This week we saw energy storage in the headlines as the market continues its meteoric growth. From news of another record-breaking quarter for storage, to utility partnerships, to updated battery technology, this week’s news round up is the opposite of Storage Wars.

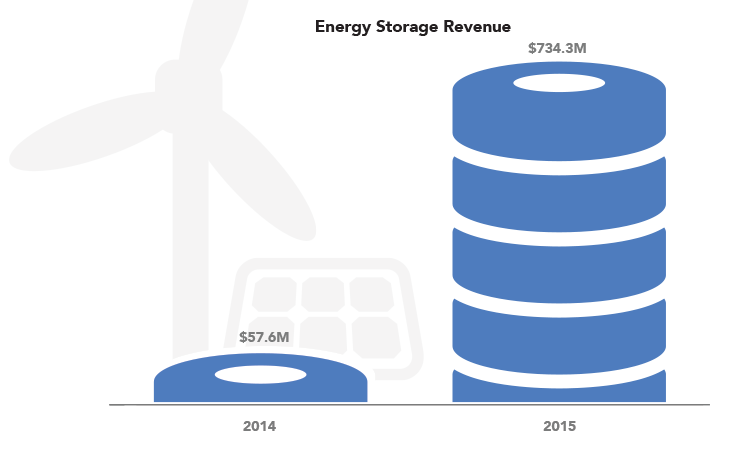

Readers of Advanced Energy Perspectives know the market for energy storage is growing, and fast. As noted in last year’s Market Report, energy storage is transitioning from a large infrastructure market of pumped hydro and underground compressed air projects – which it still is, in much of the world – to a technology-driven market, with rising scale and falling prices. And it is taking off: global revenue from Energy Storage multiplied five-fold, from $462 million in 2014 to $2.1 billion in 2015, and in the U.S. more than ten-fold, from $58 million to $734 million. (See graph below.) The incredible rate of growth can be partially attributed for starting so small – up until a couple years ago, very little non-hydro or non-compressed air energy storage existed, and battery technology was lagging behind storage needs. But even with that in mind, the numbers published by Greentech Media this week are impressive: In Q2 of 2016 a whopping 41.2 MW of energy storage was deployed in the U.S. alone. What’s more, the largest project was not in California, which has seen the majority of U.S. energy storage development thanks to a mandate passed in 2013. Indiana’s IPL Advancion Array, developed by AEE member AES Energy, provides 20 MW of interconnected energy storage.

The incredible rate of growth can be partially attributed for starting so small – up until a couple years ago, very little non-hydro or non-compressed air energy storage existed, and battery technology was lagging behind storage needs. But even with that in mind, the numbers published by Greentech Media this week are impressive: In Q2 of 2016 a whopping 41.2 MW of energy storage was deployed in the U.S. alone. What’s more, the largest project was not in California, which has seen the majority of U.S. energy storage development thanks to a mandate passed in 2013. Indiana’s IPL Advancion Array, developed by AEE member AES Energy, provides 20 MW of interconnected energy storage.

“This quarter marked several storage firsts, such as the first grid-scale project in MISO and a large solar-plus-storage at a municipal utility in Ohio,” said Ravi Manghani, GTM Research’s director of energy storage, in Greentech Media. “Additionally, the industry received a big boost from the White House, with recently announced public and private commitments that will result in 1.3 gigawatts of new storage deployments and, more importantly, spur a billion dollars in storage investments.”

That growth shows no sign of stopping, as companies announce deals with utilities to bring energy storage to the masses. This week, Axiom Energy, a storage company with a cool idea – literally, announced a deal with ConEd to provide refrigerator batteries to grocery stores in New York City. The grocery stores will use their refrigeration units to make ice at night (using frozen salt water tanks), upping their energy consumption during non-peak hours, and using the stored energy to cool during the day, which can reduce peak electricity demand by up to 40% for these businesses.

Earlier this summer, AEE member SolarCity announced a partnership with PG&E for a solar + storage project that includes grid services. The pilot will provide 150 residential customers with a smart inverter, a storage system, or both, in addition to existing solar panels. We’ve discussed in the past how solar + storage is changing the game, and this new project is no different.

“The project will demonstrate how smart inverters and behind the meter battery storage can be coordinated by the utility to optimize electric distribution planning and operations,” the companies said in a press statement.

Meanwhile, AEE member Tesla, which is already working with SolarCity in another solar + storage project, has quietly cut the cost of its storage solution. Electrek this week reported that Tesla has reduced the cost of the residential Powerpack by five percent and the commercial inverter by 19%. The company doesn’t exactly need to lower prices: demand for the Powerwall was high enough that it sold out in the first week of taking orders. This might help assuage the energy storage discontents, however, who assert that solar + storage doesn’t yet make financial sense for consumers.

Even so, the battery market continues to develop and mature. Utility Dive reports this week that of the 45 ARPA-E projects that attracted private capital, several were storage initiatives. As Julian Spector wrote in Greentech Media, “You know that an industry is maturing when the original stalwarts tap out,” referring to Sony and Nissan’s tapping out of the battery storage market. Spector also wrote an article this week explaining another trend in the battery market: using old EV batteries for small-scale storage applications.

“I think we have reached some holy grails in batteries – just in the sense of demonstrating that we can create a totally new approach to battery technology, make it work, make it commercially viable, and get it out there to let it do its thing,” Ellen Williams, ARPA-E’s director, told The Guardian newspaper.

Learn more about all advanced energy technologies with our report This is Advanced Energy, available for free at the link below!