This post is one in a series of feature stories on trends shaping advanced energy markets in the U.S. and around the world, drawn from Advanced Energy Now 2015 Market Report, which was prepared for AEE by Navigant Research.

2014 was a dynamic year for the smart buildings market, with noticeable major technology advances and a global economic boost through supportive government policies and programs. In addition, many vendors expanded their products and services targeted towards small and medium-size buildings, with building owners seeing real benefits from aggregating energy efficiency across their portfolio of smaller-scale facilities.

Though no official definition for smart buildings exists, the term refers to buildings that take an integrated approach to onsite electricity generation, energy management systems, and advances in commercial lighting and controls. Increasingly networked building controls cover a variety of building systems, including HVAC, lighting, fire and life safety, and security and access systems. These devices include a wide range of sensors, controllers, actuators, switches, air handlers, alarms, and detectors. When networked together by one or more protocols, they can drastically reduce energy usage and costs, alert building operators to repair and maintenance needs, and provide significant improvements in occupant comfort and safety.

Building energy management systems (BEMS) have emerged over the past two decades and have changed the marketplace by enhancing the abilities of traditional building control and automation systems that have been around since the 1950s. These systems are at the heart of the smart buildings market, and have recently displayed particularly significant advances in technology. Cloud-based data analytics have enabled deeper integration of onsite resources, data, and remote monitoring and control. A handful of state-of-the-art pilots are demonstrating the value of configurations that integrate distributed generation, onsite renewables, or extensive equipment monitoring and control with plug loads, PC power management, or data center infrastructure management through BEMS.

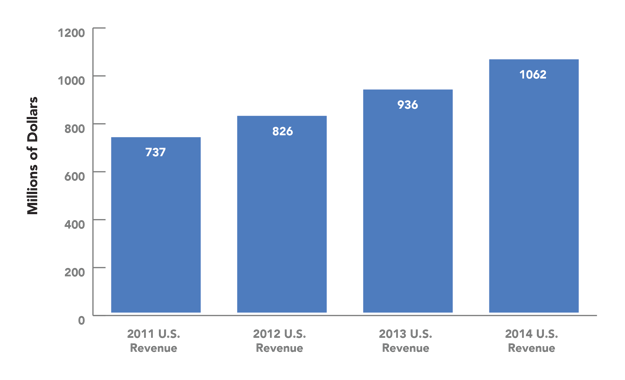

As a result, the global market for BEMS has increased 47% since 2011, estimated at nearly $2.8 billion in 2014 (see below). Growth within the United States has been similar, at 44% from 2011 to 2014, now valued at $1.1 billion, or 38% the global market. Navigant Research expects the global market for BEMS to reach $10.8 billion by 2024. North America and Europe are projected to continue leading in BEMS demand in the near term, but the Asia Pacific region is expected to display increasing activity and investment in the future.

Building Energy Management Systems Revenue

Globally, but particularly in North America and Europe, regulatory support and financing mechanisms for energy efficiency have coalesced to drive smart building investments for new buildings and retrofits in both the public and private sectors. In the United States, 25 states, representing approximately 60% of national energy consumption, now have energy efficiency resource standards. Not coincidentally, the U.S. market for energy service companies (ESCOs) has grown steadily, as it provides a low-risk financing mechanism for business owners to invest in smart building technologies to increase energy efficiency. Up 10% from 2013, Navigant Research estimates the 2014 market for ESCO services in the United States at $611.2 million, not counting ESCO-installed HVAC equipment ($4 billion nationally).

In Europe, where the markets encompassing a range of smart building technologies are the strongest, both European Union and individual state policies and financing are driving continued steady growth. Between 2007 and 2013, the European Commission provided approximately €5.5 billion in energy efficiency investments, with €290 million in financing for R&D. Individual member states, particularly the UK, Germany and the Scandinavian countries, are pursuing approaches that include energy efficiency targets, incentives, support of the ESCO concept, and new demo projects for innovative building-to-grid technologies.

Asia Pacific policies and markets remain fragmented, with Japan, Australia, and South Korea leading the pack on building energy efficiency. China has steadily increased support through its five-year plans, which have encouraged the adoption of energy monitoring technology, particularly in the public sector. Representing approximately 60% of global construction activity, China could become a standing example of how to implement energy efficient building concepts on a large scale.

A notable trend in the U.S. smart buildings market has been the increased targeting of small to medium commercial buildings. New technologies offer ever-increasing insight into energy use for these buildings, which can be aggregated across portfolios for reporting and incentive purposes. Typically, two paths to adoption have been recognized. The first, favored by small buildings, is an efficiency management path supported by utility-based programs that benchmark efficiency gains using advanced meter data. Medium-sized commercial buildings have followed a performance management approach, enabled by scaled-down BEMS tools and a growing energy management services market.

While advances in technology and a supportive market environment globally have bolstered the smart buildings market, barriers such as market fragmentation and access to capital will continue to challenge providers and potential adopters. With many technologies relatively new, there is still a learning curve for consumers in terms of understanding the purposes and capabilities of smart building technologies. Correspondingly, vendors remain focused on product development and marketing to increase awareness and appeal, and to make their products more accessible across different classes of customers.