers can save money.

These types of rates are becoming increasingly common for residential customers across the country. Consumers Energy enrolled 1.5 million residential customers into its summer TVR in 2021; Fort Collins Utilities in Colorado put all of its residential customers on such rates, with a chance to opt out, in 2018.

In designing a TVR, a utility must make four important decisions: First, will the rate be daily (“time-of-use”) or dispatchable, used only in times of need (“critical peak pricing”)? Second, will it be opt-in (letting customers choose the rate plan) or default (all customers moved to the new rate with the option to switch back)? Third, how large will the price differential be between “on-peak” and “off-peak” hours? Whereas a smaller price difference may more closely reflect the short-term marginal cost of producing electricity at peak times, a larger gap may better reflect the long-run cost of building generation, transmission, and distribution infrastructure to serve higher demand. Lastly, a utility must decide whether or not to require the use of smart devices, like a Nest or eco+ thermostat, for customers on TVR. Smart devices help customers make best use of these rates without requiring much daily thought or impacting comfort, but require an upfront investment by either the utility or the customer.

Our report looks at seven different combinations of these choices and comes to several important conclusions.

- All the rate options we examined were cost-effective using the traditional Utility Cost Test, making them eligible to be selected by a resource planning model.

- Opt-in rates were generally cheaper for utilities because smart devices are not required for customers to participate. Opt-in rates also have lower education costs, as significant utility efforts would be required to move all customers to a new rate.

- Default (opt-out) enrollments result in greater participation, generating larger aggregate impacts in terms of MWs, although the per-customer energy savings are smaller.

- While customer savings vary, the average bill reduction from a default time-of-use with smart thermostats and a long-run price differential would be approximately $7 per month.

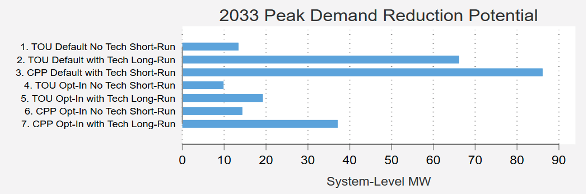

- In AES Indiana’s specific case, TVR could save between 13.4 MW and 86.1 MW for default rates, and between 9.8 MW and 37.1 MW for opt-in rates. These results tell us that these resources can significantly reduce peak load, especially when combined with other demand-side strategies.

Other benefits of TVR include their flexibility; as the peak shifts later in the day from higher system penetration of solar energy, a utility can slightly modify its rate design to maintain effectiveness. The potential of these rates to promote good customer habits, manage load, and save consumers money is also growing with the introduction of electric vehicle charging, electrification of home space and water heating, residential battery storage, and smart panels.

We encourage utilities, including AES Indiana, to consider these variable rates a valuable addition to a portfolio of supply-side resources.

Modeling Demand Response (DR)

DR (a category which includes programs such as AC and water heater load management) is a powerful tool by which customers voluntarily reduce their electricity consumption in response to a utility price signal or alert. To determine how much DR is available, utilities generally conduct a “DR Market Potential Study,” an assessment of the amount and types of untapped demand response given a utility’s mix of customers. With that information, a utility can then plan for and pursue those demand-side savings within its IRP modeling.

Unfortunately, within the IRP, DR is perennially selected at levels well below what the Market Potential Study finds available. AES Indiana offers a representative example: In 2019, its Market Potential Study found 218 MW of Realistically Achievable DR Potential, and 331 MW of Maximum Achievable Potential. But its planning model selected only 55 MW of that available and achievable DR for the entire 20-year planning horizon.

This is because DR is tricky to model using traditional planning tools. To offer the resource into a utility’s optimization model, it has to be squeezed into the digital shape of a generating plant. To do so, utilities employ a technique called “bundling” to package sets of DR resources that the model can select or reject based on the average cost of the group. In that way, results are highly dependent on a utility’s bundling strategy. We offer hypothetical examples below.

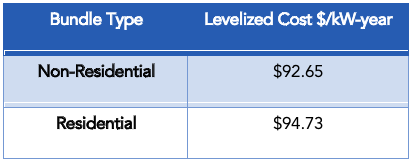

In Example A, a utility groups all non-residential DR into one bundle with a levelized cost of $92.65/kW-year, even though its industrial program is much more expensive to implement than the critical peak pricing rate it uses for commercial customers, dragging the average cost of the bundle up. Next, the utility groups all residential DR into a second bundle, even though the residential time-of-use rate it has proposed is much less expensive to implement than its residential AC load management program, resulting in a levelized cost of $94.73. If a utility’s model chooses resources from lowest-cost to highest-cost, meeting all customer demand with the final resource costing $85/kW-year, neither bundle gets selected and no DR gets deployed, despite both the commercial critical peak pricing rate and residential time-of-use rate individually having lower levelized costs than $85.

Example A. Bundling by Customer Group

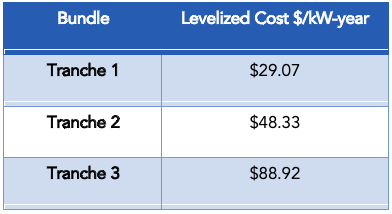

Contrast that with Example B, in which DR resources are grouped into bundles by levelized cost, each with a mix of residential and non-residential offerings. Tranche 1 contains the commercial critical peak pricing rate and the residential time-of-use rate, Tranche 2 has a small commercial direct load-control program that is slightly more expensive, and Tranche 3 contains the more costly programs for both industrial and residential customers. With the same cutoff of $85/kW-year, the utility would select Tranche 1 and Tranche 2, potentially deploying hundreds of MW in DR.

Example B. Bundling by Cost

Our report surveys several bundling strategies employed by Public Service New Mexico, Duke Energy Indiana, Xcel Energy Upper Midwest and Minnesota Power and offers two possible pathways for utilities: 1) bundling DR resources into groups of similar levelized cost, as demonstrated in Example B above; or 2) excluding offerings that do not pass the standard Utility Cost Test from all bundles so they do not drag costs up and lead to the exclusion of a whole package of otherwise economic DR options.

Planning for Shifts in Peak Load

The final section in our report offers utilities a new, long-term perspective on the resources it needs to meet changing daily and seasonal peaks that can be reduced by demand-side resources.

As more solar is added to the grid, the hardest hour of the day for a utility to serve shifts later to when the sun sets. A different set of demand-side and efficiency resources will be useful control that new, later-evening peak.

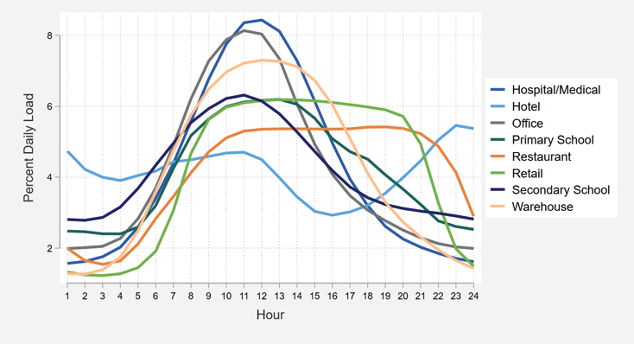

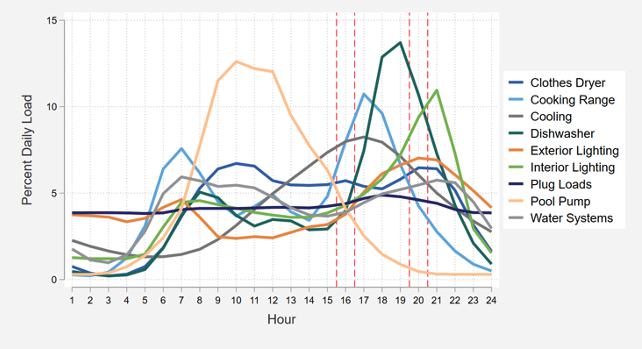

To begin, different types of customers use energy differently. Demand response programs and energy efficiency efforts can be targeted towards those customers whose energy profiles are contributing most to peak load. While programs today may focus on office lighting and warehouses to reduce today’s early evening peak, restaurant and retail business efficiency may become more valuable in a later-evening peak scenario.

Similarly, appliances have different values in contributing to peak reduction. Under today’s peak, cooking ranges, cooling, and dishwasher efficiency would be most valuable. As the peak shifts later, managing dishwasher, interior, and exterior lighting load will become most important.

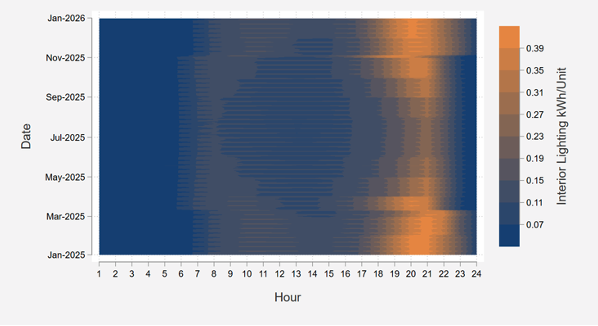

Utilities should also consider seasonality. If we look at the heat map below, we see that interior lighting is used more and later during winter evenings. A traditionally summer-peaking utility may not value interior lighting efficiency highly because the effort and cost may not be worth the small reward. But, if that same utility anticipates that it will soon move from a summer-peaking system to a dual-peaking system because of the electrification of space heating and because less solar generation is available (i.e., similar peak demand in July and January) or a winter-peaking system, it may be wise to double down on its interior lighting efficiency efforts.

Indiana utilities have historically prized peak load reductions from 3pm to 6pm in the summer. Given the widely anticipated changes coming to our energy production and use, we strongly recommend that utilities begin developing a new set of energy efficiency programs that focus on a later evening and winter peak. By doing so, they will avoid being caught unprepared in the future.

The energy system is changing. Utilities need new resources and new approaches to planning to ensure that they are serving their customers the cleanest, most reliable, and most affordable energy available, today and into the future.