Currently, over two million megawatts of generator and storage projects are actively seeking to connect to the U.S. transmission grid. The process to connect these proposed projects to the grid so they can start generating electricity—called “generator interconnection”—is outdated, slow, unpredictable, and sorely in need of reform. The 2024 Advanced Energy United Generator Interconnection Scorecard is the first-ever attempt to evaluate each of the seven regional transmission system operators on their generator interconnection processes.

Now that the Federal Energy Regulatory Commission (FERC) has handed down significant reforms (Order No. 2023) and the compliance process is taking place, this report serves as a baseline evaluation on the efficacy of the interconnection processes of the seven RTOs/ISOs as they operated before Order 2023 was passed and implemented. Its findings underscore both the importance of strong compliance with the FERC order and the urgency of pursuing further reforms beyond those already mandated by Order 2023.

The scorecard finds that interconnection is not going smoothly in any region. Two regions stand out as doing a better job than the rest: both CAISO and ERCOT receive a “B” score. CAISO is seen as having a good process that has failed to keep up with the recent increased volume of interconnection requests, while ERCOT has an efficient interconnection process, but projects face a high risk of curtailment once connected. The other regions received grades of C- or lower, reflecting a dire need for interconnection reforms. The deficiencies identified by the report ranged from process shortcomings to implementation challenges to staffing shortages.

Some of the challenges highlighted in the report may be corrected by reforms already underway, including those being made in response to FERC Order No. 2023 (the report provides a look-back since the efficacy of ongoing reforms is impossible to evaluate before they are implemented). For example, affected systems studies (which evaluate impact on neighboring transmission systems) were identified as a major roadblock and source of uncertainty; they are also one of the reforms targeted by Order No. 2023. Other shortcomings, such as lack of pre-queue information to assist developers as they prepare to enter the interconnection queue, may be partially but not fully addressed by compliance with Order No. 2023. However, it is also clear that some of the shortcomings described in the report will not be resolved by existing reform efforts. For example, availability of interconnection alternatives is not addressed in the FERC order, nor is better integration of transmission planning and generator interconnection. Similarly, implementation challenges such as staffing shortages, problematic modeling assumptions, inconsistent application of interconnection procedures, and poor construction management leading to delays and uncertainty are all outside the scope of current reform efforts. Ambitious compliance with Order No. 2023 and rapid consideration of further reforms will both be needed to bring scores up to “A’s” across the board.

Methods

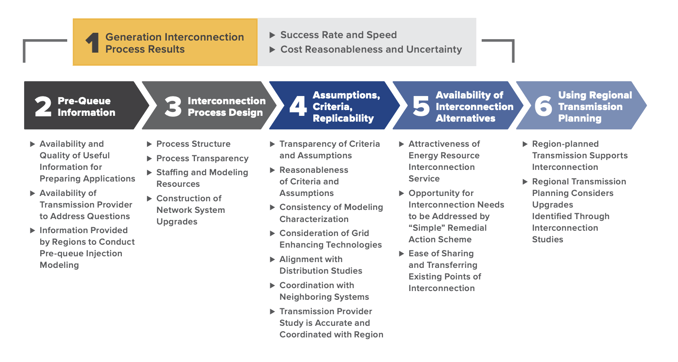

The report authors, Grid Strategies and The Brattle Group, measured each Region’s interconnection process on six dimensions: 1) Interconnection Process Results, 2) Pre-Queue Information, 3) Interconnection Process Design, 4) Assumptions, Criteria, and Replicability, 5) Availability of Interconnection Alternatives, and 6) Regional Transmission Planning. The factors which contributed to these dimensions are listed in the graphic to the right. At its core, the goal of the report is to capture how well the Regions provide information, resources, and human capital to generation interconnection applications within their footprint. The report is based on both quantitative and qualitative data, including interviews with interconnection customers and data furnished from Lawrence Berkeley National Laboratory’s (LBNL) “Queued Up: Characteristics of Power Plants Seeking Transmission Interconnection as of the End of 2022” report. These data are occasionally supplemented by data obtained directly from the Regions. The Scorecard evaluates each Region's interconnection process in its entirety, including information exchange that occurs prior to submitting an application (pre-queue) to network upgrade construction activities that are primarily the responsibility of a transmission provider. This analysis assigns a grade to each of the Regions for six categories related to the generator interconnection process. The analysis and grades are a retrospective of the past several years and proposed Order 2023 compliance measures are not considered.

The Scores

ERCOT - Overall grade: B

Interconnection applications in ERCOT have progressed more quickly and consistently than other regions, with average projects taking just two years. ERCOT can maintain an effective, high-volume serial process because there are relatively few upgrade costs shared among multiple projects in the queue and limited need for re-study that can slow the process. The ERCOT process is notable because the studies are completed by the transmission providers instead of ERCOT itself and the study criteria are focused on local upgrades. The ERCOT interconnection process gives flexibility in modifications of the interconnection requests, such as changing the point of interconnection (POI), without having to re-submit a new request. The main drawback of ERCOT’s interconnection process is that projects face a high risk of curtailment and congestion once connected due to lack of proactive transmission buildout. While the large-scale CREZ transmission buildout earned national recognition as a forward-looking plan when adopted nearly twenty years ago, ERCOT has approved only two transmission lines justified on economic benefits in the past decade.

CAISO - Overall grade: B

Until recently, CAISO kept to a timeline of around two years for processing project applications, but timelines have grown to over 3 years for recent clusters. CAISO is described as having a reputation for consistent and reliable costs thanks to rules that require transmission providers to publish per-unit costs for assessed network upgrades. Aspects of the process that were viewed favorably by interconnection customers include ease of submission, site control requirements, modification of points of interconnection (POI), the deficiency correction process, withdrawal penalties, and cost allocation rules. CAISO also supports interconnection by proactively planning transmission for the future resource mix through an annual planning process that considers future generation needs as determined by the California Public Utilities Commission.

ISO-NE - Overall grade: D+

In some areas of the ISO-NE grid, projects can move through to completion in two years, while in other areas there is complete gridlock. The report highlights numerous challenges with ISO-NE’s process and implementation. For example, ISO-NE provides expedited cost estimates, but they are often uninformative and vague. Developing benchmarking models is a high cost, time consuming requirement (which causes version control issues), and an expense that other RTOs do not require. Studies for smaller projects connected at the distribution level can be even more complex than for projects connected at the transmission level, resulting in the smaller project absorbing proportionately larger costs. Additionally, the ISO-NE transmission planning process has not resulted in any new transmission projects intended to support new generator interconnection, although the report acknowledges the promise of ongoing efforts to improve proactive regional transmission planning and procurement.

MISO - Overall grade: C-

MISO was one of three RTOs that tied with a “C-“ grade, with a relatively slow (successful interconnection applications in MISO have progressed through the queue in 2-4 years) and unpredictable process with inaccurate schedule estimates and cost estimates that have doubled in recent years. On the positive side, the tools MISO provides make its pre-queue information marginally better than the other regions, and MISO also makes it relatively easy to submit application modifications, subject to material modification review. However, after MISO decreased its distribution factor threshold (a metric used to determine whether and how much of the cost of an identified network upgrade to assign to a given project), interconnection customers see additional and often distant network upgrade requirements for interconnection requests. While MISO has been recognized as a leader in transmission planning, customers have not seen much benefit from MISO’s transmission development process in recent years, likely due to the 10-year gap between the completion of the Multi-Value Projects (MVP) study in 2011 and the more recent Long-Range Transmission Planning (LRTP) process.

NYISO - Overall grade: C-

NYISO was rated as having a relatively good process design, but poor outcomes with some execution challenges. The last cluster is reported as taking 18-24 months to reach the first study, and projects that have been in the queue for 3 years do not currently appear close to completion. NYISO does not provide full upgrade costs until very late in the process and the information provided lacks clarity. While there is some promise that ongoing regional planning efforts will improve interconnection opportunities, results have not yet materialized. When NYISO identifies transmission upgrades to unlock capacity for projects connected at the transmission level, that new headroom can easily be used by distributed generation projects that NYISO’s study process did not consider. In its Public Policy Transmission Planning Process (PPTPP), NYISO has developed several transmission lines intended to reduce congestion between upstate renewable generation and downstate demand. To date, NYISO’s economic planning framework has identified little to no transmission capacity upgrades.

PJM - Overall grade: D-

PJM received the lowest overall score due to a failure to anticipate the need for improvements before the whole process crashed under the weight of growing demand for interconnection. PJM’s interconnection study process for new projects has stopped entirely, and projects from 2019 hope to complete the process six years later in 2025. Even though PJM has developed new processes that should improve the process going forward, significant delays have been imposed on projects that have been transitioned to the cluster process. While interconnection customers can replicate PJM’s results due to model availability, this advantage is undercut by PJM’s routine failure to proactively communicate identified errors in the model and issue corrections for those models. In some instances, transmission providers have found errors in PJM’s studies that resulted in final costs being much higher than estimated earlier in the process. Interconnection customers view PJM as not having a forward-looking transmission planning process that identifies upgrades required to support the addition of new resources, although the report notes ongoing efforts that may result in improvements.

SPP - Overall grade: C-

SPP’s backlog today is five years and growing, with interconnection agreements in 2018-2020 having come to a virtual standstill. A positive note is that schedule estimates provided by SPP are relatively accurate, perhaps due to the adoption of automation, and its phased study process was praised by interconnection customers. However, SPP suffers from cost uncertainty driven by an interconnection study approach that identifies excessive upgrades, resulting in project withdrawals and the need for re-study. Its under-built transmission system also causes most projects to trigger significant network upgrades. SPP was also singled out for criticism of its refusal to provide key helpful pre-queue information, and customers noted that SPP inconsistently applies aspects of its interconnection tariff. While interconnection customers appreciated that SPP’s studies are reported in a detailed workbook that enables analysis and cost attribution, particularly where network upgrade costs are shared among projects, SPP is reported to have issues with consistency here as well.

Where do we go from here?

A functional interconnection process is critical to maintain competition between new and existing resources and to ensure reliability of the electric grid as load grows and as resources retire and new ones are needed to replace them. The challenges outlined in the scorecard range from structural, process deficiencies that will require tariff changes to implementation challenges such as use of inconsistent practices, lack of transparency, and inconsistent communication to resource limitations such as inadequate staffing and reliance on outdated tools and outside consultants to conduct the work. Some of these challenges, particularly some of those that will require tariff changes, may be addressed by compliance with Order No. 2023, but only if the RTOs respond with ambitious compliance proposals. Even with those reforms, many more tariff changes and implementation improvements will be needed to deliver an interconnection process that meets the moment, and RTOs will need to devote adequate resources to the interconnection process. Without these improvements, no region will earn an “A” and the interconnection process will remain a bottleneck in the clean energy transition.