This post is one in a series of feature stories on trends shaping advanced energy markets in the U.S. and around the world, drawn from Advanced Energy Now 2015 Market Report, which was prepared for AEE by Navigant Research.

The biofuels industry has made great strides in the past decade, with ethanol and biodiesel becoming established commodities traded on all continents and more than 32 billion gallons produced in 2014. But future growth is less certain, especially in terms of biofuel as an alternative fuel for ground transportation in developed countries. Still, there are significant opportunities in niche fuel markets, as well as new potential in emerging markets where bioenergy could play a greater role.

In the United States, in particular, the challenges to growth for biofuels for ground transportation are daunting. Falling gasoline consumption (due to more fuel efficient vehicles and changing driving patterns) and resistance from auto manufacturers to higher levels of ethanol in gasoline have created a “blend wall” preventing greater use of ethanol. Meanwhile, the highly sought after successor to corn-based ethanol, cellulosic ethanol, has not reached levels of production sufficient to fulfill federal requirements. Creating even greater uncertainty about future prospects, EPA changed its definition of cellulosic and advanced biofuels to include liquefied and compressed natural gas produced from biogas, including landfill gas. This will likely further dampen investor appetite for ethanol and biodiesel projects.

Finally, the push for bio-based alternatives to petroleum transportation fuels has been deflected by suddenly low oil prices (currently under $50 a barrel) as well as growing interest in other alternatives, namely plug-in electric vehicles (PEV) and natural gas-powered trucks.

That said, the biofuels industry continues to advance on several fronts, in specialty fuel markets and, increasingly, in developing countries.

The commercial aviation industry, for example, has played an important role in driving research and development of biofuels for air travel as well as sending a strong demand signal to producers. More than 25 international carriers from all global regions have tested or piloted biofuels in the last three years. Navigant Research estimates these efforts have resulted in more than 60,000 biofuel miles flown. In early 2014, Boeing completed a test flight using a blend of 15% “green diesel” – a synthetic, drop-in substitute for diesel – and 85% petroleum jet fuel. To meet growing demand, several high-profile, dedicated biojet biorefinery projects have begun construction. Led by the Oslo Airport’s commitment to take in 660,000 gallons of biojet fuel beginning in March 2015, airports are also demonstrating a commitment to biofuels as playing a role in the future of aviation.

Commercial aviation offers the advanced biofuels industry some notable advantages for market acceptance compared to competing against gasoline and diesel fuel, namely consolidated infrastructure and large, institutional customers capable of making strategic purchasing decisions. According to the International Air Transport Association (IATA), 1,600 airports worldwide fuel 95% of the world’s flights. This compares to more than 161,000 retail gas stations in the United States alone. This lowers the capital needed for infrastructure to bring fuel to the customer and streamlines contracting opportunities, which should accelerate commercial deployment of bio-jet fuel.

The U.S. Navy is also moving forward with its goal of sailing its Great Green Fleet in 2016. This initiative is a stem-to-stern overhaul aimed at integrating energy conservation into the U.S. fighting fleet, in part by powering ships and aircraft with biofuels. In anticipation, the Navy has procured nearly a half million gallons of advanced biofuels to support early testing and certification initiatives. Biofuels were also included in the Navy’s annual procurement for bulk fuels this year for the first time ever.

But non-road transportation applications are not the only area where biofuels are gaining ground.

In the emerging economies of Sub-Saharan Africa, Southeast Asia, and Latin America, the wide availability of biomass, combined with limited access to other sources of energy, provides promising opportunities to expand the use of bioenergy for many purposes. Conversion of agricultural waste into biogas to fuel generator sets, for example, can help anchor community microgrids. Such uses build off an established tradition of utilizing biomass for energy (e.g., burning wood or dung for cooking and heating) and rely on well-established technologies. All this makes the developing world an important growth opportunity for biofuels. While the refocus of investment away from ground transportation and toward a wider range of applications will mean less biorefinery capacity built through 2020, these niche opportunities are expected to result in the development of specialized capacity despite today’s cheap and plentiful oil.

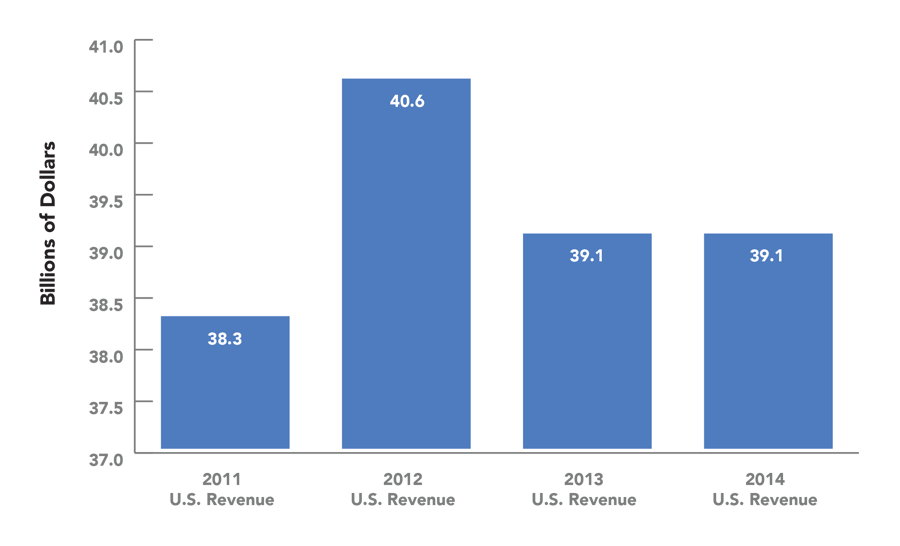

Ethanol Fuels (excluding refinery investment)

The advanced energy economy is big business -- and growing! Click the button below to download the Advanced Energy Now 2015 Market Report.