This post is one in a series of feature stories on trends shaping advanced energy markets in the U.S. and around the world, drawn from Advanced Energy Now 2015 Market Report, which was prepared for AEE by Navigant Research.

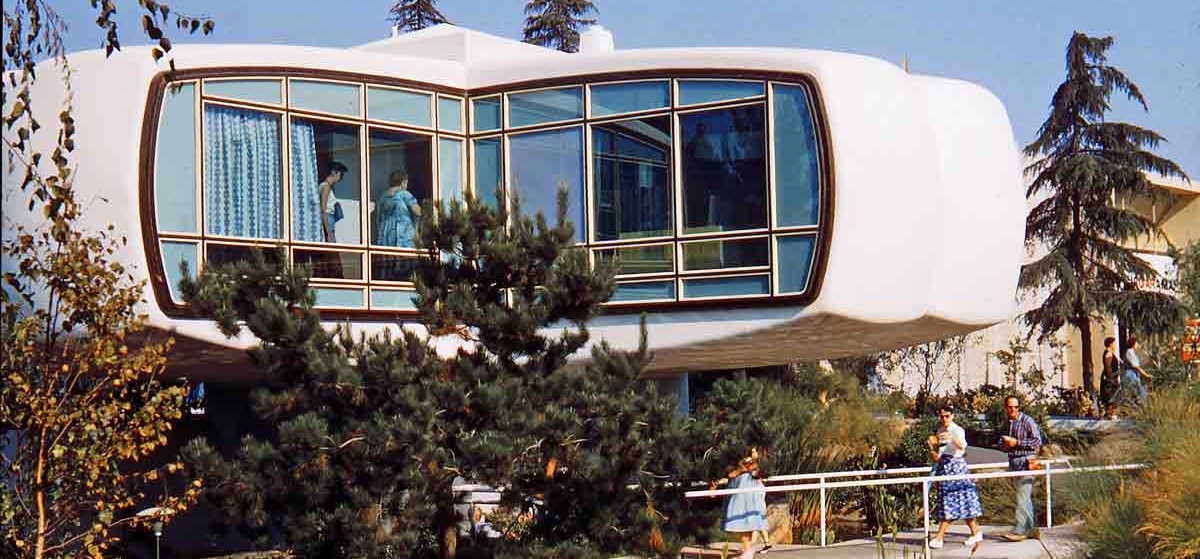

Monsanto's "Home of the Future," circa 1958. Not exactly a zero net energy building. Source.

Globally, building energy has moved into the spotlight due to the associated greenhouse gas impacts and rising energy costs. Until recently, zero net energy buildings (ZNEBs) have existed mostly on a conceptual level, with a small number of highly innovative pilots exploring the process of planning and execution of this technology. However, ZNEBs made significant headway in late 2014 after the federal General Services Administration (GSA) approved a recommendation from an internal task force to upgrade at least 50% of the federal government’s building area to ZNEB — not a small number, considering that the GSA is the owner of more than 2% of all commercial buildings within the United States.

A ZNEB uses no more energy over the course of the year than it generates from onsite renewables. Called nearly zero energy buildings (nZEB) in the European Union, nZEBs bring together existing energy efficient technologies and on-site power generation to form a high-performance building. The most common choice of renewable power is solar PV, which is now being offered as an add-on option for some new-home developments. Other technologies that are playing a significant role in ZNEBs include energy efficient lighting (e.g., light-emitting diodes, or LEDs), advanced glazing and smart glass, advanced wall insulation, energy efficient heating, ventilation, and air conditioning (HVAC) systems, and energy management systems.

While pilots are focused on testing the investment savings in lower energy bills, the strongest driver for the adoption of ZNEBs is government policy. The Energy Performance of Buildings Directive of the European Union and California’s evolving Title 24 building code are among the policies creating ZNEB markets for new commercial, new residential, and retrofitted commercial space. However, the most prominent zero energy codes are either in their early stages or a long way off. In the EU, the Energy Performance of Buildings Directive states that residential buildings subject to code compliance be zero net energy by 2019; commercial buildings must be zero net energy by 2021. Building code changes in the interim, revised every two to three years in each member state, will incrementally push toward this target.

In the United States, demand from early adopters has driven the growth of ZNEBs, with some states and municipalities being more proactive. One example is the City of Austin, Texas, which has mandated that all new residences built after 2015 be zero net energy. Several relevant policies, such as the U.S. federal government’s requirement for ZNEB for federal facilities, which come into effect in 2030, will have similar effects to policies within the EU, only on a more limited scale.

In Asia Pacific, Japan has established a leading presence in the ZNEB market, but low energy building construction has grown throughout the region in recent years. High energy prices and preferences for green buildings in countries such as Singapore will drive activity. Given the few existing national regulations in the region for zero net energy construction, ZNEB adoption will be contingent on the local regulatory landscape.

Though the near-term market outlook for ZNEBs indicates healthy growth, the long-term prospects for the market globally shows even greater promise. Navigant Research has estimated the 2014 global market at $266 million, a 22% increase over 2013 revenue of $218 million. In the United States, revenue is estimated at just under $16 million, also a 22% gain from the previous year’s $13 million and a 60% increase over 2011 revenue of $10 million.

Despite promising growth opportunities, the ZNEB market will still be limited in both the near and long term by incongruent policies in in geographically close areas, and issues with technology standards. Defining a ZNEB is no simple matter, as it can depend on the energy source, the scale of the site, and, in some cases, the temporal nature of the energy use. These concepts are challenging for consumers and policy makers alike.

Similarly, cost premiums and financing models have not yet matured for ZNEBs. Technologies used for ZNEBs, such as triple pane glass and renewable energy systems are high in cost, and long payback periods (20-25 years for some products) are not feasible in the private buildings market where ownership typically changes every few years.

Regardless, this market will be highly dynamic in the next decade as regulations become more focused, product costs come down, and building owners face rising energy costs. Ambitious codes adopted across multiple continents could signal a movement that pulls the entire building ecosystem along.