This post is one in a series of feature stories on trends shaping advanced energy markets in the U.S. and around the world, drawn from Advanced Energy Now 2016 Market Report, which was prepared for AEE by Navigant Research.

The unexpected collapse of world oil prices that began in late 2014 persisted throughout 2015 and even accelerated late in the year, driving both manufacturers and consumers to reevaluate their alternative fuel strategies particularly around NGVs. With oil prices now expected to remain well below $100 per barrel for at least several more years, much of the operating cost advantage of NGVs that helped offset the acquisition cost premium has evaporated, particularly in North America. In other regions of the world, natural gas still holds a cost advantage, although not to the degree it has in recent years.

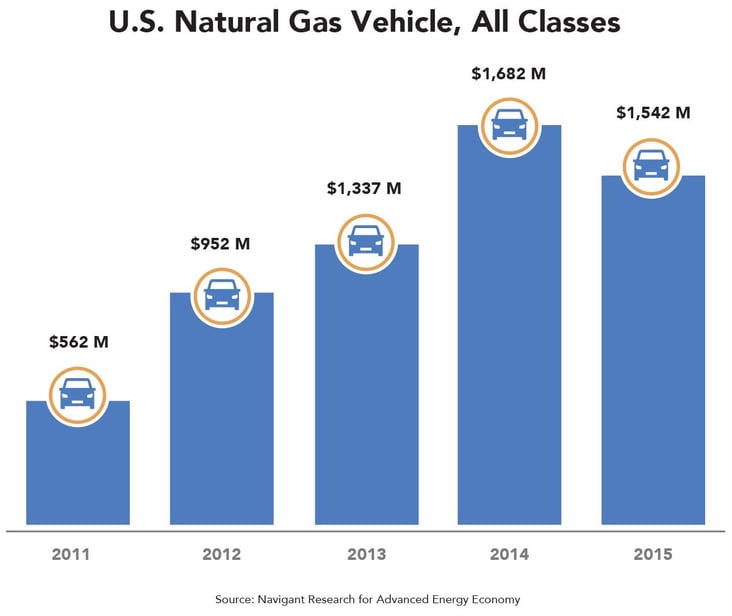

Revenue from worldwide sales of light-duty NGVs grew 15% from 2014 to 2015, but at $30.7 billion barely surpassed the 2013 revenue mark of $30.5 billion. In the United States, revenue from these vehicles fell 9%, to $919 million, but was still double 2011 revenue of $460 million.

In Europe, the longtime leader in light-duty NGVs, Fiat Chrysler Automobiles (FCA), is being challenged by VW. While FCA has the expertise and technology to challenge Ford for leadership in the North American truck and van NGV markets, any expansion of NGV availability beyond the Ram 2500 is unlikely in the near- to midterm as a result of low gasoline and diesel prices. Even Honda, the most stalwart advocate of light-duty NGVs in North America, discontinued the Civic NG in 2015 after selling only about 16,000 units in more than 16 years on the market. Sales of conventional gasoline Civics consistently exceeded 300,000 units annually in the same period.

Which is not to say these automakers don’t see value in NGVs for themselves. At the same time the Civic NG was discontinued, Honda opened a large compressed natural gas (CNG) refueling station at its Marysville, Ohio, factory to supply trucks that deliver parts from suppliers daily. FCA also opted to convert its eet of 179 class-8 trucks that deliver parts between plants in Michigan and surrounding states to CNG and install a CNG fueling facility at its Detroit terminal.

Refueling infrastructure is an issue for NGVs, in the usual chicken-and-egg fashion. Without a critical mass of vehicles on the road and reasonable prospects for growth, station operators are unwilling to invest in fueling equipment—and without ready access to refueling stations, retail customers do not buy NGVs. However, because natural gas is well-suited to larger vehicles, such as refuse trucks and buses, which are often used in limited geographies, eet operators can take advantage of the low fuel cost by installing private stations in vehicle depots.

In addition to sustained low oil prices, several factors could dampen short-term prospects for NGVs, including slowing economic growth in Brazil, Russia, India, and China (the BRIC countries), and political tensions in various regions, including the Middle East. Ongoing political tensions in Eastern Europe could also affect supply and the prices of gas exports from Russia to Western Europe. A significant economic slowdown in China is hurting overall consumer demand, particularly for new vehicles. Meanwhile, battery suppliers and OEMs, including LG Chem, GM, and Tesla, are demonstrating significant progress in battery cost and capacity, potentially giving BEVs a leg up over NGVs as alternatives to gasoline- or diesel-fueled vehicles.

Still, Navigant Research expects the global market for light-duty NGVs to grow at a CAGR of 4% from 2015 to 2025, surpassing 3.4 million vehicles by 2025. North American growth is expected to remain low compared to other global markets due to high acquisition costs for NGVs and a low price delta between natural gas and liquid fuels. Asia-Paci c is projected to be the largest regional market, accounting for over 45% of sales in 2025. NGVs are more affordable in Asia-Paci c where vehicles are typically equipped with less expensive but heavier type-1 gas cylinders rather than the lighter type-4 cylinders used in North America. Medium- and heavy-duty NGVs should continue to see more solid growth over the next decade, as they provide an alternative to diesel, and natural gas remains more practical in some ways than electri cation for heavy vehicles. A global CAGR of just under 10% is projected to bring total sales of these larger NGVs to more than 676,000 by 2025, with Asia- Pacific accounting for more than 90% of that volume.

Learn more about natural gas vehicles and other aspects of the advanced energy industry in our annual Advanced Energy Now Market Report, available for free at the link below: