Back in July, Advanced Energy Economy published a list of the top utility regulation trends of 2017 – so far. With 2017 almost in the rearview mirror, we check in on the top public utility commission actions of the year. Not surprisingly, the challenges PUCs are grappling with are wide-ranging and diverse: utility business model reforms, distribution system planning, grid modernization, rate design changes, large investments in renewables, transportation electrification, energy storage, wholesale market changes, and data access, to name a few. Here is a roundup of the top 10 matters before PUCs in 2017.

Note: some links in this post reference documents in AEE's software platform, PowerSuite. Click here and sign up for a free 30-day trial.

- Rewarding Utilities for Performance Against Policy Objectives

In 2017, we have seen an uptick in conversations about the suitability of the traditional cost-of-service regulatory model as the energy landscape changes. Many states have already begun to move toward a system that better reflects new market conditions, allows utilities to take advantage of the growing service economy, and rewards for performance against established goals. At AEE, we have been a part of the conversation (see our 21st century electricity system issue briefs on performance-based regulation and optimizing capital and service expenditures for more information) to develop new utility business models that better meet the changing expectations of consumers and society.

In January, after a seven month investigation, the Public Utility Commission of Texas issued a report to the state legislature on alternative ratemaking mechanisms which, among other things, recommended the adoption of performance-based regulation (PBR). In March, the New Mexico Public Regulation Commission initiated an investigation into its ratemaking policies, considering new financial incentives and re-examining how regulated assets should be defined and their costs recovered. Also in March, the Pennsylvania Public Utility Commission pushed forward in its alternative ratemaking investigation, asking for feedback on experiences with different methodologies, including PBR (AEE Institute filed comments here).

In April, staff of the Illinois Commerce Commission filed a report recommending that the Commission initiate a rulemaking (which opened in December) to clarify the accounting rules around cloud-based solutions, particularly around whether utilities can earn a return on them. New York and the joint utilities have been engrossed in a process to implement their earning adjustment mechanisms (EAMs), with the utilities proposing a framework in May. Over the past year, the New Hampshire Public Utilities Commission has been investigating utility cost recovery and financial incentives and in March, a working group submitted its final report to the commission, recommending, among other things, implementation of PBR. In June, the Vermont Public Utility Commission opened an investigation and has held three workshops to review emerging trends in the utility sector and to examine alternative regulation approaches.

In August, staff of the Michigan Public Service Commission issued a report with recommendations on a new regulatory framework that allows demand response (DR) investments to be recoverable with a rate of return. In addition, the MPSC held a kickoff meeting on July 24 to begin a broader PBR study, with a report due to the state legislature in April 2018. In September, the Minnesota Public Utilities Commission opened an investigation to identify and develop performance metrics and potentially financial incentives for the largest utility in Minnesota, Xcel Energy.

In November, National Grid filed a rate case in Rhode Island on the heels of the state’s Power Sector Transformation Process (AEE Institute and NECEC submitted joint comments) that included a suite of performance incentive mechanisms and plans to fully deploy advanced metering infrastructure (AMI). Also in November, the California Public Utilities Commission issued a draft resolution (final decision expected before the end of the year) beginning the competitive solicitation process for utilities to start former Commission Florio’s regulatory incentive pilot.

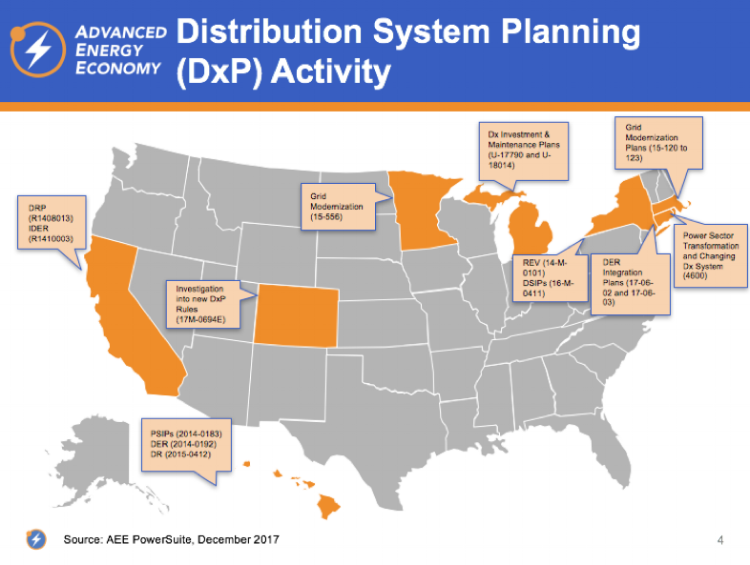

- Reconsidering How Utilities Undertake Distribution System Planning

Several states in 2017 have started to expand their distribution planning, which has traditionally focused on just poles and wires investments, to more fully consider new advanced energy technologies and DERs that can provide similar (or even better) performance, potentially at lower cost.

The New York Public Service Commission has been busy refining the state’s utilities’ distributed system implementation plans (DSIPs), which were filed last summer (by Con Edison, Central Hudson, National Grid, Orange and Rockland, and New York State Electric and Gas and Rochester Gas and Electric). In March the utilities jointly filed a report and in May jointly filed a supplement on the identification and sourcing process for non-wires alternative projects. In late September and early October the utilities filed status reports (by New York State Electric & Gas Corporation (NYSEG) and the Rochester Gas and Electric Corporation (RG&E), Central Hudson Gas and Electric, Con Edison, Orange and Rockland, and Niagara Mohawk Power) on progress so far on hosting capacity analyses (i.e., estimating the load that the grid can accommodate without requiring grid upgrades) and implementation of interconnection portals (i.e., automating the application management process) – both key steps to integrating a higher share of DERs on the grid.

In April, the Rhode Island Public Utilities Commission, Division of Public Utilities, and the Office of Energy Resources started a modernization initiative called Power Sector Transformation, with a workstream focused on distribution system planning (AEE Institute and NECEC submitted joint comments). In November the agencies issued a joint phase 1 report to the Governor with recommendations on key steps Rhode Island should undertake to modernize its electricity system, including improving distribution system planning.

In April, the Minnesota Public Utilities Commission issued a distribution system planning questionnaire in its grid modernization proceeding. The questionnaire sought input from stakeholders (AEE Institute submitted comments) to identify potential improvements in utility planning processes, especially with regard to the growth of DERs.

In Michigan, the two largest utilities – DTE Electric Company and Consumers Energy – filed draft five-year distribution system maintenance and investment plans. Keep an eye out for their final distribution system plans emphasizing near-term priorities and investments, which are due by the end of January 2018. The Commission staff is also ordered to begin a stakeholder process after the final plans are filed and develop a report by September 2018 on future iterations of the distribution planning process (AEE Institute held a forum in Michigan in August to discuss best practices). In June, the main Connecticut utilities – United Illuminating Co. (approved on December 7) and Connecticut Light and Power Co. (approved on October 4) – submitted DER integration pilot plans that include hosting capacity analysis maps to provide customers and third parties more transparency into their distribution systems. They also both included DER and load forecasting to inform distribution system planning, and a DER portal and management system to facilitate the two-way sharing of information between customers and the utility (see trend 10 for more on data access).

The California Public Utilities Commission has also made significant progress in its Distribution Resource Plan (DRP) proceeding. In September, the Commission issued a final decision on demonstration projects for an integration capacity analysis (similar to the hosting capacity analyses described earlier) and locational net benefits analysis and directed the states’ utilities to implement the approved methodologies across their service territories. Most recently, in October the Colorado Public Utilities Commission opened a proceeding to consider various rule changes including potential new rules around distribution system planning.

- Investments to Enable a Dynamic and Flexible Grid

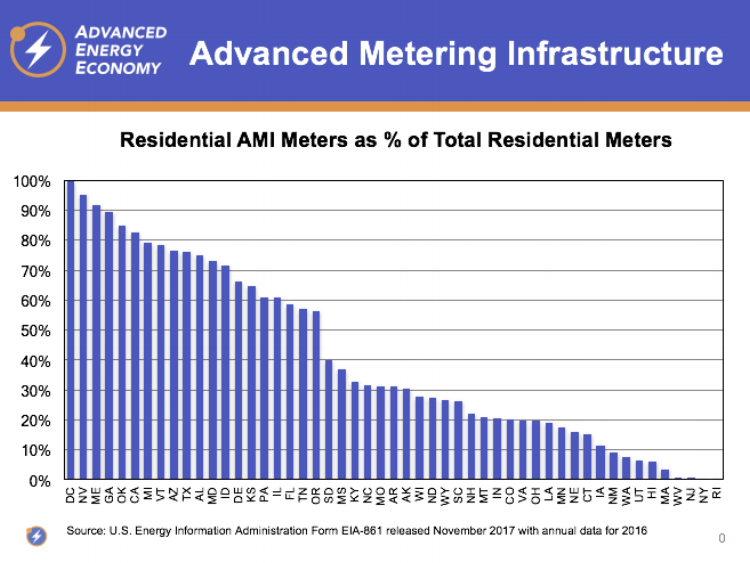

A key first step to realizing a 21st century electricity system is making foundational investments in technologies that can facilitate the seamless integration of distributed assets into the grid. In 2017, many utilities have proposed broad grid modernization plans or advanced metering roll-outs to set the foundation for a modern grid (see our recent post on the leaders and laggards). To see how each state stacks up, see the graph above showing the most recent data on residential smart meters installed by state.

In February, the Public Utilities Commission of Ohio (PUCO) approved AEP Ohio’s Phase 2 gridSMART project, which among other things includes the installation of almost 900,000 smart meters by 2021 and a $20 million investment in voltage optimization technology. In April, PUCO also opened an initiative called PowerForward to review potential regulatory policies and technological innovations that could modernize the grid and enhance the customer electricity experience. Also in February, Orange and Rockland Utilities in New York filed an application that included an expansion of its existing AMI roll-out to a full deployment for an additional $98 million.

In April, the Missouri Public Service Commission opened an investigation into emerging issues in the electricity sector including the installation of advanced metering infrastructure (AMI) and a review of what new customer sited technology and distribution system upgrades are needed to facilitate DER integration. In Colorado, the Public Utilities Commission approved a settlement agreement in July that, among other things, initiates full AMI roll-out in Xcel Energy’s service territory commencing in 2020. And Entergy – one of the largest utility holding companies in the South – has been seeking approval for AMI roll-outs in several jurisdictions in 2017, including recent affirmative decisions in Louisiana, Mississippi, Arkansas, and a pending application in Texas.

In August, Hawaiian Electric Co. filed a revised $205 million grid modernization plan that includes a targeted smart meter deployment, investments in a wireless communications network and enhanced distribution technology, and the installation of advanced inverters to enable private rooftop solar adoption. In September, Vectren in Indiana received approval for a $446 million, seven-year grid modernization plan that includes investments in distribution automation technology, AMI, and an advanced distribution management system. And most recently, Duke Energy Florida received approval in November for a settlement agreement, settling issues with its Levy Nuclear Project and which included the installation of AMI, a new Shared Solar program, and the installation of 500 electric vehicle (EV) charging stations.

- Successors to Retail Net Energy Metering

Net energy metering (NEM) has been widely successful in spurring the adoption of distributed solar across the country. However, as the number of NEM customers increases, pressure has been building in various jurisdictions to consider alternative rate designs and successor tariffs for NEM customers. Over the past 12 months, we have seen a flurry of activity.

The Maine Public Utilities Commission kicked off the changes in January by approving revisions to its NEM rules, grandfathering existing customers under current rates for 15 years and establishing a 10-year transition period, with new DG customers in each subsequent year compensated slightly less than those who signed up the year before.

March was also a very busy month. Arizona Public Service filed a settlement agreement that follows the same general principle, grandfathering existing NEM customers for 20 years and establishing a transitional step-down rate for new customers. Arkansas adopted changes to its net metering rules, adding a 25-kW cap for residential customers and a 300-kilowatt cap for non-residential customers, with longer-term changes to net metering still to come. And the New York Public Service Commission adopted an interim methodology for valuing DERs (AEE Institute filed comments). Specifically, the order maintains net metering for existing solar customers until January 2020, and then slowly reduces the compensation for new solar users from the retail rate toward a "value stack" methodology that is based on the utility's avoided costs and other DER values.

In June, the New Hampshire Public Utilities Commission lifted its 100-MW NEM cap, grandfathered existing customers through 2040, and reduced the NEM credit for new customers to full retail energy and transmission rates but just 25% of the distribution rate. In May, Indiana passed a bill reducing its NEM rate for new customers over the next five years until it is close to the utility avoided-cost rate. And in June, Nevada passed a net metering bill (AB 405) that immediately restored net metering, albeit at a slightly lower rate (and with compensation declining, ultimately to 75% of the retail price, as adoption increases). The decision finally put to rest a contentious debate that raged throughout 2016. In July, Idaho Power jumped into the mix when the utility filed a petition to close its net metering tariff for new residential and small general service customers beginning January 1, 2018 (grandfathering customers on their existing rates).

This fall, we continued to see significant revisions to existing rates. In September, the Utah Public Service Commission approved a stipulation filed by PacifiCorp and Vivint Solar that grandfathered existing net metering customers on their current rates through 2035 and set a three-year transition period when net metering customers would receive export credits slightly below the existing retail rate until the completion of a final order in a new proceeding to investigate a long-term export credit. In November, the Public Utilities Commission of Ohio amended its net metering rules, reducing the excess generation rate utilities are required to offer net metering customers from the unbundled generation rate (which includes some capacity-related riders) to the energy-only rate, ultimately reducing the credit by about 30%. Most recently, the Louisiana Public Service Commission proposed modified net metering rules compensating new DG customers at the avoided-cost rate, which includes the commodity rate plus any locational, capacity-related, or environmental benefits.

- Electric Vehicle Integration

EV adoption and integration has risen to the fore in many jurisdictions, as states are looking to electrification to reduce carbon emissions and utilities are looking for new ways to increase electricity sales. Actions have included widespread electrification programs, statewide EV investigations, and targeted pilots or demonstration projects.

In January, the three big investor-owned utilities in California (San Diego Gas & Electric, Pacific Gas & Electric, and Southern California Edison) filed transportation electrification proposals with the California Public Utilities Commission (CPUC) totaling over $1 billion in investments. At the end of November, the CPUC issued a proposed decision approving $43 million in funding for pilots in phase 1 of the plans (a final decision on phase 1 is expected December 14 and on phase 2 in Q2 2018). In Oregon, PacifiCorp and Portland General Electric have been negotiating settlement agreements in their 2016 transportation electrification proposals. In August, Pacificorp filed a joint settlement agreement in its application and Portland General Electric in June filed a non-unanimous settlement in its application.

In April, the Michigan Public Service Commission began a collaborative to address plug-in EV issues (AEE submitted comments). In May, the Pennsylvania Public Utility Commission initiated an investigation to review the statewide rules and utility tariffs pertaining to third-party EV charging stations (AEE submitted comments). In September, Nevada opened a rulemaking to implement SB 145 which, among other things, created an Electric Vehicle Infrastructure Demonstration Program. In November, the Colorado Public Utilities Commission opened a proceeding to investigate electrification of its transportation sector.

Several other utilities have also proposed pilots. In April Pepco, in the District of Columbia, proposed a $1.6 million EV pilot program through 2019 to test incentives and evaluate and obtain information on potential EV impacts on the distribution system. In April, Gulf Power Co. in Florida received approval in its recent rate case for a revenue-neutral EV pilot program. In June, the Utah Public Service Commission authorized an EV incentive and time of use pilot program for Rocky Mountain Power. In November, Eversource received approval in its Massachusetts rate case for a $45 million EV infrastructure program to increase the availability of charging stations and lower the barriers to EV adoption in the state.

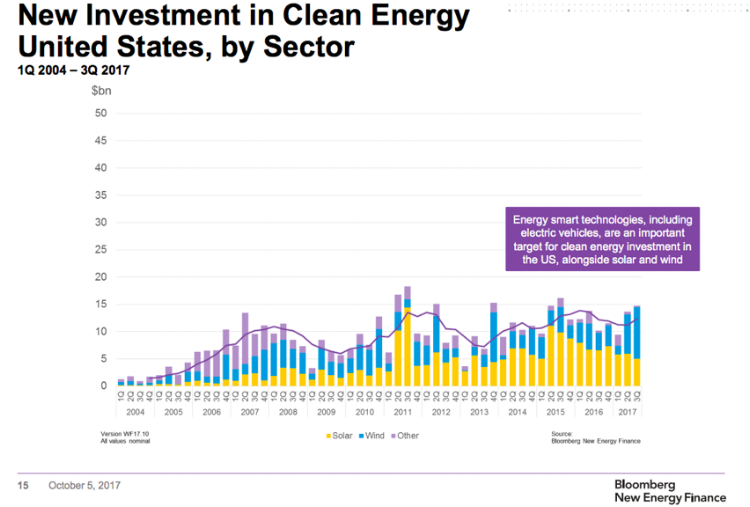

- Investment in Renewables Goes Big

2017 has continued to see large investments in renewable energy, with over $30 billion through the first three quarters, according to Bloomberg New Energy Finance. Large investments have largely been driven by the falling cost of renewables and increased appetite from residential and corporate customers for 100% renewable energy offerings.

Several utilities have proposed building or procuring ambitious amounts of renewables this year. In March, Southwestern Public Service Co. filed an application to build a 522 MW wind plant in New Mexico and a 478 MW wind plant in Texas for $1.63 billion and to enter into a 30-year power purchase agreement for an additional 230 MW of wind. In April, PacifiCorp in Oregon filed its 2017 integrated resource plan (IRP), which called for the retirement of 3,650 MW of coal-fired plants by 2036 and the addition of 1,959 MW of new wind (1,100 by 2020), 905 MW of repowered wind (i.e., upgrading aging turbines with modern units, by 2020), and 1,040 MW of new solar.

In May, Dominion Energy in Virginia filed its 2017 IRP, which included the closure of a 790 MW oil-fired facility by 2022 and a 261 MW coal-fired facility by 2022, along with the development of at least 3,200 MW of solar by 2032 (including 990 MW owned by non-utility generators by 2022) and 12 MW of offshore wind by 2021. In August, Interstate Power and Light in Iowa filed an application for 500 MW of new wind generation on top of the 500 MW that were approved in October 2016. In July, Public Service Company of Oklahoma (PSO) requested approval to enter into an agreement with Invenergy Wind Development and its $4.5 billion, 2,000 MW wind facility (with an expected 51% capacity factor) in Oklahoma. If approved, PSO would own 30% of the project (with Southwestern Public Service Co. in Arkansas and Texas owning the other 70%). In August, Xcel Energy in Colorado, in phase II of its 2016 IRP, filed a settlement agreement that included the retirement of two coal plants (totaling 660 MW) by 2025 and the addition of 1 GW of wind and 700 MW of solar by 2023.

Utilities in vertically integrated markets have increasingly turned to renewable energy tariffs to give customers more choice over their energy sources. In February, Xcel Energy in Minnesota received approval for two pilot programs – Renewable*Connect and Renewable*Connect Government – aimed at large businesses and government entities respectively. In May, Dominion in Virginia filed an application for six voluntary renewable energy tariffs, collectively called Schedule Continuous Renewable Generation (AEE has been a party to this proceeding), and in October Dominion proposed an additional experimental and voluntary companion tariff (Schedule RF). In June, Alliant Energy in Iowa petitioned for a voluntary renewable energy tariff, giving customers three subscription options 1) a 100% solar option; 2) a 50% solar and 50% wind option; and 3) a 25% solar and 75% wind option. In August, Consumers Energy Co. in Michigan received approval for a three-year, voluntary large-customer renewable energy pilot program. In November, Westar Energy and Kansas Gas and Electric Co. (jointly Westar) filed an application for a Direct Renewable Participation Service (DRPS) tariff and Ameren Missouri filed an application for a new Renewable Choice Program, both targeted at large commercial and industrial customers.

- New Opportunities for Energy Storage

The energy storage market has continued its recent momentum into 2017. Driven by improving economics, a changing grid, and business model and rate design changes, energy storage is increasingly being recognized as a valuable and necessary asset for a 21st century grid.

More and more states are requiring energy storage to be evaluated in their IRPs. In August, the New Mexico Public Regulation Commission amended their IRP rules to include energy storage as a commercially feasible alternative supply and demand-side resource and requiring utilities to consider them in their planning. In October, the Washington Utilities and Transportation Commission (UTC) laid out a framework for utilities to consider energy storage on a more level footing with other resources in future planning and procurement proceedings. The UTC will further develop specific rules around evaluating storage investments in its ongoing integrated resource planning proceeding.

A few other states have opened broader rulemakings to refine their energy storage frameworks or policies. Oregon continued progress in meeting its legislative requirements to consider utility energy storage project proposals submitted by January 2018, and to implement an energy storage procurement program by January 2020. In July, the Public Utilities Commission of Nevada opened a rulemaking to investigate setting energy storage procurement targets. Meanwhile, the California Public Utilities Commission released a decision in April to fine-tune its storage framework and policies, which the three large IOUs must use when filing their storage procurement applications in March 2018.

We have also continued to see utilities propose new energy storage projects. In July, the Kauai Island Utility Cooperative (KIUC) received approval for a power purchase agreement with AES Lawai Solar for the largest combined solar and storage facility in Hawaii – a combined 28 MW solar PV and 100 MWh battery storage system to help with ramping toward the afternoon/evening peak, shaving the evening peak, offsetting night-time oil-fired generation, and assisting in grid stabilization. In October, Duke Energy Indiana filed a petition for a new 2 MW solar and 5 MW/5 MWh storage microgrid (Camp Atterbury Microgrid) and a 5 MW/5 MWh energy storage facility (Naab Battery). And in October, the Public Utility Commission of Texas issued a proposed decision approving AEP Texas North Co.’s proposed installation of two utility-scale lithium-ion batteries on its distribution system (one would cost $700,000 in lieu of a $5.3 million traditional investment and one would cost $1.6 million in lieu of a $6 to $17.2 million traditional investment).

- Rate Design for a DER Future

New technologies, especially the rise in customer-sited distributed generation such as rooftop solar, have led many utilities to propose new rate designs and many PUCs to initiate alternative rate design investigations.

Back in January, the Public Utility Commission of Texas issued a final report to the state legislature on new rate designs and recommended phasing in alternative ratemaking mechanisms over three to five years. In April, the Missouri Public Service Commission began to explore and gather information on five emerging issues in the utility sector, including the implementation of alternative rate designs, the installation of AMI, and establishing a competitive EV market. And in October, New York Public Service Commission Staff issued a scope of study report to examine bill impacts of a range of mass-market rate reform scenarios.

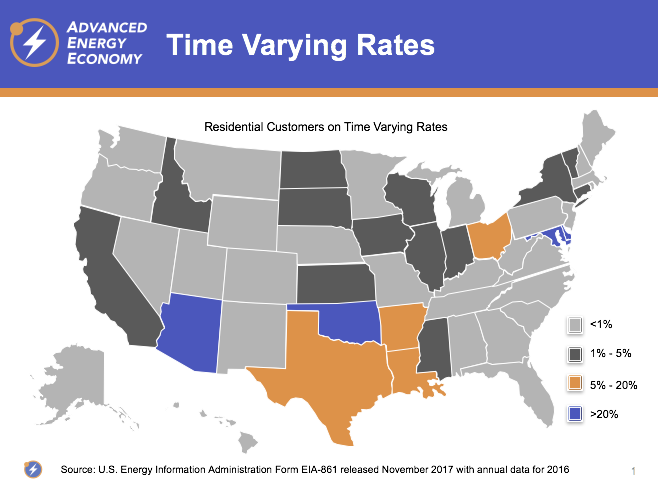

A few other states have begun the move toward time varying rates. The big three California utilities have been conducting time-of-use (TOU) pilots throughout 2017 in order to gather information and aid in their transition to default TOU rates in 2019. In February, Tucson Electric Power in Arizona received approval for a new optional TOU rate with a plan to make the rates default for new customers starting in January 2018. In November, Xcel Energy in Minnesota filed a petition for an innovative two-year opt-out residential TOU rate design pilot. If approved, the pilot would include three different rates, an on-peak rate (average of 23.82 cents per kWh), a mid-peak rate (average of 11.07 cents per kWh), and an off-peak rate (average of 5.68 cents per kWh). At the end of November, National Grid in Rhode Island filed a grid modernization plan as a supplement to its rate case that included full advanced metering roll-out to all of its 790,000 customers coupled with an opt-out time varying rates program by 2022.

- Wholesale Market Issues and Changes

The last few months have been overshadowed by Energy Secretary Rick Perry’s grid review study and the Department of Energy’s (DOE) subsequent proposed bailout of uneconomic coal and nuclear plants now pending before the Federal Energy Regulatory Commission (FERC). PUCs across the country have certainly taken notice, with NARUC commenting: “This proposal contravenes the States’ authority.” At least one state has opened its own inquiry. In September, Commission Andy Tobin of the Arizona Corporation Commission requested an investigation into Arizona's changing energy mix and to identify considerations that should be made to maintain a reliable and secure baseload energy portfolio in the future.

A few other states have opened slightly different investigations into their wholesale market rules. In August, Connecticut’s Department of Energy and Environmental Protection and the Public Utilities Regulatory Authority opened a proceeding to examine the role of existing nuclear, large-scale hydro, demand reduction measures, energy storage, and renewable energy in helping the state meet its carbon emissions targets; the best mechanisms to ensure progress toward those targets; and the compatibility of such mechanisms with competitive wholesale and retail electricity markets. Also in August, the New York Independent System Operator and the Department of Public Service initiated a process to examine the potential for carbon pricing in New York's wholesale energy market in order to align New York state policy and wholesale electricity market rules.

Texas and its exclusive wholesale market operator the Electric Reliability Council of Texas (ERCOT) – have been engaged in several different wholesale market rule changes in 2017. In May, the Public Utility Commission of Texas (PUCT) staff filed a report presenting possible changes to its operating reserve demand curve, which was created to ensure reliability and promote scarcity pricing in ERCOT's energy-only market design. And in March, the PUCT adopted an amendment allowing Emergency Response Service resources such as demand response to participate as alternatives to reliability must-run contracts which traditionally have relied on coal plants to ensure the grid stays operational during emergency events.

- Unlocking Access to Customer and System Data

The rapid deployment of smart meters – and the granular customer and electricity system data they provide – have led many states to revisit their data access rules in the past year. Timely and convenient access to energy data can help customers track and manage their energy use, empower third-party companies to animate the market for DERs, and enable utilities to transition to a more customer-focused culture and business model.

Over the past year, the Public Utility Commission of Texas has been investigating changes to Smart Meter Texas (SMT) – a web portal that provides data access to customers and authorized competitive service providers – through several dockets (42786, 46204, and 46206). Most recently, Commission Staff filed a formal petition on August 16 to open a new docket (47472) to determine what changes, if any, should be made to existing SMT requirements. In July, the Illinois Commerce Commission issued an order encouraging utilities to consider adopting an Open Data Access Framework to enable a marketplace for new products and services and utilize investments made in AMI.

In an August resolution (E-4868), the California Public Utilities Commission approved a new click-through authorization processes that streamlines, simplifies, and automates the process for customers to authorize their utility to share their energy-related data with third-party demand response providers. The Minnesota Public Utilities Commission (PUC) has also been refining their data access rules, particularly related to customer privacy. In June, the PUC approved a model form for utilities to use for obtaining customers’ consent to release their energy usage data to third parties.

Utility commissions across the country have been busy this year adjusting regulatory frameworks to a changing electricity marketplace. AEE has prepared a series of seven issue briefs that address how the power sector can successfully transition to a 21st Century Electricity System. Also, to keep up to date on energy policy developments across the country yourself, check out AEE’s PowerSuite and start a free 30-day trial.