This post is one in a series of feature stories on trends shaping advanced energy markets in the U.S. and around the world, drawn from Advanced Energy Now 2016 Market Report, which was prepared for AEE by Navigant Research.

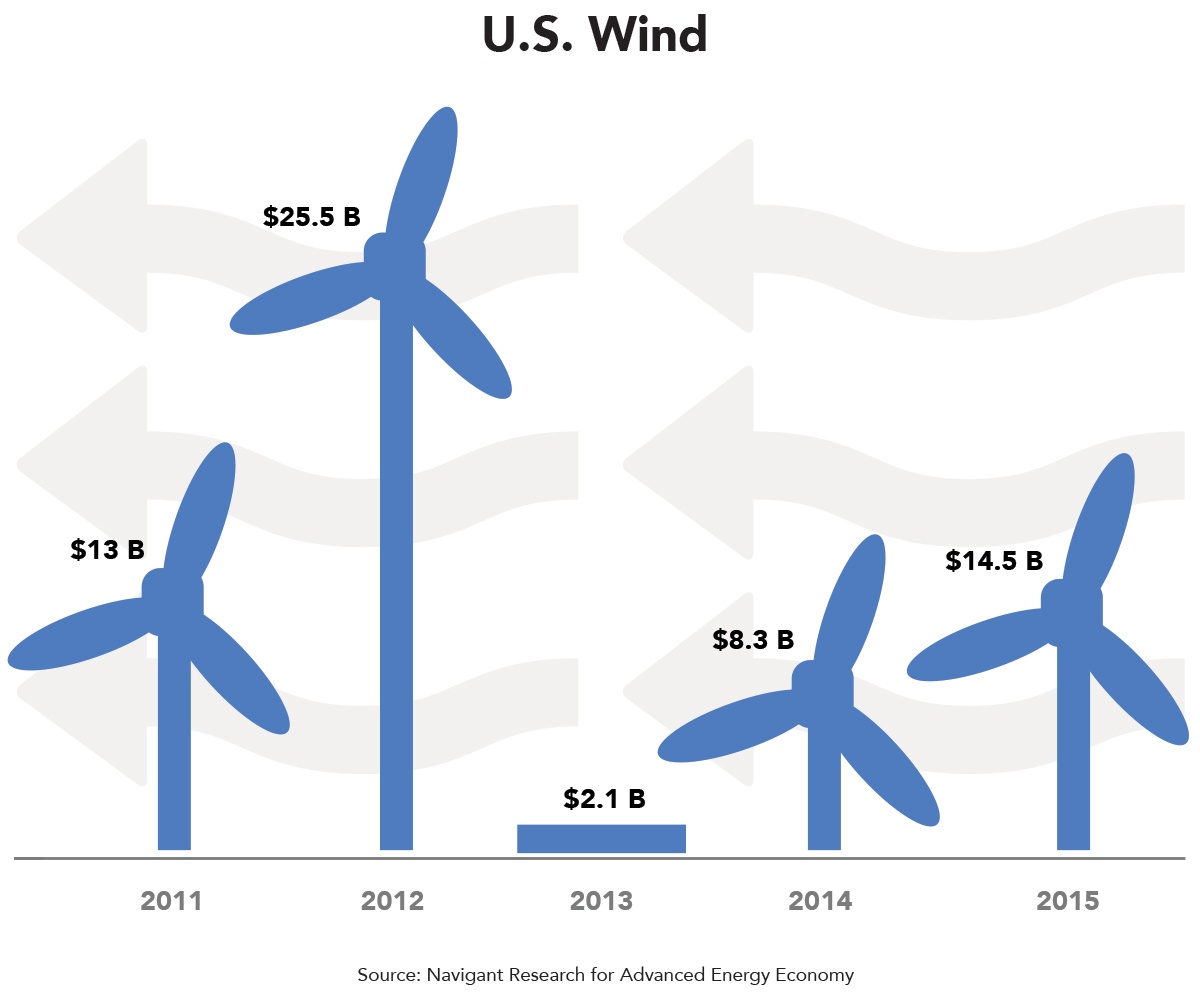

With expiration of the production tax credit (PTC), the wind industry in the United States raced to commence construction on projects before the 2014 end-of-year cutoff of eligibility. As a result, more than 8.5 GW of wind power was brought online in 2015, producing revenue of $14.5 billion (up 75% over 2014), with another 9.4 GW now under construction that qualified under the old rules. (See above.) Now, with the long-term extension and gradual phase-out of the PTC over the next four years, passed by Congress in December, the wind industry boom is expected to continue for the next several years. The momentum should build toward a likely PTC- driven installation peak in 2018 (due to projects that commence construction prior to January 1, 2017, securing the 100% PTC), after which PTC gradually phases out through 2019 (80% of the full PTC for projects that commence construction in 2017, 60% in 2018, and 40% in 2019). At that time, depending on natural gas pricing, the ability to further reduce wind installation costs, and the Clean Power Plan, the wind industry will likely be better able to compete head-to-head with other resources in the marketplace – as it is now already doing successfully in several regions of the country.

Texas stands to be one of the biggest winners of the PTC extension with over half of the expected capacity in the pipeline being built in the Lone Star State alone. This is largely due to the robust transmission system now in place in Texas – speci cally, the Competitive Renewable Energy Zone (CREZ) transmission system, which was completed in early 2014. With development of large amounts of wind generation in remote locations, a strong transmission system is needed to connect this power to population centers over the grid. CREZ leads the way, with the capability of transmitting up 18.5 GW of wind power alone and as much as 6 GW of solar that is expected to be online by 2017.

Companies such as Vestas, General Electric (GE), and Siemens are among those that are well positioned to capitalize on U.S. market growth – and beyond. Recent deals between major actors in the wind market point to consolidation and other alliances to make the most of new market opportunities. The Gamesa/Siemens merger, expected to be nalized in early 2016, will give the company a combined market share of 15% globally, which would surpass GE and Vestas. For its part, Vestas teamed up with Mitsubishi Heavy Industries in 2013 for a joint venture specializing in offshore wind turbines. Nordex also acquired Acciona wind power in late 2015 in a deal worth $880 million.

With the onshore wind industry expected to continue its boom, the question comes whether offshore wind will finally take off in the United States as well. Though rich with offshore potential along the northeast, gulf coast, and even in the Great Lakes, the United States still remains devoid of any operating offshore wind capacity. Currently, the 30 MW Block Island wind farm off the coast of Rhode Island, developed by Deepwater Wind, is the only project under construction in the United States. DONG Energy, one of the largest offshore wind developers in the world, has secured leases nearby, off the coast of Rhode Island and near Martha’s Vineyard in Massachusetts. Other projects, such as the Fishermen’s Energy Atlantic City wind farm or the massive Cape Wind project have made it far in the permitting process but have run into signi cant roadblocks – Cape Wind losing its utility contracts in the face of unrelenting legal challenges and Fishermen’s Energy failing to get approval from New Jersey utility regulators.

Globally, offshore wind had a record year, adding 3.7 GW of capacity (up from 995 MW in 2014) and bringing cumulative installations worldwide to approximately 12 GW by the end of 2015. Over 65% of the 2015 capacity additions was installed in Germany. Other key markets, such as the United Kingdom, the Netherlands, and China, added capacity as well.

Learn more about the wind market the entire advanced energy industry in Advanced Energy Now 2016 Market Report, available for free at the link below.