This post is one in a series of feature stories on trends shaping advanced energy markets in the U.S. and around the world, drawn from Advanced Energy Now 2017 Market Report, which was prepared for AEE by Navigant Research.

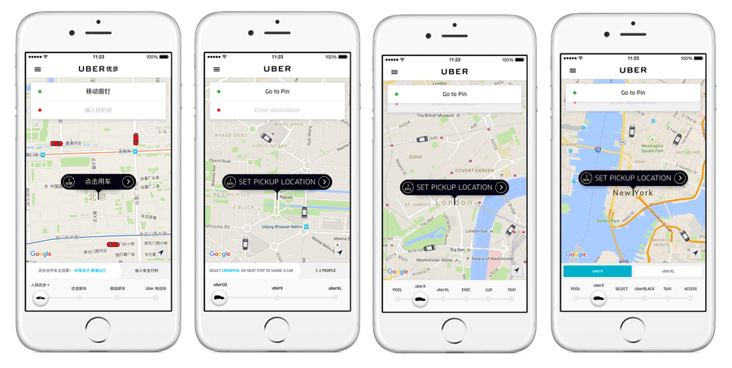

Uber screenshots from China, India, England, and the United States. Images courtesy of Uber.

The personal transportation market is evolving in new ways. In the near future, it is reasonable to expect that car-sharing and ride-hailing will combine with autonomous vehicle technology and connectivity to remake personal transportation. Cars may not fly, but riding from here to there will be on-demand, cleaner, and safer.

Since Uber was founded in 2009, adoption of the company’s mobile app-based transportation service has exploded, also inspiring car sharing competitors like Lyft. Now, people in 56 countries and more than 200 cities worldwide are able to “grab an Uber” by tapping the screen on their phones. This year, CNBC reported that there are more Uber cars than yellow cabs on the streets of New York City. With $8.7 billion in equity funding, Uber is accelerating its efforts on EVs and autonomous vehicles, which it sees as central to its business plan. And incumbent vehicle manufacturers are taking notice.

In early 2016, General Motors (GM) invested $500 million in Lyft and offered a program called Lyft Express Drive to rent relatively new cars to drivers on that platform (for $0 to $239/week based on number of rides, plus mileage fees). GM has also teamed up with Uber to offer a similar pilot program for its drivers. In that program, Uber drivers will get vehicles through GM’s existing car-sharing company, Maven, which launched in Germany and the United States in early 2016.

Car-sharing operations are also starting to feature EVs as emissions-free options for riders. Uber has partnered with China-based auto and bus manufacturer BYD to provide electric e6 taxis in Chicago and London. Uber drivers in Chicago have the option to rent the e6 taxis from the Green Wheels USA dealership for $200 a week, and Uber customers will be able to choose an EV through the smartphone app when booking a vehicle. In London, Uber has also partnered with Nissan and BYD to give drivers the option to rent all-electric vehicles, and may expand to hundreds more in anticipation of stricter emission laws in the capital’s urban center.

Then there is the dawning of vehicle automation, which is now on the horizon. Traditional auto manufacturers like BMW, GM, and Audi; Tier 1 suppliers such as Delphi, Continental, and Autoliv; new entrants like Tesla; and technology companies such as Google, Baidu, and NVIDIA all want a place in the autonomous driving age. Ride-hailing companies Uber, Lyft, Israel’s Gett, and China’s Didi Chuxing are similarly interested in automation as a hedge against the cost of human drivers in their network. Long-haul trucking companies are showing interest, for the same reason.

Uber announced that the company would be testing a self-driving pilot program in Pittsburgh last fall, though, according to the company’s website, the cars still have a “safety driver” behind the wheel to “make sure the ride goes smoothly.” Otto, a company that specializes in self-driving 18-wheelers that was acquired by Uber, helped Anheuser-Busch deliver a 120-mile beer shipment last spring. Meanwhile, in Europe, the European Truck Platooning Challenge saw six companies organize to test long-haul equipment in a robotic caravan following a single human driver.

Fully self-driving cars and trucks won’t happen overnight. Indeed, vehicle automation can be broken down into five distinct levels, adopted by the National Highway Traffic Safety Administration (NHTSA):

- Level 0: the human driver does everything;

- Level 1: an automated system on the vehicle can sometimes assist the human driver conduct some parts of the driving task;

- Level 2: an automated system on the vehicle can actually conduct some parts of the driving task, while the human continues to monitor the driving environment and performs the rest of the driving task;

- Level 3: an automated system can both actually conduct some parts of the driving task and monitor the driving environment in some instances, but the human driver must be ready to take back control when the automated system requests;

- Level 4: an automated system can conduct the driving task and monitor the driving environment, and the human need not take back control, but the automated system can operate only in certain environments and under certain conditions; and

- Level 5: the automated system can perform all driving tasks, under all conditions that a human driver could perform them.

Navigant Research estimates that between 20% and 25% of vehicles in use in the key markets of North America, Western Europe, and Asia Pacific will have full automation (NHTSA Level 4) by 2035.

Vehicle automation promises one other potential benefit: safety. There were more than 32,000 fatal crashes in the United States in 2015, resulting in more than 35,000 deaths. A NHTSA study estimated that the economic cost of vehicle crashes in the United States in 2010 was $242 billion when taking fatalities, injuries, and property damage into account. Adding in quality-of-life values, the total societal cost from auto accidents in 2010 ballooned to $836 billion. While no comprehensive study has yet been performed, The National Highway Safety Administration will increasingly be evaluating the potential for automation to reduce these costs – and save lives.

Point-to-point transportation available on-demand could slash wasted time and improve quality of life in cities and suburbs, while car-sharing and automation would ease congestion, increase efficiency, and reduce the number of personally owned vehicles making one-person trips. Indeed, Navigant Research expects global vehicles in use will likely begin a steady decline in the 2030s, eventually dropping by half or more by mid-century. Just as the mass-produced automobile changed the way people work, live, and play in the 20th century, the new shared mobility system enabled by automation, connectivity, and electrification will change society in the 21st century.

Find out more about this year's advanced energy trends and the full size of the advanced energy market by downloading Advanced Energy Now 2017 Market Report, available for free at the link below: