Photo by Tom Burke, used under a Creative Commons license.

In July, we published a list of the top 10 utility regulation trends of 2018 – so far. With 2018 winding down, we check in on the top public utility commission (PUC) actions and trends of the year. Ten prominent trends and actions stand out above the rest, from renewables continuing their downward price trajectory, to electric vehicle charging infrastructure build-outs getting approved, to exploration of utility business model reforms and non-wires alternatives to traditional distribution investments. Here is the full round-up of the top 10 matters before PUCs in 2018.

Note: some links in this post reference documents in AEE's software platform, PowerSuite. Click here and sign up for a free trial.

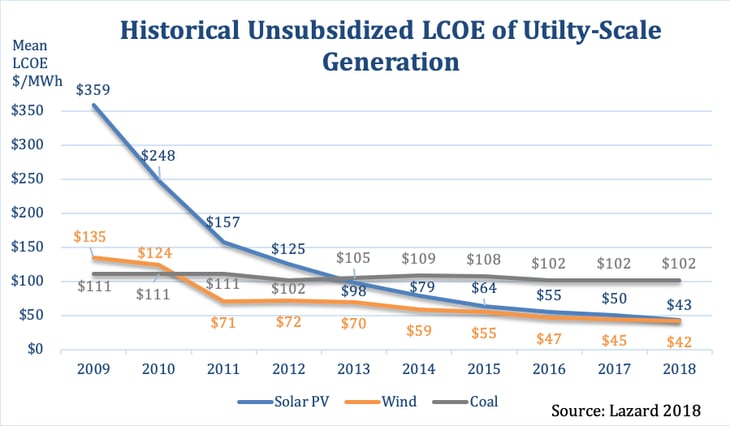

1. Renewable Energy Winning On Price

In 2018, the trend in recent years toward a cleaner more flexible grid has continued. In the first three quarters of 2018, there have been over $35 billion of new investment in clean energy, as defined by Bloomberg New Energy Finance. This trend is driven in large part by the falling costs of wind and solar power. As shown in the graph below, the mean levelized cost of energy (LCOE) for large-scale solar PV and onshore wind fell 13% and 7% respectively from last year — allowing them to compete favorably with traditional resources in many regions.

This continued price decline means it is now often cheaper to build new wind and solar plants than operate existing coal-fired power plants – a reality expressed in many regulatory filings in 2018. Perhaps most notably, in October Northern Indiana Public Service’s 2018 IRP found that the utility could save customers $4 billion by replacing its entire coal fleet by 2028 with a portfolio of solar, wind, storage, and demand management resources.

In February, the California Public Utilities Commission (CPUC) adopted a reference system plan that the state’s load-serving entities used to file their integrated resource plans (IRPs) in August. The plans are intended to optimize the utilities’ portfolios of resources to reduce economy-wide greenhouse gas emissions 40% from 1990 levels by 2030. The model selected a portfolio of new resources for the reference system plan (i.e., the optimal system-wide plan, but not necessarily the optimal utility-specific plan) that consisted of 63% solar, 22% energy efficiency, 9% storage, and almost 4% wind resources. Many load-serving entities (LSE) indicated in their individual IRPs that they were on track to meet the state’s GHG reduction target, and at least one LSE, Southern California Edison (SCE), urged the CPUC to consider a more stringent plan that included an electric grid supplied by 80% carbon-free electricity by 2030.

In March, the Virginia State Corporation Commission (SCC) approved Virginia Electric and Power’s (Dominion Energy) 2018 to 2032 IRP, which included, among other things, the development of at least 3,200 MW of solar by 2032 and 12 MW of offshore wind as early as 2021. In a similar vein, the Idaho Public Utilities Commission in April accepted Rocky Mountain Power’s (PacifiCorp) 2017 to 2036 IRP, which called for 3,500 MW of coal retirements through 2036; 1,100 MW of new wind and 905 MW of upgraded/retrofitted wind resources by 2020; 859 MW of additional wind generation after 2020; and 1,040 MW of new solar by 2036.

In March, the Arizona Corporation Commission (ACC) voted down the utilities' IRPs on the grounds that they over-relied on natural gas without adequate price sensitivity analyses. Then the ACC opened a new proceeding in May to amend and review Arizona's current resource planning and procurement rules and align them with Commissioner Tobin's proposed 80% by 2050 Clean Resource Energy Standard and Tariff. In June, Consumers Energy Co. in Michigan filed an IRP out to 2040 that calls for 6,350 MW of solar (including 5,000 MW by 2030), 450 MW of energy storage, and the retirement of two coal units by 2023 and another two by 2031. Also in June, Xcel in Colorado filed a Clean Energy Plan Portfolio as part of its 2017 IRP plan that proposed to retire early two coal plants and replace them with 1,100 MW of wind, 700 MW of solar, 275 MW of storage (all paired with solar), and 383 MW of flexible natural gas assets.

In July, NV Energy announced plans in their 2018 IRP to add about 1 GW of new renewable energy resource and 100 MW of battery storage by 2023 and in October issued over 350 MW of request for proposals for new renewable energy projects (bids were due by December 10). And most recently in December, the Iowa Utilities Board approved MidAmerican Energy Company application for ratemaking principles (i.e., how costs will be recovered when costs of the new facilities are included in rates) for 591 MW of new wind generation - enabling them by 2021 to become the nation's first investor-owned utility (IOU) to achieve 100% renewables.

2. Electric Vehicle Investments Take the Spotlight

According to AEE’s PowerSuite, $58 million in electric vehicle (EV) utility infrastructure programs were approved in 2017 and $880 million were approved in 2018, with another $1.5 billion proposed in 2018 that are still pending – an upward trend to say the least. The deployment of EV charging infrastructure and EV integration have risen to the fore in many jurisdictions, as improvements in technology have dramatically expanded the EV market. Actions have included statewide foundational EV investigations, widespread infrastructure deployments, and a range of demonstration projects. For more information on what utility commissioners need to know about the accelerating EV market, see AEE’s EV issue brief.

California has once again dominated the EV spotlight. In January 2017, the three big investor-owned utilities in California (San Diego Gas & Electric, Pacific Gas & Electric, and Southern California Edison) filed transportation electrification proposals with the CPUC totaling over $1 billion in investments. In January of this year, the Commission approved 15 of 17 proposed priority review pilots, totaling $41 million, and in May the Commission approved $738 million in investments for standard review projects and two rate design proposals. The May decision was a big boost for the future of the EV market in California, as it allowed, among other things, San Diego Gas & Electric to propose a performance incentive mechanism for its residential charging program. There has been no shortage of additional applications, but perhaps most notably, Southern California Edison in June proposed a four-year, $760.1 million program focused on charging light-duty vehicles in multi-unit dwellings and workplace settings that builds on their Charge Ready Pilot approved in 2016. In November, the Commission issued a proposed decision authorizing an additional $22 million in bridge funding for Phase I while the Commission considers their broader application.

California also made waves in December when the CPUC issued an order instituting a rulemaking to provide more structure and guidance on transportation electrification investments and to streamline the application process — up until now, all applications have been considered on a case-by-case basis. As approved, the order dropped a provision for a two-year moratorium on new utility applications included in the draft, but concerns remain that this new rulemaking will slow down the build-out of charging infrastructure to support California’s burgeoning EV market.

Other states have made notable progress as well in 2018 in the EV space. In September, the Department of Public Utilities (DPU) in Massachusetts approved a petition for a $23.8 million EV program to build, own, and operate the charging infrastructure on the utility side of the meter and offer incentives for infrastructure and charging stations on the customer side. The program is intended to facilitate the deployment of up to 1,200 Level 2 charging ports at 600 stations and 80 DC Fast Charging ports at 80 stations over three years — and allows National Grid to earn up to a $1.25 million performance incentive based on the number of charging stations in use (with incentives kicking in when at least 75% of their target goal, or 510 stations, has been reached).

In March, the Hawaiian Electric Companies (HECO) filed an electrification of transportation strategic roadmap to grow the EV market in Hawaii and move the state closer to its goal of 100% renewable fuels in transportation by 2045. Key parts of the roadmap include working with stakeholders to lower the purchase price and educate customers on EVs, working with third parties to facilitate the build-out of charging infrastructure, supporting a transition to electric buses, creating grid service opportunities for demand response participation and smart charging, and ensuring the smooth integration of EVs through grid modernization investments.

In September, Potomac Electric Power Co. in the District of Columbia proposed a $15 million transportation electrification program that included time-of-use (TOU) rate options, installation credits, installation of public Level 2 and fast charging infrastructure, and the establishment of a $1 million innovation fund and $1.5 million technology demonstration program.

In October, Xcel Energy in Minnesota proposed two EV infrastructure pilot programs — owning and operating the infrastructure for a $14.4 million fleet EV infrastructure program and a $9.2 million program for public charging infrastructure. Also in October, Duke Energy Carolinas in South Carolina proposed an electric transportation pilot consisting of four programs: 1) a $400,000 residential EV charging program; 2) a $2.54 million EV school bus charging program; 3) a $1.14 million EV transit bus charging program, and 4) a $2.61 million fast charging station program. Duke Energy Progress also proposed a pilot consisting of three programs: 1) a $1.27 million electric school bus charging program; 3) a $570,000 electric transit bus charging program; and 4) a $1.3 million fast charging station program.

Several states have also begun to investigate the role of utilities in the EV market. In April, the New York Public Service Commission opened a proceeding to consider the role of electric utilities in providing infrastructure, along with rate designs to accommodate the needs of and electricity demand for EVs and electric vehicle supply equipment. In November, the state's utilities (Joint Utilities), the New York Power Authority (NYPA), and the New York State Energy Research and Development Authority (NYSERDA) proposed an incentive program to encourage the deployment of public DC fast charging stations.

In May, the Nevada Public Utilities Commission adopted rules allowing NV Energy to build EV charging stations and directed NV Energy to use $15 million in existing incentive funds to help build out the state's charging infrastructure. In July, the Vermont Public Utility Commission opened an investigation pursuant to H917 and held a kickoff workshop in October to investigate promoting the ownership and use of electric vehicles in the state.

In August, Commissioner Dunn in Arizona opened an inquiry into barriers to EV adoption, utilization of rate design to promote charging infrastructure, the Commission’s approach towards EV suppliers, and future EV opportunities such as EV rideshare and vehicle-to-home charging. In September, the Pennsylvania Public Utility Commission issued a final policy statement clarifying that an EV charging facility open to the public for the sole purpose of recharging an EV battery for compensation should not be construed to be sales to residential consumers and should therefore not be subject to regulation.

Those are just a few examples, with developments in 2018 also popping up in Colorado, Iowa, Maryland, Michigan, Missouri, Ohio, and Oregon.

3. Modernization Investments to Improve the Reliability and Resiliency of the Grid

Grid modernization has long been a buzzword in the electricity industry. It has most commonly referred to investments, such as advanced metering infrastructure, intended to enhance the customer experience and support integration of new advanced energy technologies into the grid. Often overlooked, however, are the reliability and resiliency benefits — of increasing importance as the intensity and occurrence of severe weather events persist. Many of these investments also fall under the rubric of “grid hardening,” microgrid, and energy storage proposals.

In July, Dominion Energy in Virginia outlined a 10-year, $3.1 billion grid transformation plan and requested approval for $816 million in capital investments for Phase I of the plan, covering years 2019 to 2021. Key parts of the Phase I plan include: the installation of over 1.4 million smart meters, totaling $314 million; $7.2 million investment in a customer information platform; $313.1 million investment in grid hardening; $69.9 million in upgraded communication technologies; $16.8 million in IT and physical security investments; $7.2 million in emerging technology investments such as smart lighting, a microgrid demonstration project, and EV support infrastructure; and the creation of a $12.9 million analytics center for excellence that will enable Dominion to use predictive analytics to process the new data collected through the installed smart meter infrastructure. Virginia Advanced Energy Economy worked alongside GridLab to develop a guide for Virginia on a grid modernization plan moving forward. In July, the Hawaii Public Utilities Commission opened a docket to investigate the development of a microgrid tariff for Hawaiian Electric Co. to strengthen and more easily integrate renewable energy into the grid.

The energy storage market also continued its momentum into 2018 and is increasingly being recognized as a valuable and necessary asset for a 21st century grid. In late 2017, the Massachusetts Department of Public Utilities opened an inquiry, with a subsequent straw proposal issued in June, into the eligibility of energy storage systems paired with distributed generation to net meter and whether these facilities could be bid into the ISO New England Forward Capacity Market. In January, California further refined its energy storage framework by adopting rules to govern the use of multiple-use energy storage applications (i.e., storage’s ability to provide multiple value streams to the electricity grid). Also in January, the Public Utility Commission of Texas (PUCT) dismissed a request by AEP Texas North Company to install two battery storage projects on their distribution system. Instead, PUCT Staff opened a new rulemaking in February to look more broadly at how utilities can use non-traditional technologies to solve distribution problems and the potential impact on the competitive retail market and Texas’ wholesale market.

In June, the New York Department of Public Service and New York State Energy Research and Development Authority (NYSERDA) filed a New York energy storage roadmap to comply with Gov. Cuomo's 1,500 MW by 2025 target. The roadmap outlines the market-supported policy, regulatory, and programmatic actions necessary to achieve the state’s near-term energy storage installment goals and recommendations for the DPS to consider when designing the energy storage program.

In September, Public Service Electric & Gas in New Jersey proposed a $4.1 billion Clean Energy Future Plan that includes a $180 million energy storage proposal. In October, Portland General Electric filed a plan in Oregon to advance its energy storage modeling capability over the next couple of years by quantitatively co-optimizing benefits across all potential benefits (i.e., all bulk energy, ancillary services, transmission and distribution services, and customer energy management services) of energy storage resources on its system. Most recently, in October, the Public Utilities Commission of Nevada issued a report (prepared by Brattle Group) on the economic potential for energy storage in Nevada.

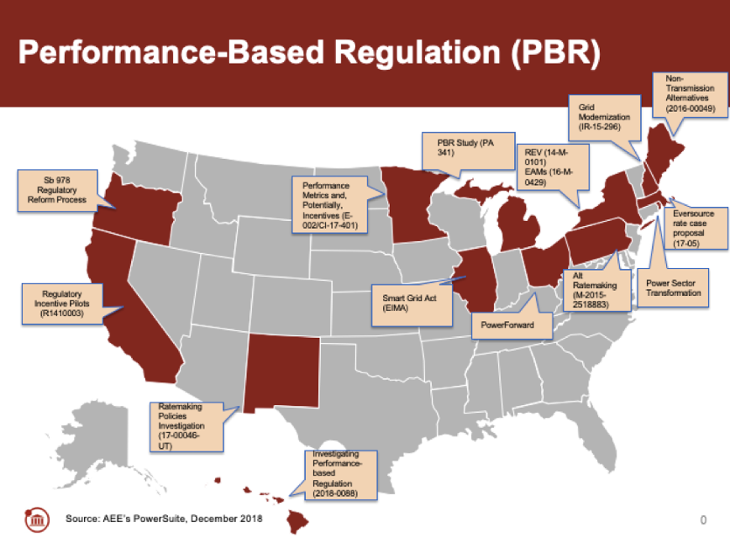

4. Utility Business Model Innovation

Many states have begun to evolve from a traditional cost-of-service regulatory model toward a system that better reflects new market conditions, allows utilities to take advantage of the growing service economy, and rewards performance against established goals rather than inputs. For more information, take a look at the Navigating Utility Business Model Reform paper and series of case studies AEE Institute released in November, in collaboration with Rocky Mountain Institute and America's Power Plan. The case studies highlight utility business model reforms being implemented in the U.S and abroad while the paper lays out a menu of business model reform options and practical guidance for pursuing reform at the state level.

In July, Commissioner Tobin requested that the Arizona Corporation Commission open the nation’s first docket to investigate the role of blockchain technology to facilitate the concept of transactive energy – the idea of a retail marketplace where owners of DER can trade, and be compensated for, electricity or services in real time.

In May, the Pennsylvania Public Utilities Commission issued a proposed policy statement that invites utilities to explore alternative ratemaking methodologies in their general rate cases to promote state and federal policy goals, provide incentives to improve system efficiency, and allow utilities to adequately recover their costs. The Commission also adopted a motion by Vice Chairman Place that gives utilities the option to consider alternative rate designs, performance incentive mechanisms, decoupling, and demand-based and time-of-use pricing. (See AEE Institute’s comments.)

In April, the Public Utilities Commission of Hawaii opened an investigation into performance-based regulation (PBR) policies for HECO, specifically focusing on aligning utility incentives with performance on desired outcomes, such as increased renewable energy, lower cost, and improved customer service. Much of 2018 was spent gathering information, with PUC Staff issuing a report in November on prioritized outcomes, regulatory options, and metric development.

In July, the Vermont Public Service Commission issued an order providing guidelines for the development of future alternative regulation plans in Vermont. Key guidelines include: advancing state energy goals, enabling innovation, and benefiting consumers. The Commission also left the door open for utilities to propose performance incentive mechanisms, multi-year rate plans, and innovative rate designs.

In August, National Grid in Rhode Island submitted an executed, amended settlement agreement with Commission Staff, the Office of Energy Resources, and several other parties that established a new performance incentive for system efficiency, as well as suit of additional metrics related to integrating renewable energy that will be tracked and may become eligible for financial incentives over time. In August, the Public Utilities Commission of Ohio released a roadmap and report on Ohio's electricity future. (For details, see our perspective on how this played out here.) In September, the Public Utility Commission of Oregon submitted their final report to the Legislature with recommendations on a roadmap for the changing electricity sector, including the development of modern regulatory tools, market structures, and processes to achieve the state’s objectives. And just this past week, Illinois issued its Draft Utility of the Future Report in its NextGrid Initiative.

In addition to these efforts to rethink utility business models and regulation on a broad basis, many states have taken on specific aspects of utility business model reform, such as the treatment of capital versus operating expenditures (see #5, below) and non-wires alternatives to traditional utility investments (#6).

5. Equalizing the Treatment of Capital and Operating Expenditures

A key stumbling block in the traditional utility business model is the inability of utilities to earn a return on operating expenditures, such as energy procurement contracts, fuel, labor, maintenance, and service expenditures — inherently disincentivizing utilities from procuring service-based solutions provided by private advanced energy companies rather than making capital investments on which they do earn a rate of return. This limits the ability of utilities to take advantage of many new technologies that are solely offered through service contracts, such as cloud computing, since these services displace an earnings opportunity. This occurs at the expense of customers and also puts utilities at greater risk of obsolescence. States are starting to recognize these obstacles and are exploring methods to overcome them. (See AEE Institute’s report on Utility Earnings in a Service-Oriented World for more analysis of the options available to regulators.)

In December of 2017, the Illinois Commerce Commission (ICC) initiated a rulemaking on the regulatory accounting treatment of cloud-based computing solutions (including software as a service [SaaS], platform as a service [PaaS], and infrastructure as a service [IaaS]). This December, the ICC issued a proposed second notice order that, if approved, would establish a regulatory accounting alternative that utilities may utilize to offer a more equitable financial treatment of cloud-based solutions. The proposed rule allows for utilities to pre-pay for a cloud service and amortize those costs and derive earnings from them as it would a typical asset. However, it goes further by allowing some earnings on pay-as-you-go services, though not on an equal level with pre-paid cloud computing services. (For more information, see AEE Institute’s case study on the Regulatory Accounting of Cloud Computing).

In December, based on the Smart Grid Policy Act of 2010 and following a multi-year stakeholder process, the Maine Public Utilities Commission designated Central Maine Power and Emera Maine as non-transmission alternatives (NTAs) coordinators, in order to develop cost-effective substitutes for traditional transmission projects in the Pine Tree State. As a result, in June the utilities filed a report with recommendations (and a supplemental report in October) for a rate incentive proposal that would eliminate the existing incentive for them to favor transmission and distribution (T&D) investments over NTAs. Specifically, they recommended a revenue decoupling mechanism, a ratemaking approach to treat NTA investments in a similar manner to T&D investments, and an approval process for NTA proposals.

In September, the Hawaii Public Utilities Commission approved HECO's proposal to establish a performance incentive mechanism (PIM) for certain power purchase agreements (PPAs). Specifically, the PIM is a shared savings mechanism based on an 85% customer/15% utility split of the savings, compared to benchmark prices, up to $3 million for any proposed PPAs from January 2019 until March 31, 2019. The benchmarks are recent renewable PPAs that have been approved in Hawaii, including solar (with 9.5 cents per kWh the benchmark) and solar plus storage projects (with 11.5 cents per kWh the benchmark). The approved PIM is an additional incentive to a PIM approved in April based on an 80% customer/20% utility split up to $3.5 million for any proposed PPAs by the end of 2018. Together, the PIMs are intended to accelerate the procurement of low-cost renewable energy by giving utilities a financial incentive.

6. Non-Wires Alternatives to Traditional Utility Investments

Non-wires alternatives (NWAs) are increasingly being looked at as viable options in several key states. In a business-as-usual scenario, if a utility has an infrastructure need — usually the result of new load growth or the deterioration of an existing asset — it will choose to invest in new poles-and-wires solutions, for example by replacing a transformer, upgrading the feeder, or building a new substation. The utility would then earn profit on the newly invested capital. An NWA — e.g., targeted energy efficiency and demand response programs or energy storage — may meet this need at a lower cost. But if the NWA is classified as an operating expenditure it will replace an earning opportunity for the utility. Many states are starting to recognize this perverse incentive and are exploring potential solutions. Perhaps the most well known example is Con Edison’s Brooklyn Queens Demand Management Program.

In August, the Public Service Commission of the District of Columbia established six working groups to begin Phase II of its grid transformation proceeding, including one on NWAs. In November, the California Public Utilities Commission issued a ruling clarifying how its competitive solicitation framework for NWAs will apply to the state’s 2019 distribution investment deferral solicitations. The Commision also adopted a schedule to approve the solicitations for selected deferral projects for 2019. In December, the Public Utilities Commission of Ohio kick-started its PowerForward Collaborative, which among other topics will focus on identifying where NWAs, such as storage, would be beneficial to deploy and establishing a streamlined process to submit NWA proposals.

In November, National Grid in Massachusetts, as part of its rate case, discussed the potential role of NWAs in future distribution system planning investments. Specifically, the utility proposed three conditions that, if met, would allow a request for proposals for a NWA: 1) the cost of a potential traditional infrastructure investment is more than $1 million, 2) the amount of load that needs to be addressed is less than 20% of the area load, and 3) the need is more than three years out. One barrier that National Grid identified was that solutions providers to date are not usually providing integrated solutions that are cost-effective, although this is likely to change in the near future.

Finally, in November Smart Electric Power Alliance, Peak Load Management Alliance, and E4TheFuture released a released a report with a series of case studies looking at 10 such NWA projects in the United States.

7. Direct Access Programs and Renewable Energy Tariffs

As renewable energy has become more competitive on price and more corporations have set sustainability targets, large customers are increasingly looking for ways to not only power their operations with 100% renewable energy, but also reduce their price volatility and reduce their energy costs. For this, they are looking to enter into long-term contracts either through their utility or with independent power producers. To give these customers the renewable energy they want, utilities in vertically integrated markets are developing new direct access programs and renewable energy tariffs.

In January, Public Service Co. of New Mexico filed an application, which was approved in March, for three power purchase agreements (PPAs) – 50 MW of wind power and 1 MW of storage from Casa Mesa Wind for 25 years, 166 MW of wind from Avangrid Renewables for 20 years, and 50 MW of solar from Route 66 Solar Energy Center for 25 years – to power Facebook’s data center in Los Lunas through a special services contract. In its approval, the Commission cited the various benefits of the special contract, most notably $72 million in investment for New Mexico from Casa Mesa Wind, $75 million for the Route 66 Solar Energy Center, $500 million for the Avangrid Renewables project, as well as $1 billion for the data center itself.

Also in January, Duke Energy Carolinas and Duke Energy Progress jointly filed a petition for a 600 MW Green Source Advantage Program in North Carolina (they subsequently filed a petition for the same program in South Carolina in October), meeting HB 589's requirement to develop a renewable energy program for the state's military, University of North Carolina System, and large non-residential customers. And in November, Duke Energy Carolinas requested approval for a new Renewable Energy Advantage (REA) Rider Pilot (through 2024) that would allow residential and small business customers to purchase renewable energy credits (RECs) to offset all or a portion of their consumption.

In March, the Virginia Corporation Commission approved Dominion Energy’s proposed RF tariff and RG tariff, targeting commercial and industrial customers. The tariffs will allow customers to pay for and receive the environmental credits associated with new renewable energy that is developed or procured for their incremental energy needs. In May, the Oregon Public Utilities Commission opened a new proceeding to address Portland General Electric Co.'s proposed green tariff filed in UM-1690, which would allow large businesses and municipal customers to source their energy from new renewable sources under five, 10, 15, or 20-year contracts. In June, Ameren Missouri, Commission staff, and several other parties filed a non-unanimous stipulation (subsequently approved) that adopted a voluntary renewables program open to large customers with at least 2.5 MW of peak annual demand and any governmental entity regardless of size. Customers will be able to subscribe for up to 100% of their load for a 15-year contract at a fixed price based on the wholesale market price in that month. In November, Nevada Power and Sierra Pacific Power filled a joint application for a NV GreenEnergy 2.0 Rider that would allow commercial customers to contract with them to increase their supply of renewable energy at market-based fixed prices.

These are just a few examples. Other action in 2018 has occurred in Indiana, Michigan (see our detailed look back here) and Wisconsin (Wisconsin Electric Power and Northern States Power Company).

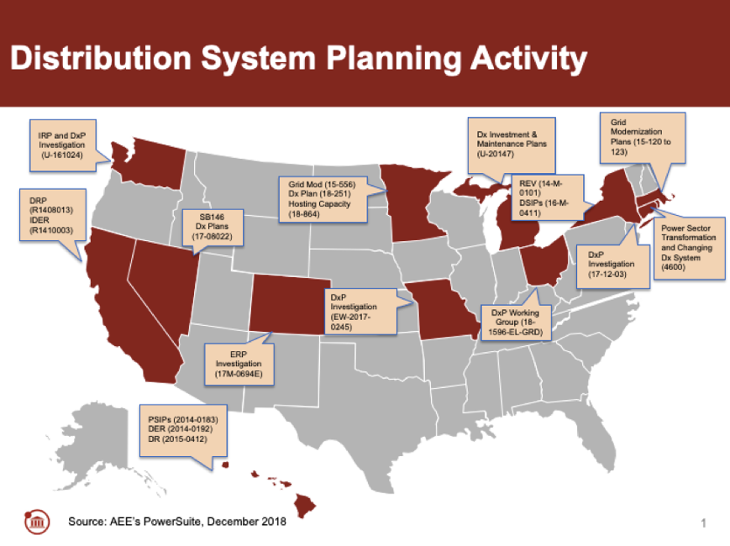

8. Improvements to Distribution Planning Processes

In 2018, an increasing number of utilities and DER providers came together to consider how DERs can be more fully integrated into the system, allowing utilities to take advantage of the benefits DERs can provide and optimizing distribution system planning and investments to account for and include DERs. Interest in this topic has become so widespread that in November the National Association of Regulatory Utility Commissioners (NARUC) and the National Association of State Energy Officials (NASEO) announced the formation of a task force to study how to better align distribution system planning and resource planning processes. By expanding distribution planning to consider DERs, in addition to traditional infrastructure investments, and by properly valuing those distributed assets for both their costs and the benefits they provide, the grid can become more flexible, reliable, resilient, and clean, all while saving money for customers. (See AEE’s issue brief on Distribution System Planning.)

In April, Missouri Public Service Commission staff submitted a report in the Commission’s comprehensive modernization proceeding with recommendations to develop a more detailed analysis on the needs, costs, and benefits associated with DER and the development of an integrated distribution system planning process. Following the report, the Commission issued for comment draft rules regarding the treatment of distributed resources to facilitate a more holistic distribution system planning process.

Also in April, the Minnesota Public Utilities Commission staff issued a report that proposes draft integrated distribution plan processes for the state's utilities (subsequently approved in August). Filing requirements differ by utility but include: 1) planning objectives, 2) processes for developing distribution plans, including stakeholder engagement, 3) baseline distribution system, DER deployment, and financial data requirements, 4) hosting capacity and interconnection requirements, 5) DER futures analysis, 6) long-term distribution system modernization and infrastructure investment requirements, and 7) non-wires alternatives analyses. Following the report, in November Xcel Energy submitted its 2018 integration distribution plan and its 2018 distribution system/hosting capacity report.

In May, the Connecticut Public Utilities Regulatory Authority set the scope of its distribution planning process. Specifically, the process will cover the key cost drivers of maintaining and modernizing the distribution system, how demand and consumption patterns are changing and how distribution system planning can change to address these needs, and the current state of the grid and what is needed to optimize the grid of the future.

In April, in Michigan Consumers Energy and DTE Electric filed their five-year distribution plans and in September, the Michigan Public Service Commission staff filed a report making recommendations for a future distribution planning framework. Key recommendations included: 1) requiring multiple scenario load forecasting and probabilistic planning, 2) requiring publicly available hosting capacity information, 3) requiring utilities with advanced metering infrastructure to utilize Green Button (i.e., providing access to customer usage data), 4) requiring plans to provide detailed information on criteria for non-wires alternatives projects, 5) requiring the development of a common cost-benefit methodology and 6) requiring plans to contain workforce adequacy and development plans. In November, the Commission outlined next steps with Consumers Energy and DTE Electric ordered to file their next plans by mid-2020.

In July, New York’s investor-owned utilities (ConEd, NYSEG and RG&E, Central Hudson, and Orange & Rockland) filed the first biennial updates to their June 2016 distribution system implementation plans .

In October, the Public Utilities Commission of Nevada adopted a temporary regulation that requires utilities to file a resource plan every three years that includes a distributed resource plan. Key parts of the distributed resource plan include: 1) load and DER forecasting, 2) locational net benefits analysis, 3) a grid needs assessment to identify and screen grid upgrades and 4) a hosting capacity analysis. Most recently in October, the Public Utilities Commission of Ohio opened a proceeding to kick-start its PowerForward Distribution System Planning Workgroup with its goals to identify issues that currently exist, or that may arise, in the integrated distribution planning process and to ultimately develop recommendations on improvements. (For background on the PowerForward process to date see here.)

9. The Rise of Dynamic Rate Designs

The rise in customer-sited distributed generation such as rooftop solar – and the rising differential between average and peak demand in many states and service territories – have led utilities to propose new rate designs that better align with these developments. Specifically, states have been looking to more sophisticated rate designs that send price signals to customers that align with public policy goals. (For a deep dive into the nation’s largest dynamic rates program see our case study on Baltimore Gas and Electric’s Smart Energy Rewards Program.)

Just before the new year last year, the big three investor-owned utilities in California (Pacific Gas and Electric, San Diego Gas and Electric, and Southern California Edison) all proposed plans to move to default residential time-of-use rates, albeit on a different time horizon than originally planned by the Commission. An earlier decision ordered the utilities to move to default time-of-use rates by 2019; however, not all utilities followed suit (and the Commission subsequently approved alternative rollout plans in May). Pacific Gas & Electric proposed a preferred October 2020 roll-out, saying that would allow it to conduct a less rushed and more thoughtful marketing campaign. Southern California Edison proposed a 15-month transition plan to move customers to the default time-of-use rate, starting in October 2020 – asking for a later start to allow for replacing an obsolete billing and customer care system with a modern platform before implementing the new rate design. Finally, San Diego Gas & Electric proposed a 10-month migration (marketing, education, and outreach) plan to move customers to the default time-of-use rate starting in 2019 (the Commission issued a proposed decision in November to adopt the plan).

Never a state lacking in regulatory activity, California has had a few more notable actions. In November, Pacific Gas & Electric proposed a new, unique commercial electric vehicle (CEV) charging rate to act as an alternative to a demand charge. The rate gives customers the option to sign up for one of two subscription plans, based on expected load, that essentially allows them to pay a subscription fee per month for load blocks (either every 10 kW or every 50 kW, depending on the plan) up to a certain threshold. If a customer's actual demand exceeds the plan the customer would pay an overage fee equal to 200% of the additional equivalent monthly kW subscription rate for all additional units. Customers may also opt into a lower subscription allotment if they wish to manage and reduce their peak demand. Both plans would also include time-of-use volumetric rates to encourage charging during non-peak demand hours.

Also in November, the California Solar & Storage Association, California Energy Storage Association, Enel X, Engie Services, Engie Storage, OhmConnect, Solar Energy Industries Association, and Stem filed a joint petition requesting that the California Public Utilities Commission (CPUC) open a rulemaking to address dynamic pricing rate designs for the state's three large electric IOUs. Specifically, they are requesting that the rulemaking consider ordering the IOUs to offer optional real-time pricing (RTP) tariffs to all customer classes and to consider two demand charge-related reforms to apply consistently across the IOUs for non-residential customers currently subject to demand charges.

Back in the snowy Midwest, the Minnesota Public Utilities Commission in May approved one of the more innovative rate design pilots developed to date. Xcel Energy’s two-year residential time-of-use rate design pilot is an opt-out program (i.e., customers will be enrolled automatically unless they take action to decline), rather than the more typical opt-in, in two communities in the Minneapolis area for a maximum of 10,000 customers including deployment of advanced meters for participants. To be rolled out as early as 2020, the pilot will include three different rates – an on-peak rate (average of 23.82 cents per kWh), a mid-peak rate (average of 11.07 cents per kWh), and an off-peak rate (average of 5.68 cents per kWh).

In November, Commonwealth Edison petitioned the Illinois Commerce Commission to revise its Integrated Distribution Company Implementation Plan to enable the utility to promote, advertise, and market a four-year residential time-of-use pilot program. The TOU pilot is a three-part supply rate – super peak, peak, and off-peak – that is intended to lower supply costs, encourage EV charging during off-peak hours, and reduce system demand.

10. Valuing the Benefits and the Costs of Net Metering

Net energy metering (NEM) for decades has been successful in spurring the adoption of distributed generation across the country. Minnesota was the first state to adopt a NEM law, in 1983. However, as the number of NEM customers increases, pressure has been building in various jurisdictions to consider alternative rate designs and successor tariffs for NEM customers. Over the past couple of years, several states have taken various approaches to successor tariffs to NEM, ranging from reductions in net metering rates for exported electricity to development of granular methodologies for determining the value of distributed generation on the grid. This year, we are seeing more of the same, with mixed results for customers.

In March, NorthWestern Energy in Montana filed a cost-benefit analysis, which the utility hired Navigant Consulting to prepare, calculating the value of solar energy put back on the grid at $0.04 per kWh, significantly lower than the $0.12 per kWh that NorthWestern Energy currently credits customers. (In comparison to the Montana study, a similar draft study released in Maryland around the same time found the value of solar to be 10 times higher.) NEM advocates, including distributed solar companies and their customers, will likely contest this assessment in the utility’s next rate case.

In Arizona – long ground-zero in the NEM debate with its high solar penetration – an Administrative Law Judge issued a recommended decision in April (subsequently approved in September) in both Tucson Electric Power (TEP) and UNS Electric’s solar rate cases, which established solar export rates (9.64 cents per kWh for TEP and 11.5 cents per kWh for UNS Electric) for NEM customers, with these rates reset in the future based on a five-year average of utility-scale solar generating costs (with decreases capped at 10% per year and new customers locked into their rates for 10 years from interconnection); also approved was a new $2.33 monthly meter fee for residential customers with solar.

There have been actions to reassess NEM in other states as well, for example in Idaho, where the Public Utilities Commission announced in May it will open a new docket to study the costs and benefits of net metering on Idaho Power's system (including all net metered assets, not just on-site solar), proper rates and rate design, and compensation for net excess energy provided back to the grid. Also, in April, the Michigan Public Service Commission approved a new residential distributed generation tariff that requires new NEM customers to purchase energy from the grid at the retail rate but receive credit for excess electricity generated only at the utility avoided cost rate. The new tariff directly resulted from a February 2018 legislatively mandated study on the costs and benefits of distributed generation. And in November, the Michigan PSC opened another proceeding to initiate a stakeholder process to explore options and new rules for interconnection, DG, legacy net metering, and defining legally enforceable obligations under the Public Utility Regulatory Policies Act (PURPA). In September, the West Virginia Public Service Commission initiated a rulemaking to propose revisions to the state's net metering rules – specifically on charges for energy consumption for customer generators, and on ways that any rule changes should affect existing net metering customers.

A few other states are investigating NEM frameworks that are structured to account more precisely for the value that DER provides to the system – both locational and temporal – to address concerns about impacts on non-DER customers without depriving DER customers and the system as a whole of the value they bring. (See AEE’s issue brief on Rate Design for a DER Future.) For example, in April, the New Hampshire PUC directed parties to conduct a distribution-level locational DG valuation study to evaluate alternative study designs and methodologies to address the potential locational value of DG on the utility distribution system. Commission staff in November refined the study scope and established a timeline for next steps. Perhaps most notably, New York has continued its process of investigating a “value stack” methodology that moves beyond the aforementioned transitional net metering-style rate designs. In July, New York Commission staff issued a draft white paper with recommendations for a compensation methodology for avoided distribution costs; utilities also filed distribution marginal cost studies, which will be used to help quantify the distribution value of DER. And in November, the Maryland Public Service Commission issued a final report (prepared by Daymark Energy Advisors) on the Benefits and Costs of Utility Scale and Behind the Meter Solar Resources in Maryland and asked for comments before the New Year.

Keep up-to-date on all regulatory action with AEE's PowerSuite. Click below to start a free trial: