This post is one in a series of feature stories on trends shaping advanced energy markets in the U.S. and around the world, drawn from Advanced Energy Now 2016 Market Report, which was prepared for AEE by Navigant Research.

The IoT concept, though much hyped for its future potential, is not just coming. It is already well on its way – into the home. Smart thermostats allow a user to remotely control household temperatures via a smartphone. Smart meters can connect to thermostats for DR. Some LED lights have embedded radios that allow the user to remotely control them from mobile devices. Smart appliances and security systems are able to connect via wireless or wired technologies and share status or other data for home automation, safety, and convenience. These devices enable customers to input data into behavioral ef ciency software which can generate recommendations to lower energy use. Though still early, this trend is accelerating as device manufacturers add connectivity to more devices.

Navigant Research de nes residential IoT as connected devices in the home that provide human or unaided control of functional systems that bene t residents in terms of comfort, security, energy ef ciency, maintenance, and automation. This is carried out with intelligent devices and sensors that provide control, with or without human intervention, and relay data via wired or wireless connections and with intelligence from the Internet. The key drivers of the residential IoT include:

-

Home security: Consumers get integrated home security systems that not only connect door locks and cameras, but also provide access via the Internet or mobile device to a smart thermostat and lighting and energy management tools.

-

Energy management: A growing perception among consumers is that connected devices, like thermostats, LED lighting, and smart meters, coupled with services, can help them more efficiently manage energy consumption.

-

Mobile devices and applications: The proliferation of smartphone applications has created the expectation among consumers that in-home devices embedded with a wireless radio interface can be monitored or controlled.

-

In-home networks: Along with mobile devices, a home Wi-Fi network has enabled static devices like smart thermostats to connect to the Internet, share data, and be monitored or controlled remotely.

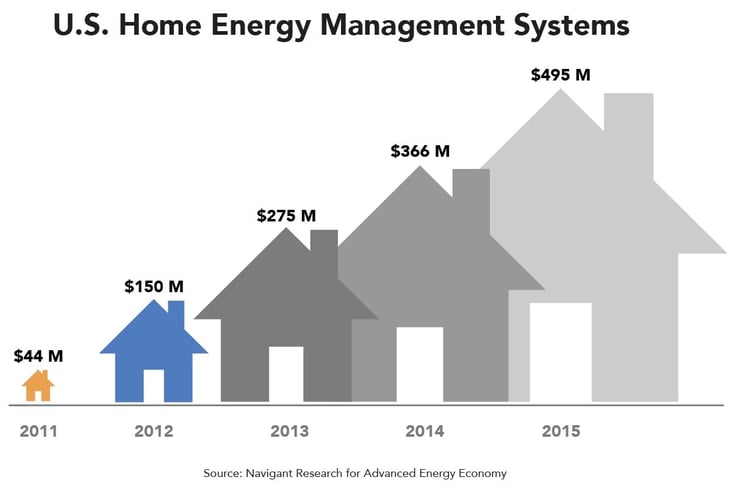

In related product categories followed for the Advanced Energy Now 2016 Market Report, revenue from Home Energy Management Systems (HEMS) has grown globally from $93 million in 2011 to $1.1 billion in 2015, and in the United States from $44 million to $495 million. Smart appliance revenue has climbed from $266 million to $1.7 billion globally, and from $105 million to $472 million in the United States.

Already a wide array of companies is providing products and services to drive the residential IoT trend. These companies foresee a thriving market well into the next decade, and they include some well-known brands:

-

Nest, a division of Alphabet, sells smart thermostats, connected smoke and carbon monoxide alarms, and connected cameras.

-

Comcast’s Xfinity service can connect smart thermostats, smart locks, lighting, and sprinkler systems, among other things.

-

Samsung’s SmartThings Hub connects an assortment of devices, including locks, thermostats, lighting, and cameras.

-

Belkin’s WeMo offers a collection of Wi-Fi-connected devices such as light bulbs, switches, and small appliances that can be controlled from smartphones or tablets.

-

Lowe’s offers the Iris platform, which enables users to connect thermostats, locks, cameras, and other sensors in a home.

-

Apple’s HomeKit is a framework for controlling devices like smart thermostats, lighting, cameras, switches, and sensors through iPhones and iPads.

Despite the many drivers for the residential IoT, some significant obstacles stand in the way of a flourishing market:

-

Protocols and standards: Multiple protocols and standards create an interoperability issue, confusing consumers and stalling adoption.

-

Price of devices: Even with component prices dropping, the newest IoT gear is still more costly than traditional alternatives, and will be for the immediate future.

-

Battery life: Some IoT devices like sensors or door locks will need to function reliably for a long time on batteries; there is still uncertainty about how long those batteries need to last.

Navigant Research expects global revenue attributed to residential IoT devices to grow from $7.3 billion in 2015 to $67.7 billion in 2025, which represents a CAGR of 25%. The North American market is expected to see revenue grow from nearly $2.5 billion in 2015 to $17.7 billion in 2025, with a CAGR of 22%. Shipments of smart meters, smart appliances, smart thermostats, and security and management systems are expected to be among the main revenue drivers.

As tempting as it may be to ignore the hype of “internet of... whatever,” in the residential and consumer markets, the Internet of Things is already here.

Learn more about efficient building management, and much more, in AEE's annual Market Report, available for free at the download link below.