This post is one in a series of feature stories on trends shaping advanced energy markets in the U.S. and around the world, drawn from Advanced Energy Now 2015 Market Report, which was prepared for AEE by Navigant Research.

Governments globally are keen to see wide-scale adoption of alternative fuel vehicle technologies as a solution to both environmental and energy security issues. As such, national, state, and local governing bodies have provided a range of incentives to early adopters in efforts to jump-start the market. In the past year or two, market dynamics have taken a favorable turn, with rapid reductions in battery and natural gas prices. Electricity and natural gas have now taken center stage as near-term alternative fuel solutions, though for different reasons and for different vehicle applications.

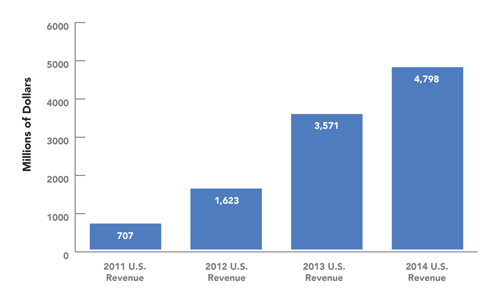

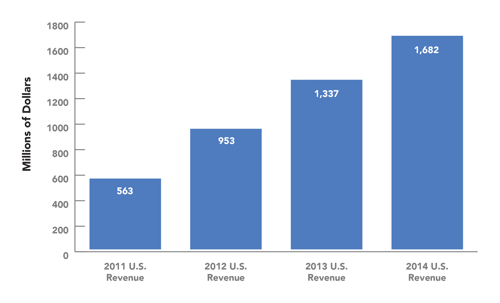

Plug-in electric vehicles (PEVs) are now an established segment of the global light duty vehicle market and are growing quickly, with 567% revenue growth worldwide between 2011 and 2014. Natural gas vehicles (NGVs) have made inroads in heavier commercial vehicle segments in North America while the established light duty NGV markets in Europe and some Asia Pacific countries are growing as well.

Plug-in Electric Vehicles

Natural Gas Vehicles

Navigant Research estimates that PEV sales in 2014 surpassed 320,000 units globally, 60% above 2013 levels. PEV sales are highest in the United States, with plug-in hybrid electric vehicles (PHEVs) holding a slight edge over battery electric vehicles (BEVs). Navigant Research expects 2015 to exhibit strong growth over 2014 (around 72%) due to vehicle introductions in the SUV segment from Tesla and Volvo, and introduction of the next generation Chevrolet Volt. Though the United States is the largest market, China is the fastest growing. PEV sales in the country grew five-fold from 2013 to 2014, largely on the introduction of the plug-in hybrid BYD Qin. Navigant Research forecasts PEV sales in the country will likely double in 2015 and grow to nearly 725,000 vehicles by 2023.

NGV growth has also been significant globally with sales in 2014 up 44% over 2009. Nearly 2.5 million NGVs were put on the road worldwide in 2014. Navigant Research forecasts the global market will near 4.1 million vehicles by 2023. The United States represents just a small fraction of the NGV market, with just over 45,000 unit sales in 2014; however, it is one of the fastest growing markets, with sales in 2014 four times greater than in 2009. U.S. NGV sales are concentrated in commercial vehicle applications, with around 40% of sales being in the medium and heavy-duty segments and over 50% of sales in the light-duty truck segment, with the remainder being passenger cars.