/top-10-utility-reg-2020-so-far-745.png?width=745&name=top-10-utility-reg-2020-so-far-745.png)

In December, we published a list of the top 10 utility regulation trends of 2019. With 2020 now past the halfway point, we check in on the top public utility commission (PUC) actions and trends so far this year. Ten trends stand above the rest, from the impact of COVID on everything, to a growing trend in electric vehicle make-ready investments, to an increasing number of states implementing 100% clean energy targets. And, for the first time, we are including in our curation a key trend in federal regulation of wholesale electricity markets, as it goes directly to the question of who is in charge of energy policy in a changing electricity landscape. Prepare to settle in, as here is the full round-up of the top 10 utility regulation trends so far in 2020.

Note: some links in this post reference PUC filings and other documents in AEE's software platform, PowerSuite. Click here to sign up for a free trial.

1: COVID COVID Everywhere

Back in March, when the COVID lockdowns were just beginning, AEE wrote a COVID-inspired acrostic giving a quick overview of the way the virus was starting to rear its head in PUC dockets around the country. Five months on, from every day life to every day dockets, COVID has managed to infuse everything, making it impossible to talk about anything from rate cases to utility program budgets to how to hold a hearing without considering the impact from COVID.

While COVID is everywhere in PUC dockets, here we’ll just give a quick snapshot of three types of PUC dockets explicitly about COVID. First, a slew of state commissions have put disconnection moratoria into effect.

/PS%20Covid%20impact%20map.png?width=578&name=PS%20Covid%20impact%20map.png) (Interactive version of this map available here)

(Interactive version of this map available here)

Second, several states are using dockets to think about how to sustain economic development amid COVID. For example, in April, the New York PSC solicited input from the clean energy industry on the impacts being experienced as a result of COVID and ideas that should be considered to sustain critical workforces. The Commission also held a series of input sessions centered on the various components of the clean energy industry. In Hawaii, the PUC considered how clean energy projects could meaningfully contribute to the state’s COVID recovery.

Third, a growing number of states are opening dockets to broadly understand the impact of COVID on customers and utilities. Such dockets now exist in Maryland, New York, Massachusetts, Michigan, Connecticut, Texas, Arizona and Wisconsin.

2: More Utility Business Model Innovation

Several states continue to push forward with efforts to examine the evolving role of the utility and other market participants, and how the utility business model should evolve in parallel. In particular, there are a number of ongoing proceedings on performance-based regulation (PBR), which seeks to better align utility financial incentives with desired outcomes and state policy goals. State interest in PBR is driven in part by a recognition that the prevailing cost-of-service utility business model, which has worked well for many years, is not as well suited to a future where customer and third-party investments in distributed energy resources (DERs) need to be better integrated for maximum benefit to the system as a whole (see Trend 7 below for more information on DERs).

/PBR%20map%208-20.png?width=564&name=PBR%20map%208-20.png)

Hawaii is in Phase II of its investigation into development of a PBR framework, which has been underway since 2018, as required by SB 2939.

The Public Utilities Commission of Colorado has recently completed a series of workshops and taken stakeholder input on PBR and performance-based incentive mechanisms (PIMs) and will submit a report to the Legislature (as required by SB 236) by November 2020. The report will identify PBR options for a variety of goals, including the expansion of distributed energy resources.

Nevada has been conducting a similar stakeholder process in its investigation into a range of alternative ratemaking options, including PBR.

In Michigan, where the state launched its MI Power Grid initiative late last year, a whole range of topics are up for discussion, including workstreams that will address utility incentives/disincentives and new business models.

3: Statewide Data Platforms Emerge

Two states are considering statewide data platforms to provide easier access to energy use data for customers and market participants. In 2019, New Hampshire’s General Court passed a bill directing the state’s Public Utilities Commission to establish a statewide “Multi-Use Energy Data Platform” to be built and administered by the state’s utilities. The repository is intended to standardize gas and electric customer usage data and provide easier access for customers and their designated third parties. Intervenors filed initial scoping comments and use cases in the Spring.

New York is also considering a statewide data platform and a consolidation and revamp of its data access policies. The New York Public Service Commission initiated a proceeding on the strategic use of energy data that is considering two separate initiatives, laid out in staff whitepapers filed in May. The first whitepaper describes a Data Access Framework that is meant to consolidate data access policies across a number of existing programs and use cases into a single framework that provides consistent data access requirements based on the risks posed by the content of the data, the method of transmission, and the given use. The staff whitepaper also proposes a single certification process that would only need to be done once by a company and would be valid statewide at any of the state’s utilities or state energy agencies. The rigor of the certification process and cybersecurity requirements would depend on the types of data transactions a company wishes to engage in. The certification process would replace a utility-by-utility registration process that is currently in place.

A second whitepaper proposes the development of a state-run and administered data platform, dubbed the Integrated Energy Data Resource (IEDR). The IEDR goes further than the platform proposed in New Hampshire by consolidating both customer usage data and utility system data in a single location. Utility system data could include a wide range of items such as system elements and typology, hosting capacity, load profiles, performance statistics, investment plans, and non-wires alternative opportunities. The whitepaper envisions that by co-locating and standardizing so many different types of energy data in one place, new relationships in the data and insights into New York’s energy system will be made available to a range of users.

4: Getting Ready for Electric Vehicles

In 2020, we have seen a growing interest among utilities and regulators to capitalize on the array of benefits stemming from transportation electrification. Specifically, an increasing number of PUCs have been considering efforts to spur investments in, and deployment of, electric vehicle (EV) charging infrastructure, with a number of them recently moving forward with so-called “make ready” programs. The make-ready infrastructure model can take several forms, but typically involves utilities offering an incentive for third-party companies to install charging stations while the utility takes care of any infrastructure work required on the utility side of the customer meter.

In July, the New York Public Service Commission (PSC) issued a blockbuster of an order establishing a $701 million statewide make-ready program. While there have been a number of high-profile approvals of utility EV infrastructure investments in the past, this is the largest program authorized by a commission in the United States outside of California, and it has the potential to stimulate millions of dollars in private investment in EV charging infrastructure.

In February, the Maine Public Utilities Commission approved portions of several proposed EV pilots by Central Maine Power, including $240,000 in make-ready investments supporting 60 Level 2 stations and modified rates to help reduce the operating costs for DCFC station hosts. This decision points to an increasing focus on transportation electrification throughout the state and the engagement of utilities in decarbonization efforts.

In March, the State Corporation Commission of Virginia approved all of the EV-related items in Dominion Energy Virginia's Grid Transportation Plan 1B, representing $28 billion in investment. One of the approved program components provides rebates for make-ready infrastructure.

In July, the California Public Utilities Commission issued a proposed decision on Southern California Edison’s (SCE) $443 Million Charge Ready 2 Infrastructure and Market Education program. This proposed decision approves $443 million in funding across three areas, including make-ready infrastructure expansion, an own-and-operate component, and a new construction rebate. The make-ready expansion will install infrastructure for multi-unit dwellings (MUDs), workplaces, destination centers, and fleets to serve approximately 22,000 charging ports in SCE’s service territory.

Other states, including Connecticut, Michigan, and California are currently considering make-ready investments.

5: PUCs Put Self-Scheduling Under a Microscope

Over the past few years, the practice of “self-scheduling” coal plants - i.e., running them even when they are not the cheapest resource available for customers - has garnered increased attention, especially in the MISO and SPP markets. In the first half of 2020, several state Commissions have begun to more closely review how their utilities engage in this practice.

Self-scheduling refers to wholesale market rules that allow market participants to choose to operate a resource (such as a power plant) regardless of market clearing prices. Under these rules, a market participant may designate that its resource “must run” even if the market price it will receive is below its cost of operation. This practice can be used as a reliability mechanism to ensure that there is enough generation available to meet energy needs in periods of high demand, or as a mechanism for resources like energy storage to manage their unique operations (e.g., state of charge). However, in states where vertically integrated utilities are able to receive full cost-recovery through bundled retail rates and fuel cost adjustments, many utilities have taken advantage of self-scheduling rules to run their uneconomic coal units in the absence of reliability needs and then charge captive ratepayers for the difference between the clearing price in the energy market and the actual cost of running the plant. Across these regions, ratepayers are on the hook for billions of dollars for keeping uneconomic coal resources online, which harms consumers and prevents resources like wind, solar, storage, and demand-side management from entering the market.

In the past year, several states have opened dockets to review utility self-scheduling practices. In Missouri, the Commission has ordered all utilities to provide information during fuel adjustment and cost-recovery dockets to get more transparency into utility self-scheduling practices. Going one step further, in Minnesota, Xcel filed a plan at the end of 2019 to limit the use of its remaining two coal plants by moving to seasonal operations instead of relying on year-round self-scheduling. In July, the Minnesota Commission gave its approval for coal plants to sit idle for six months out of the year and only be used June to August and December to February to meet seasonal demand peaksar. Xcel expects to save $8.5 million to $28.5 million on fuel costs annually and $18.4 million in total operation and maintenance costs over the remaining lifespans of the plants. In addition, the utility expects to save over $27 million in capital costs at one of the coal units.

Self-scheduling appeared before the Indiana Utility Regulatory Commission twice this year. In May, the IURC decided not to review the self-scheduling practices of Indianapolis Power & Light (IPL), but later did agree to review Duke Energy’s practices through a fuel adjustment clause proceeding. Estimates show that Duke is running approximately 5 GW of self-scheduled coal, at a loss of over $20 million in a three month period alone in 2019 (representing 8% of Duke’s total costs during this period). Intervenors are arguing that the utility, at minimum, should not receive cost-recovery when these units are run at an economic loss, and Duke should follow the practice of Xcel in Minnesota and commit to running these plants only during seasons when energy costs are already highest to save ratepayers money. AEE’s analysis shows that by rapidly transitioning to advanced energy resources and away from coal generation can provide between $105 million and $423 million in savings to Duke ratepayers by 2025. The IURC has scheduled a hearing on this issue for September 21 with final action expected by the end of the year.

6: The ‘Bright Line’ Between State and Federal Jurisdiction Gets Blurred

The division of regulatory authority between the federal government and the states spelled out in the Federal Power Act (FPA), once described by the Supreme Court as “a bright line, easily ascertained,” was anything but during the first half of 2020. As states continue to adopt aggressive clean energy and environmental policies supporting the development and retention of new carbon-free generation, and as new technologies like energy storage and distributed energy resources that provide both wholesale and retail services proliferate (and create more dynamic power flows across transmission and distribution systems), that “bright line, easily ascertained” is becoming more blurred.

The year began in the wake of the Federal Energy Regulatory Commission (FERC)’s December 2019 decision addressing complaints that prices in the PJM Interconnection (PJM) capacity market were being “distorted” by resources supported by state policy programs. FERC agreed with those assertions, and ordered PJM to impose bid floors, through what is known as the Minimum Offer Price Rule (MOPR), on state-supported resources like renewables participating in Renewable Portfolio Standard (RPS) programs, nuclear plants receiving revenues under Zero Emission Credit (ZEC) programs, and even demand response and energy efficiency resources participating in retail demand-side management programs. These bid floors force these resources to offer at higher prices in the capacity market, risking that they won’t clear in the auctions to receive capacity payments, nor will they be counted toward regional resource adequacy requirements. This outcome raises the costs of these state programs, setting up a direct conflict between FERC’s regulation of the wholesale markets and state energy and environmental laws.

The reverberations of the December 2019 MOPR decision have been felt not just in PJM, but also ISO New England and New York ISO, where FERC has imposed similar policies on their capacity markets.

In April, FERC rejected arguments from several states (as well as industry voices like AEE) that its application of the MOPR to state-supported resources exceeds its jurisdiction and intrudes on the states’ authority over generating facilities. The issue has now moved to the courts; nearly two dozen parties have sought judicial review, with briefing expected to begin later this year. Meanwhile, states in these markets have begun to consider options for avoiding the impacts of MOPR, which they see as undermining their energy laws. Among the options being explored is pulling out of regional capacity markets altogether, with states taking the lead in managing resource adequacy (see #10, below).

FERC’s efforts to ensure that energy storage resources can fully participate in wholesale markets have also gotten pushback on jurisdictional grounds. In its landmark Order No. 841, FERC determined that it has authority to regulate participation in wholesale markets by energy storage resources that are connected to the state-regulated distribution system or located behind a retail customer’s meter. FERC also rejected calls by states and utilities to give them the right to “opt out” and adopt blanket bans on wholesale market participation by distributed storage resources. States and utilities took that determination to court, asserting that FERC had exceeded its jurisdiction and intruded on the jurisdiction of the states to regulate use of the distribution system.

In July, the United States Court of Appeals for the D.C. Circuit rejected those arguments, “swiftly conclud[ing]” that Order No. 841’s focus on ensuring that storage can compete in wholesale markets fits squarely within FERC’s jurisdiction, and that nothing in that order alters the existing authority of the states to regulate the safety and reliability of distribution facilities.

Just days later, FERC stuck up for state authority, albeit on narrow grounds, when the commissioners unanimously dismissed a Petition filed by a group calling themselves the New England Ratepayers Association (NERA) that asked the agency to declare excess energy production from distributed energy resources (DER) participating in state net metering programs to be a wholesale sale subject to exclusive FERC authority. Granting this request would have effectively unraveled net metering policies in place in more than 40 states. A wide-ranging set of state governors, legislators, and regulators weighed in loudly at FERC, arguing that granting the Petition would significantly intrude on the states’ jurisdiction to regulate retail transactions between utilities and end use customers. (For a sampling of state views, see this AEE webinar on the topic.) FERC sidestepped the jurisdictional controversy, finding instead that the Petition did not identify any controversy or uncertainty regarding state net metering laws that required a declaration from the Commission to resolve.

7: Regulators Grapple with Distributed Energy Resources (DERs) and Distribution System Planning (DSP)

In prior reviews of trends in 2018 and 2019, we identified much regulatory activity related to distributed energy resources (DER) and changes in distribution system planning (DSP) needed to facilitate those DERs. In 2020, that trend continues.

Just this summer, Connecticut’s Department of Energy and Environmental Protection (DEEP) and Public Utilities Regulatory Authority (PURA) initiated an investigation to review a number of near-term topics related to the implementation of its 2019 Framework for an Equitable Modern Grid. This proceeding builds on DEEP and PURA's joint study on the value of DERs in another Connecticut proceeding to identify ways to maximize the benefits and minimize deployment and integration costs.

Way out to the west, the Hawaii Public Utilities Commission is investigating the technical, economic, and policy issues associated with DER as they pertain specifically to Hawaiian Electric Co. (HECO), Hawaii Electric Light Co. (HELCO), and Maui Electric Co. (MECO). In this investigation, the Commission is focusing on programmatic issues, such as the types of new DER programs that should be examined and developed; rate designs that will be offered to customers; and how to address existing DER programs and tariffs. The Commission will also review technical issues, such as identifying improvements that can be made to the interconnection process and technical standards to better facilitate the integration of DER onto the utilities' systems.

Other ongoing proceedings to address implementation of DERs are active in California, Arkansas, and New York.

Closely related to DERs and utility business model innovation (discussed in detail in #2, above) are efforts to modernize distribution system planning. As we see it, major elements of modern distribution planning are to increase transparency of the planning process, get more stakeholder engagement, and seek out DER-based solutions to grid needs where these are more cost-effective than traditional solutions. For this to succeed in a meaningful way, utilities require appropriate financial incentives to fully embrace these new opportunities to engage customers and third-party DER providers in the planning and operations of the distribution system. Thus, business model innovation is an important enabler of modern distribution system planning.

In November, the Public Utilities Commission of Colorado opened an information gathering proceeding on distribution system planning (DSP) and non-wire alternatives (NWAs) pursuant to SB 236. The Commission is soliciting feedback and proposed rules from interested stakeholders to inform the Commission of the costs and benefits, impact to ratepayers, and impact on distributed energy resource integration and growth due to the implementation of DSP filings. Other states currently involved in DSP efforts include Michigan, Minnesota, Colorado, New York, and California.

8: More Than a Quarter of States Go for 100%

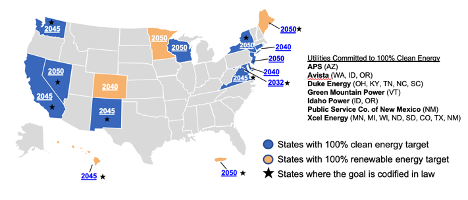

From the Eastern seaboard to the West Coast, the trend toward 100% clean or renewable energy has only accelerated in 2020, despite the headwinds presented by COVID. Fourteen states, plus Puerto Rico and the District of Columbia, have 100% clean or renewable energy targets as of 2020, with others, such as Illinois, signaling they will soon follow-suit. Utilities from Idaho and Oregon to Minnesota and Wisconsin have likewise made commitments to 100% clean energy. Regulators in states like Hawaii, California, and Washington continue to implement robust clean energy goals, but we’ve also seen action in public utility commissions in states not previously associated with clean energy.

STATES AND UTILITIES WITH 100% CLEAN OR RENEWABLE ENERGY GOALS

With passage of the Virginia Clean Economy Act (SB 851 / HB 1526) in March, Virginia became the newest official member of the 100% club. The Commonwealth’s State Corporation Commission has already begun implementation of the multifaceted VCEA, which not only includes 100% requirements, but also energy efficiency, renewable, and storage targets. In late June, the Commission opened a docket to establish regulations and interim targets for the storage provisions in the VCEA. Virginia AEE submitted comments to the docket in July. The Commission has likewise begun deliberations around the PIPP program, a provision of the VCEA aimed at supporting low-income ratepayers.

New York regulators have continued to make steady progress towards the state’s expanded Clean Energy Standard, which would have the Empire State generate 70% of its power from renewables by 2030 and have a 100% carbon-free power sector by 2040. In June, the Commission published a whitepaper laying out a roadmap to meet these goals.

Meanwhile, in nearby Connecticut, regulators at the Public Utilities Regulatory Authority (PURA) and staff at the Department of Energy and Environmental Protection (DEEP) are exploring pathways to a 100% zero-carbon electricity sector by 2040. This activity comes on the heels of Gov. Lamont’s 2019 Executive Order.

In Arizona, the state’s Corporation Commission has taken the reins in the drive towards 100%. In late July, the Commission’s staff proposed a 100% clean target by 2050, along with other rules to modernize the state’s electric system. The staff’s recommendation comes on the heels of a January announcement by Arizona Public Service (APS), the state’s largest utility, that it plans to deliver 100% carbon-free electricity to customers by 2050. In October 2019, AEE and APS began work on a joint project to help the utility meet its ambitious clean energy goals. This project brings together 15 of AEE’s member companies, along with AEE staff and staff from APS, to explore how new and emerging technologies, from electric vehicles to demand response, battery storage, and hydrogen can help meet the electric power needs of the future.

Regulators in Nevada have been deeply engaged in the state’s planned transition to 100% clean energy by 2050 – a goal established in 2019 under SB 358. In late February, the Commission issued a Procedural Order to manage regulatory implementation of the law, and required NV Energy (the state’s IOU) to submit a plan for the transition to 100% by November 4.

And in New Mexico, the Public Regulation Commission has been making steady progress on implementation of the Energy Transition Act (SB. 489), which would transition the Land of Enchantment to 100% clean energy by 2045. Central to this transition is the closure of the San Juan coal plant. On July 29, the Commission unanimously accepted the recommendations of the Hearing Examiners regarding the plant closure and clean replacement resources.

9: The Storage Story – From Batteries to Hydrogen

The decline in the costs of batteries and hydrogen is fueling an increasing interest in these storage technologies to provide enhanced resiliency and reliability to the grid and to complement the deployment of clean renewable energy and other distributed generation assets. With storage, policymakers are hitting regulators throughout the U.S with new capacity targets in 2020. These regulators then need to identify how to cost-effectively implement programs that can provide non-wires alternatives, peaking capacity, and a variety of ancillary services such as voltage control.

For example, in June 2020, the Virginia State Corporation Commission (SCC) opened a docket to adopt regulations to achieve the deployment of energy storage as required by the Virginia Clean Economy Act by January 1, 2021. The legislation requires Appalachian Power Co. (APCo) and Virginia Electric and Power Co. (Dominion) to petition the Commission for approval to construct or acquire 400 MW and 2,700 MW, respectively, of new utility-owned energy storage resources by 2035. The legislation also requires the regulations to include programs and mechanisms to deploy energy storage, including competitive solicitations, behind-the-meter incentives, non-wires alternatives programs, and peak demand reduction programs.

In Maryland, the Public Service Commission opened a proceeding to implement the 2019 Energy Storage Pilot Project Act. This Act required the Commission to establish an energy storage pilot program and each investor-owned electric company to develop energy storage projects and submit applications to the Commission for approval.

In December 2019, the Public Service Commission of South Carolina opened a docket examining Dominion Energy’s request for a Storage Tariff for storage facilities paired with certain renewable generation facilities, and would be applied to new energy storage facilities that execute a power purchase agreement.

In New Hampshire, the Public Utilities Commission has an active docket examining Liberty Utilities’ proposed battery storage aggregation pilot program.

Last, the implementation of Order No. 841 at the Federal Energy Regulatory Commission (FERC), and ongoing active FERC and stakeholder processes in PJM and NYISO looking at the capacity value of storage, has highlighted the growing trends in energy storage and the benefits they can provide in wholesale as well as markets. FERC and several RTOs have noted that hybrid resources are the “next wave of opportunity for storage” with a recent uptick in activity. In Texas, the Electric Reliability Council of Texas (ERCOT) is working to integrate hybrid resource technologies into its wholesale markets in order to make the power grid more flexible, efficient, and resilient by pairing battery storage with solar generation (see also SB1941).

Beyond batteries, hydrogen energy storage has increasingly been attracting regulators and utility companies as a potential pathway to help achieve decarbonization targets. Electrolysis costs are declining, which in turn is driving European companies to take the lead in blending hydrogen with natural gas for power generation or using hydrogen carriers for seasonal storage. Hydrogen can be used to address “duck-curve” issues with large amounts of solar or wind energy on the grid. Some states, like California are exploring setting standards for hydrogen in gas pipelines and others are exploring alternatives to gas pathways that will include hydrogen.

For example, in Massachusetts, in July 2020, as part of the sale of the assets of Columbia Gas from NiSource, buyer Eversource agreed to conduct a business case analysis of potential decarbonization strategies, including the use of hydrogen. Also in Massachusetts, the Attorney General’s office in June 2020 called upon the Department of Public Utilities to proactively manage the transition away from natural gas to help achieve the state’s net-zero GHG goals in a new investigation.

10: States Seek Input on Resource Adequacy

Mounting state-federal jurisdictional tension (see #6 above) has led a growing number of states to question whether resource adequacy—the responsibility to ensure sufficient resources will be available to meet demand in a future year—should be returned entirely to state control. Specifically, in regions that currently ensure resource adequacy via centralized capacity markets (PJM, ISO-NE, and New York), several state PUCs have begun proceedings to look into reforming or even exiting these markets, which are subject to FERC jurisdiction. So far, the Department of Energy and Environmental Protection in Connecticut has taken stakeholder comments and and held a technical conference, the New York Public Utilities Commission has invited three rounds of comment and commissioned analysis from The Brattle Group, and the New Jersey Board of Public Utilities has initiated a formal investigation, received two rounds of comments from interested parties on such options, and scheduled a technical conference on Sept. 18. Stakeholders in Illinois have been discussing legislative pathways to address the same questions, and other states not formally exploring the issue have expressed interest in doing so.

The impetus for these proceedings is the expansion of the minimum offer price rule (MOPR), referred to in New York as buyer-side mitigation (BSM). MOPR interferes with the ability of resources procured to meet state policy goals to also count toward meeting regional resource adequacy requirements by imposing an offer floor price that closes many resources out of the market. States are therefore faced with the choice of paying to over-procure capacity or walking away from their clean energy policies. This has left many states in search of a third way.

Unfortunately, a clear third way has not (yet) presented itself. Leaving the capacity market and transferring resource adequacy responsibility to state or utility control (an option known in PJM as the Fixed Resource Requirement, or FRR) comes with complex legal and administrative burdens and forces states to give up many of the benefits that a competitive, regional market confers. Pursuing reform within existing markets has also proven difficult because there are no solutions ready to be pulled off a shelf and implemented. States have turned to stakeholders for ideas, advice, and information, and these proceedings have drawn significant participation from a wide array of parties presenting an equally broad range of perspectives.

In addition to individual state proceedings, regional efforts are also underway. In New England, stakeholders are preparing to embark on a discussion about market design reforms (including but not limited to resource adequacy) to better align state policy goals and market outcomes.

The outcomes of all of these proceedings are still pending. With the near-term impacts of MOPR in PJM potentially tempered by PJM’s approach to implementing FERC’s order, careful study combined with “wait-and-see” may turn out to be the best approach. That said, these discussions are certain to continue throughout the rest of the year and continue well into the future. Depending on how states respond, these proceedings could lead to much broader reforms to capacity markets in PJM, ISO-NE, and NYISO.

Contributing to this post were Ryan Katofsky, Danny Waggoner, Matt Stanberry, Dylan Reed, Sarah Steinberg, Jeff Dennis, Suzanne Bertin, Harry Godfrey, Lisa Frantzis, Caitlin Marquis, and Erica Glenn.

Keep up to date on all regulatory action with AEE's PowerSuite. Click below to start a free trial: