This post is one in a series of feature stories on trends shaping advanced energy markets in the U.S. and around the world, drawn from Advanced Energy Now 2016 Market Report, which was prepared for AEE by Navigant Research.

In order for any alternative to gasoline or diesel to be viable as a transportation fuel, refueling infrastructure needs to be readily available. In the arena of alternative fuels for transportation, natural gas has proven to be one of the most popular alternatives to traditional liquid fuels in many global markets. Natural gas for use as a transportation fuel is available in two forms, CNG and LNG, with the former being by far the more common. CNG is primarily used for vehicles that operate within a limited geographic region, while LNG is more commonly used for long-haul trucking applications. CNG is stored in high-pressure tanks at 3,000–3,600 psi and can be stored for extended periods of time. LNG is stored in low pressure, cryogenic tanks at -259 degrees F.

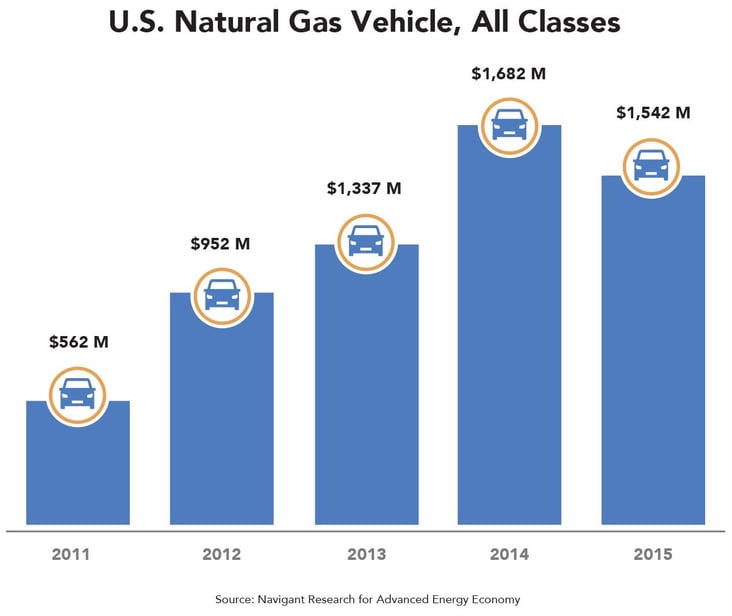

Natural gas has a number of distinct benefits compared with other options, particularly for larger vehicles. As a resource, natural gas is widely distributed around the globe, and with newer extraction techniques, such as horizontal drilling and hydraulic fracturing, usable supplies have risen signi cantly in the past decade. As a result, prices have fallen to less than half of the peaks reached in 2005 and 2008. However, in the last 12 months, low gasoline prices have begun to hurt demand for NGVs, which in turn discourages investment in infrastructure. As the price differential between the two fuels shrinks, the operating cost savings lag behind the premium in vehicle purchase price, which for light-duty NGVs is $7,000 to $15,000 and for medium- to heavy-duty NGVs is up to $50,000. U.S. revenue from sales of light- and heavy-duty NGVs was down 9% and 7%, respectively in 2015, though the two still combined for over $1.5 billion in total.

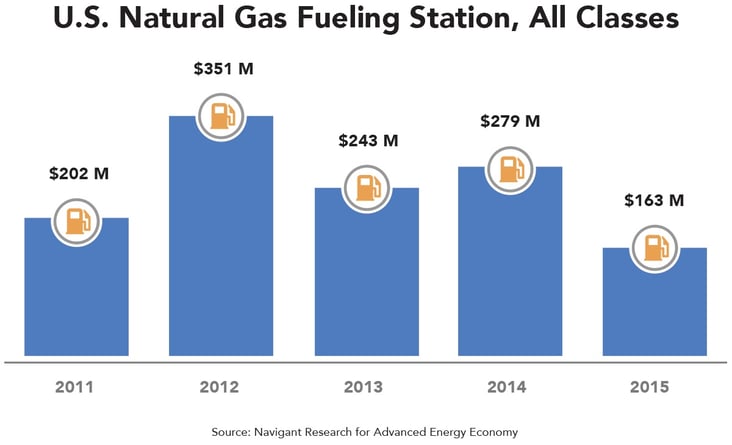

With NGVs struggling in the market, the U.S. market for Natural Gas Fueling Stations serving long-haul trucks was down 45% in 2015, with revenue of $55 million. For light-duty vehicles, revenue from Fueling Stations was down 40%, to $108 million. In total, the U.S. market in 2015 was $163 million. (See top graph.)

Despite facing difficult market conditions at the moment, natural gas still has its advantages. Where fueling stations are available, CNG and LNG are typically fast and convenient to use. Fast- ll CNG pumps and most LNG pumps can be used to refuel a vehicle at speeds comparable to pumping diesel fuel. “Slow- ll” (low-pressure) systems, however, provide the convenience of lling lower duty cycle vehicles (vehicles that are less frequently used) wherever there is a connection to a natural gas distribution main. Compared to the batteries in EVs, natural gas has signi cantly higher energy density and longer potential range for larger, heavier vehicles. Natural gas-fueled engines also have reduced emissions of CO2 and other pollutants compared to gasoline or diesel-fueled internal combustion engines.

As a result, the drive toward fueling infrastructure for NGVs continues. Clean Energy Fuels of Newport Beach, California, is the largest developer and operator of natural gas filling stations in North America. With more than 500 public and private stations in operation throughout 43 states, Clean Energy Fuels accounts for more than one-third of the 1,669 stations counted by the U.S. Energy Information Administration (EIA). In addition to operating public stations, Clean Energy Fuels runs stations for private operators, such as refuse collection companies, construction rms, transit bus eets, and more than 40 airports. The airport facilities are typically used to fuel NGVs for inter-terminal transport, rental car companies, and hotels.

Most infrastructure investment is being made in private stations used by large truck or bus fleets. In late 2015, FCA announced a $40 million investment in Detroit to convert 179 parts-hauling trucks to CNG. The switch will give FCA the largest private fleet of CNG powered medium- and heavy-duty vehicles in the state of Michigan. In addition, the company also built a $5 million on-site CNG fueling station that was built by TruStar Energy and is the largest private CNG station in North America.

Also not scared away by low oil prices, Honda opened a massive fast- ll CNG refueling station at its Marysville, Ohio, assembly plant in August of 2015. With a capacity of 440,000 vehicles per year, the plant is among the largest in the country. The fueling station, built by Trillium CNG, services existing CNG vehicles while also encouraging suppliers and logistical partners to adopt and expand the use of NGVs.

Navigant Research projects that the total number of global NGV fueling stations will grow from approximately 23,000 in 2015 to nearly 39,000 in 2025. More than 80% of these stations are expected to be CNG stations to support light-duty NGVs, which are projected to account for 90% of the NGV fleet at that time.

Learn more about natural gas vehicles and the entire advanced energy industry in our 2016 Market Report, available for free at the link below: