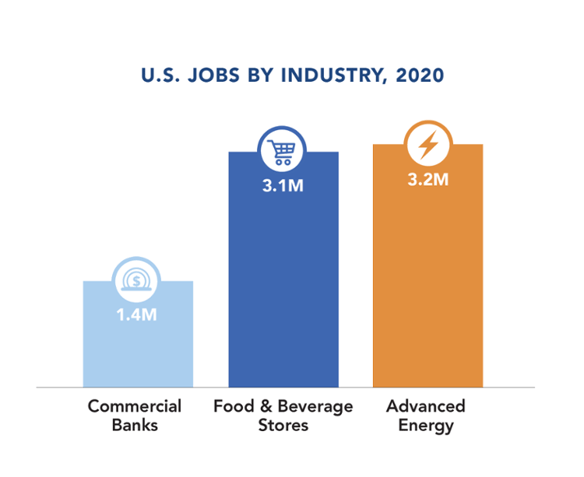

As we learned from the Advanced Energy Now 2021 Market Report, the U.S. market for advanced energy products and services proved remarkably resilient in 2020, despite the disruptions of COVID-19. Excluding Ethanol – a large but volatile slice of the domestic market that flipped from record 2019 revenue to 2020 crash – U.S. advanced energy revenue grew roughly 8% per year in both 2019 and 2020. But the COVID impact on employment was more severe, at one point accounting for the loss of more than 600,000 jobs. Still, at 3.2 million jobs nationwide at the end of 2020, advanced energy employs more U.S. workers than Food & Beverage Stores and twice as many as Commercial Banks. What’s more: advanced energy jobs are on the rebound, and ready to scale up for a national push for clean energy and jobs.

Before COVID, advanced energy employment was on a solid growth trajectory. Advanced energy jobs grew 3.8% from 2017 to 2018 and 2.1% from 2018 to 2019 – twice the rate of overall U.S. job growth both years. Advanced energy employment reached 3.5 million in 2019, and employers surveyed late in that year predicted further growth of 5% in 2020.

Then the pandemic hit, disrupting supply chains, shutting down projects, and preventing customer contact. As reported by BW Research Partners in a series of memos, clean energy jobs fell by 100,000 in March 2020 and kept falling; by June, employment in the industry was down 620,000 jobs, fully 15% of the total. Over the summer, however, with businesses making adjustments for new working conditions, the industry started to rebound, adding jobs slowly but steadily, ending the year down less than 320,000 jobs, or roughly 9% of pre-COVID employment.

The latest figures – data from U.S. Department of Energy, U.S. Energy and Employment Report (forthcoming), collected and analyzed by BW Research Partnership, and summarized in a new AEE fact sheet – show advanced energy ended 2020 with 3.2 million employees nationwide. That’s a decline of 9% from the 2019 total.

Energy efficiency has been hardest hit, with employment down 11% from 2019 to 2020, but at 2.1 million jobs, making homes, offices, and industries more efficient still accounts for the largest concentration of advanced energy workers. The broad categories of Advanced Electricity Generation, Advanced Grid & Storage, and Advanced Fuels all saw declines year over year, as business segments like rooftop solar, energy storage, and microgrids scrambled to regain their previous momentum.

Even under pandemic conditions, however, some advanced energy jobs continued to grow. In the midst of a record year in new capacity installations, wind energy employment grew 2%, to 117,000 jobs, in 2020. Jobs associated with electric vehicles grew 2% as well, a harbinger of the electric transportation revolution now starting to take off.

And even with the pandemic not yet ended, optimism prevailed in the advanced energy industry. Surveyed late in 2020, advanced energy employers predicted job growth of 8% for 2021, enough to nearly wipe out the losses of 2020.

The timing could not be better. In states around the country and even in Washington, D.C., we see policymakers ready to embrace advanced energy as the way to achieve climate goals and jumpstart the economy at the same time. And well they should: In a series of reports commissioned by AEE late last year, we found that federal investment across a range of advanced energy technologies in specific states would produce a high rate of return in GDP and job growth: 4X in Florida, 6X in Colorado and Nevada, 7X in California, 8X in Illinois and Pennsylvania, and a whopping 14X in Arizona. The energy transition already gaining momentum due to market forces can also drive job growth as the U.S. builds an advanced energy economy that is prosperous, resilient, and equitable.