This post is one in a series of excerpts from the Advanced Energy Now 2021 Market Report, prepared for AEE by Guidehouse Insights.

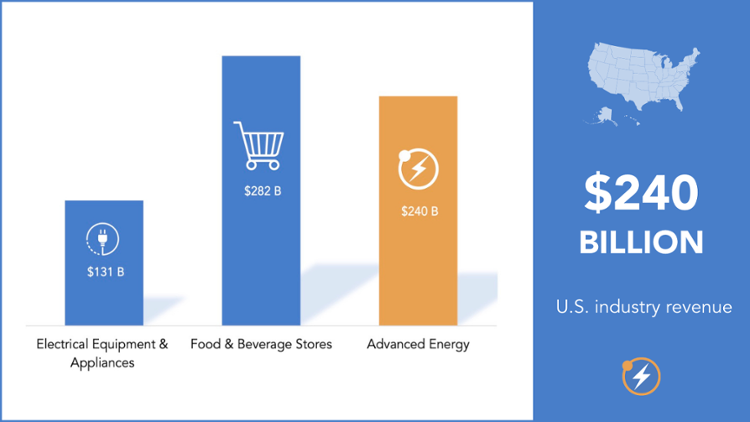

Advanced energy revenue reached over $1.4 trillion worldwide in 2020, growing by 2.5% over 2019, following 7% growth the year prior. Advanced energy revenue is now greater than pharmaceutical manufacturing globally, and double that of coal mining. In the United States, advanced energy revenue had a strong year in 2019, growing a robust 18%, before falling 2% in 2020, in parallel with the decline of U.S. GDP overall. Still, at $240 billion, U.S. advanced energy revenue is close to that of food and beverage stores and twice the revenue of electrical equipment and appliances. Since 2011, U.S. advanced energy revenue has grown at CAGR of 5%.

Globally, the biggest revenue increase among the seven segments of advanced energy came in Advanced Transportation, up $41 billion (15%) to nearly $319 billion in 2020. This growth was led by Plug-In Electric Vehicles (PEV), up 27% over 2019. PEVs overtook Hybrid Electric Vehicles as the largest revenue segment in 2017 and has only grown its segment share since.

While Advanced Transportation also grew the fastest in 2020 (15%) due to the surge in PEV sales, Electricity Delivery and Management also demonstrated ongoing strength, growing 9% in 2020, to $149 billion. Energy Storage has been one the primary catalysts of this growth, with revenues increasing every year since 2014, including an impressive 35% year-over-year growth in 2020.

Building Efficiency also saw a notable increase in 2020, up $16.6 billion, or 5%, to $342 billion globally. This growth was led by residential energy efficiency and smart appliances, which collectively grew by 10% in 2020. This growth helped to mitigate more severe COVID-related impacts seen in commercial and industrial subsegments. High-efficiency Lighting, the largest category of Building Efficiency, was up 1% in 2020, to $146.5 billion, after 4% growth the year before.

Advanced Fuel Production experienced the sharpest revenue decline, down nearly $38 billion, or 17%, to $184 billion globally. This drop is largely attributed to the impacts of COVID-19, which had dramatic effects on vehicle travel – and therefore consumption of gasoline, with which ethanol (the largest component of Advanced Fuel Production) is mixed. One new development in this edition is the emergence of hydrogen fuel, which has been growing significantly – though more in Hydrogen Production Technology than in the fuel itself – since 2018, reaching $60 million in 2020.

In the United States, the bulk of the $5 billion overall drop in 2020 revenue came from one segment, Advanced Fuel Production, which was down $20.9 billion, largely due to a sharp decline in ethanol revenue from a nine-year peak the year before. But the rest of advanced energy remained strong even in the COVID year, with growth of 8% overall when ethanol alone is excluded from the U.S. total. Driving this resilience has been a surge in revenue across several product categories, including PEVs, Energy Storage, Residential Energy Efficiency, and Wind.

Advanced Transportation saw both the largest revenue increase ($5.1 billion) and the biggest growth year over year (16%). Leading this growth was revenue from PEVs, up 19% from 2019, to $19.7 billion. Indeed, PEV growth has been explosive, with a compound annual growth rate (CAGR) of 45% since 2011. Previously, PEV gains have come at the expense of hybrid vehicles, which peaked at $15 billion in 2013. But after a period of relative stagnation, Hybrid Vehicles have also shown growth over the past two years, with revenue rising 8% in 2020, to $10.9 billion.

Building Efficiency – the largest segment of U.S. advanced energy revenue – saw 5% revenue growth in 2020, reaching $94.5 billion and continuing its unbroken streak of year-over-year increases. There was a notable drop, however, from the 9% growth seen in 2019, as well as the 10% CAGR since 2011, largely due to COVID-19. Impacts from the pandemic were experienced in the commercial and industrial (C&I) space due to a decline in C&I construction and changing work environments. However, with people spending more time at home and energy load shifting from C&I to residential, residential energy efficiency investments associated with new home construction and renovation drove up Building Efficiency revenues, as did sales of smart appliances.

U.S. Advanced Fuel Production mirrored the global market in a deep decline. Following a record year in 2019, both in total ($54.5 billion) and growth rate (63%), revenues plummeted, dropping $21 billion, or 39%, to $33.6 billion in 2020. This is almost exclusively due to Ethanol sales, which were dramatically impacted in both consumption and price. U.S. Ethanol sales declined 13% by volume in 2020, while the price per gallon dropped even further (33%). This is largely a function of COVID-19, which reduced gasoline consumption globally. As a fuel substitute, the price of ethanol is highly correlated to the price of gasoline, further compounding the demand impact.

Advanced Electricity Generation revenue showed impressive growth in the face of COVID-19, up 10% in 2020 to $39.8 billion. This segment has fluctuated between roughly $30 billion and $40 billion since 2011, with a low of $24.2 billion in 2013, for a CAGR of 2%. Growth in 2020 was principally a function of Wind, which grew 32% in a record year of deployment, following an 18% increase the year before. Solar growth was strong in 2019, with revenues up 14%. But 2020 saw a 5% drop in revenue, despite a 6% increase in capacity installed that year, primarily in grid-scale projects. Distributed solar fell 10% in capacity installed in 2020.

Electricity Delivery and Management was the second-highest advanced energy growth segment in 2020, increasing by 10% over 2019, to $22.2 billion and adding $2 billion in overall revenues. As with Advanced Electricity Generation, one product category shows disproportionate growth – Energy Storage, with revenue up 139% in 2020, to $1.6 billion. Also buoying this segment is Smart Street Lighting, with 20% growth, to $7.4 billion, adding $1.2 billion to U.S. advanced energy growth in 2020.

Click below for the full Advanced Energy Now 2021 Market Report or two-page Highlights.