This post is one in a series of feature stories on trends that shape advanced energy markets in the U.S. and around the world. It is drawn from Advanced Energy Now 2017 Market Report, which was prepared for AEE by Navigant Research.

The biofuels market in the United States is primarily driven by the Renewable Fuel Standard (RFS). While Congress set the original targets in 2007, the U.S. Environmental Protection Agency (EPA) sets the final mandate for each calendar year to adjust for market conditions. In 2016, the EPA expanded the biofuels market by nearly 1.2 billion gallons for 2016, and another 1.17 billion gallons for 2017 across the four major renewable fuel categories: advanced biofuels; biomass-based diesel; cellulosic biofuel, made from cellulose or lignin; and “renewable fuel,” primarily corn-based ethanol, the largest category.

Conventional biofuels have seen their target steadily increased by 3% per year since 2015, reaching the initial Congressional requirement target of 15 billion gallons for the first time in 2017. Advanced biofuels are set to increase 18.5% in 2017 compared to 2016, reaching 4.28 billion gallons. The carve-out for biomass-based diesel (biodiesel and renewable diesel produced from vegetable oils or animal fats) was increased from 1.73 billion gallons in 2015 to 1.9 billion gallons in 2016 and now to 2 billion gallons in 2017.

The 2017 cellulosic biofuel requirement was set at 311 million gallons, up from 230 million gallons in 2016. The United States used 159 million gallons of ethanol-equivalent cellulosic biofuels in 2016, 32 million gallons above 2015, but falling far short of the 2016 mandate. Biogas from anaerobic digestion is supplying the bulk of all cellulosic biofuels – 157 million gallons of ethanol equivalent – as only 3.3 million gallons of cellulosic ethanol was blended in 2016.

The higher 2017 target for ethanol is supported by U.S. DOE data, which shows that gasoline consumed in 25 states and the District of Columbia contained more than 10% ethanol on average in 2015. Prior to this, the market had run up against the “E10 Blend Wall,” a technical limitation for cars produced prior to 2001 that had set a limit on RFS volumes as gasoline consumption declined amid fuel economy increases.

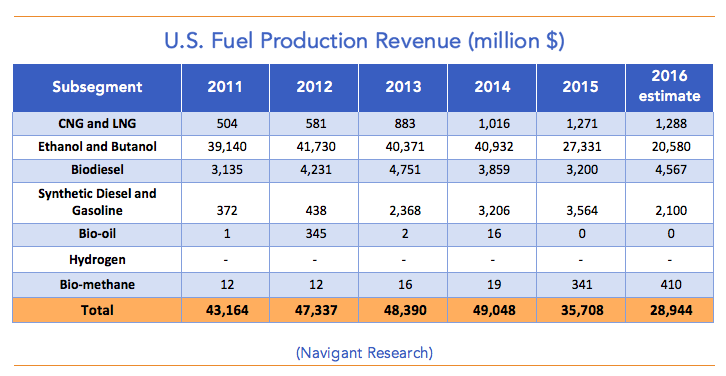

The ethanol industry had pushed for E15 to become the new standard, but automakers claimed that earlier models could be harmed by the higher ethanol content. As cars produced prior to 2001 become more rare on U.S. roads, the E10 Blend Wall will be less of an obstacle to ethanol use. According to the Renewable Fuel Association (RFA), fueling station companies such as Sheetz, MAPCO Express, Protec Fuel, Murphy USA, and others now offer E15 to 2001 and new vehicles at several stations today. Over the next 12 months, nearly two thousand stations are expected to come online thanks to USDA grants and ethanol and agricultural subsidies. But U.S. revenue from corn-based ethanol continues its decline, falling from $39 billion in 2014 to $27 billion in 2015, and then to an estimated $20 billion in 2016. Global wholesale ethanol prices were down 20% in 2016, reaching an average of $1.50 per gallon, and U.S. prices dropping to an average of $1.40 per gallon in 2016. The price of ethanol is tied to the price of two other resources: oil and crop feedstocks. As a fuel substitute, the price of ethanol is highly correlated to the price of gasoline and hence crude oil. The RFA reported in late 2016 that operating capacity of the industry was 15.4 billion gallons per year, meaning the mandate will cover 97% of the capacity in 2017 – high enough to support all of the plants currently operating. This should allow the industry to operate with a healthy margin during 2017 overall, though seasonal swings will occur.

Learn more about advanced fueling trends and other market forces driving advanced energy in the free market report, available for free: