Today, the Business Council for Sustainable Energy (BCSE) and Bloomberg New Energy Finance (BNEF) released their 2018 “Sustainable Energy in America Factbook,” which quantifies power generation investments and production market share across the U.S., along with other noteworthy highlights. Reviewing the 2017 data, one quickly sees that advanced energy is booming, despite policy and market uncertainties on federal and state levels.

Overall, U.S. investment in clean energy reached $57 billion in 2017, up from $56 billion in 2016, representing about 17% of the global total, according to the 2018 Factbook. Here are other key takeaways:

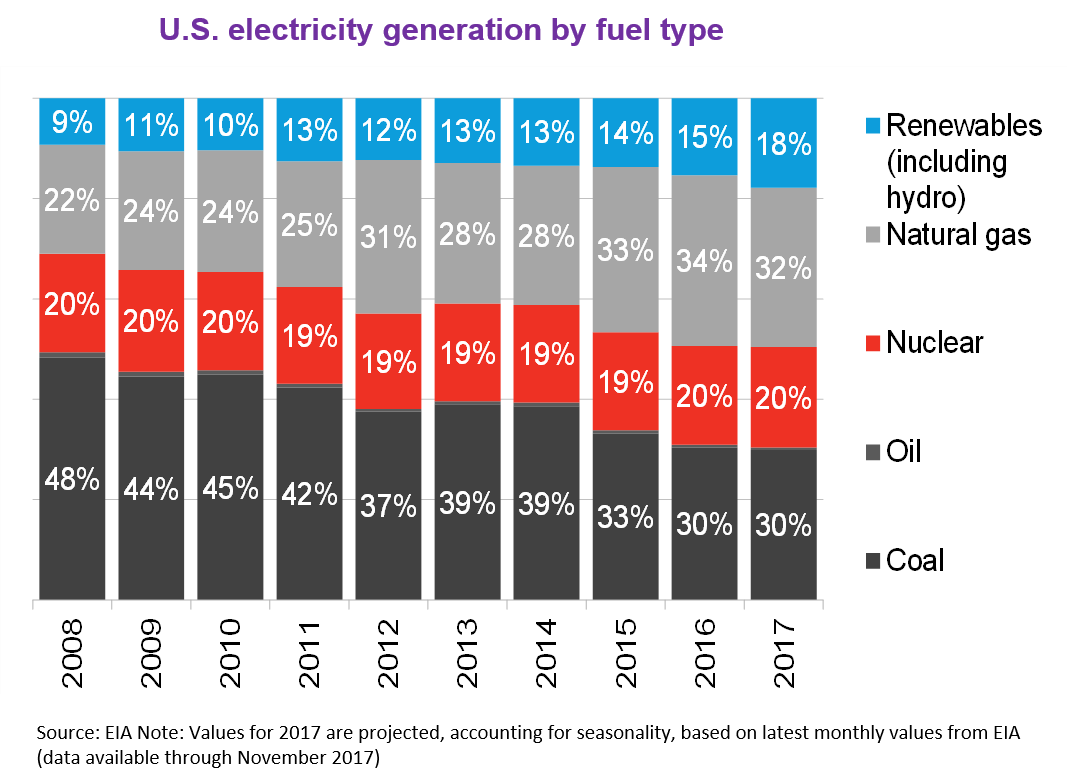

- Renewables are now 18% of U.S. power generation — double their contribution a decade ago. Renewable energy grew at a near-record pace of 14% to 717 TWh in 2017, with new wind and solar capacity, and a hydropower rebound as Western droughts eased. This segment now represents 18% of total U.S. electricity generation, up from 15% just a year ago.

- Though natural gas-fired generation decreased 8.1%, it remained the number one producer of U.S. power at 32%. Recovering gas prices, as well as a 1.7% year-on-year fall in total generation (including estimates for distributed solar), may have also contributed to the drop in natural gas-fired generation. But natural gas retained its number one position as electricity production from coal slipped by 3%.

- Energy productivity and GDP growth both accelerated —demonstrating that the U.S. economy can grow even as total energy consumption declines. The U.S. economy advanced 2.3% in 2017 while U.S. total energy consumption dipped 0.2%, to 97.2 quadrillion BTU. Energy productivity, the amount of energy needed to drive each unit of GDP growth, climbed 2.5% in 2017. Since 2008, energy usage has shrunk 1.7% as GDP has grown by 15.3%. Energy efficiency clearly contributed to this ongoing trend; however, the growth in utility spending on efficiency for electricity slowed, as fewer states are introducing new energy efficiency resource standards, while existing mandates have matured.

- Corporations are increasingly demanding cleaner energy and capturing gains from energy efficiency. The report noted key trends AEE has tracked as companies seek to procure clean energy sources in the same service territory as their operations. Their clean energy deal volumes for offsite PPAs rose to 2.9GW in 2017, the second highest on record behind the 3.2GW of new contracts signed in 2015. Corporate leaders are also weighing in on key policy issues, as we’ve seen at AEE.

- Consumers devoted a smaller share of spending toward electricity than at any time ever recorded. The total share of household expenses dedicated to energy also hovered near an all-time low. American consumer spending on electricity shrank slightly in 2017 to 1.3% of personal consumption expenditures, down from 1.4% in 2016. Greater energy efficiency and the continued availability of cheap fuels likely contributed to keeping electricity costs a modest part of total consumer expenditures.

- Power and natural gas prices remain low across the country, and contract prices for wind and solar continue to plunge. Electricity buyers secured renewables at ever cheaper price points. The most competitive power purchase agreements (PPAs) came in at just over $20/MWh for solar, while wind PPAs executed in the U.S. wind belt averaged an estimated $17/MWh in 2017.

- Renewables, energy efficiency, and natural gas employed 3 million Americans in 2016. Energy efficiency was the top employer among the sustainable energy sectors tracked in the report, with 2.2 million jobs in 2016. Solar was the fastest growing job-creator among electricity generation technologies, and employed the highest number of workers in 2016, more than double those from fossil generation.

- In transportation, sales of battery, plug-in hybrid, and hybrid vehicles accelerated. Manufacturers delivered new, longer-range versions of existing models, like the Toyota Prius and the Chevrolet Bolt. Meanwhile, the price of lithium-ion battery packs, a key cost component for battery electric vehicles, plummeted 23% year-on-year. U.S. sales of electric vehicles (EVs), including battery electric vehicles (BEV) and plug-in hybrid electric vehicles (PHEV), jumped to over 194,000 units in 2017, up 23% from the year prior.

The BCSE report shares many more details on key trends: U.S. established as a liquefied natural gas exporter; federal and state policy recaps; investments in power and gas infrastructure; retail, industrial and wholesale prices; comparisons to other countries, impact on emissions, and more.

You can compare these findings to AEE’s Advanced Energy Now 2017 Market Report and delve into the 52 technologies illustrated in AEE’s directory, This Is Advanced Energy.