Following the Clean Power Plan has been a waiting game lately. Waiting for court dates, waiting for state planning decisions, waiting to learn what the next President will make of the CPP. We’re excited that the waiting game for the proposed Clean Energy Incentive Program is over (and we’re wasting no time diving in), but we’re also still waiting for the final model trading rules.

That doesn’t mean this time is going to waste. While the CPP winds its way through the courts, analysts of all sorts are frantically crunching numbers and cranking out modeling scenarios to give us all a better picture of what the CPP means for our future electricity system. Spoiler alert: It looks pretty much like the one we’ve got now, just with a lot more advanced energy. Even bigger spoiler: We’re already well on our way to CPP-required levels of emissions.

Current trends in the electric power sector could get emissions very close to where we need to be in 2030 all by themselves, at least for now. According to the latest short-term energy outlook from the Energy Information Administration (EIA), carbon emissions from the power sector this year will be 25% below 2005 levels—even with an expected uptick in coal and natural gas use later this year. If first quarter trends were to continue, we’d get all the way to the 32% reductions required under the CPP by 2030. At least one state has already met that goal: In 2015, emissions in Arkansas dipped to 30.1 million tons, lower than the state’s 2030 CPP target of 30.6 million tons.

These trends in the electricity system make abundantly clear that we can reach the CPP goals without disastrous effects on grid reliability or electricity prices. What this snapshot doesn’t tell us, however, is whether the trends we see today would continue without the CPP in place. After all, a changing economy, fluctuating commodity prices, advancing technology trends, etc. can change the emissions picture significantly over 15 years.

These trends in the electricity system make abundantly clear that we can reach the CPP goals without disastrous effects on grid reliability or electricity prices. What this snapshot doesn’t tell us, however, is whether the trends we see today would continue without the CPP in place. After all, a changing economy, fluctuating commodity prices, advancing technology trends, etc. can change the emissions picture significantly over 15 years.

For a full assessment, we need to consult the various models of CPP compliance scenarios released in recent weeks. These exercises confirm that the CPP will lock in and expedite the trend toward advanced energy. Given uncertainty about what will happen to natural gas prices, how many existing nuclear facilities will retire, how fast and how far advanced energy prices will drop between now and 2030, and other imponderables, the CPP may make the difference between accelerating our current progress, sliding into neutral, or even shifting into reverse.

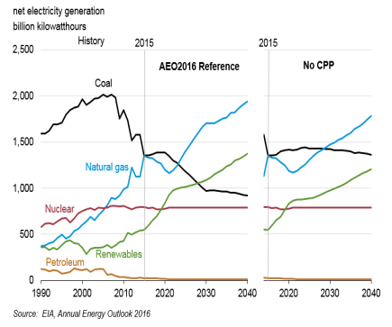

In fact, that is exactly what EIA’s Annual Energy Outlook shows. EIA released a preview of the full AEO in May, outlining the results of its two reference scenarios—one with the CPP, and one without. According to EIA’s modeling, coal generation without the CPP will remain steady rather than drop, as it does under the CPP. Renewable energy capacity would increase with or without the CPP, but EIA projects that nearly twice as much renewable capacity will be added from 2021 to 2030 with the CPP (91 GW) than without (48 GW). Notably, retail prices in the CPP reference case average just 3% higher than prices in the no-CPP case. EIA has never been optimistic on advanced energy, so our suspicion is that compliance with more renewable energy would be cheaper. It’s also important to note that models like EIA’s NEMS struggle to fully incorporate energy efficiency. If energy efficiency is deployed at higher levels under state plans than these models project, that will bring compliance costs down and a number of models actually project net savings. Even so, EIA’s results confirm that emission reductions under the CPP don’t have to come at a high cost.

Meanwhile, modeling by the North American Reliability Corp. (NERC), which we wrote about last week, shows coal generation not just holding steady, but actually increasing, in the absence of the CPP, based on the assumption that natural gas prices will increase. NERC, too, predicts that renewable capacity will increase with or without the CPP, but its models project just 10-20 GW more renewables under the CPP, with the effects of the CPP kicking in after 2022. As we wrote last week, we expect these numbers to be much higher, but NERC’s findings still confirm the CPP’s role as a market driver.

Finally, M.J. Bradley & Associates released modeling results that show how much easier it will be for states to achieve compliance with extension the Investment Tax Credit and Production Tax Credit (ITC/PTC) approved late last year and lower projected natural gas prices. Compared to pre-ITC/PTC extension modeling done by the firm in January, the results show significantly more renewables, and fewer carbon emissions, under business as usual scenarios.

With all of these models, a lot is riding on the underlying assumptions, including natural gas prices and nuclear retirements. In New England, we’ve already seen that a single nuclear plant going offline can lead to an uptick in emissions across the entire region.

Despite modeling projections showing the CPP as an important market driver, there is a still a chance that we’ll get to CPP levels without the CPP, because of a factor that none of these models capture: Many utility planners and regulators are operating under the assumption that some form of carbon regulation will become business as usual, no matter what.

Scott Weaver, manager of strategy policy analysis at AEP, told Bloomberg BNA, “...directionally we've been heading on that track for a number of years,” adding, “I wouldn't say the Clean Power Plan necessarily created a shift in our plans, but it's something we've already been planning for and will continue to plan for as we're going forward.” Similarly, Asim Haque, recently appointed Chairman of the Public Utilities Commission of Ohio (PUCO), told Daily Energy Insider, “I think based upon consumer sentiment in my dealings with the Clean Power Plan and in my dealings with some really big cases in Ohio here, we now need to think about planning for the future with this kind of clean energy policy piece in mind.”

As utilities and regulators continue to prepare for a low carbon future, CPP and reference case scenarios may start to converge even more—but we are pretty sure the vast majority of planners would rather know the actual rules rather than guessing.

Keep up to date on all things advanced energy with AEE Weekly. Sign up below!